Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly assist with requirements a and b QUESTION (30 marks) Heavy Machinery Ltd Heavy Machinery Ltd is a company that manufactures and sells heavy machinery

Kindly assist with requirements a and b

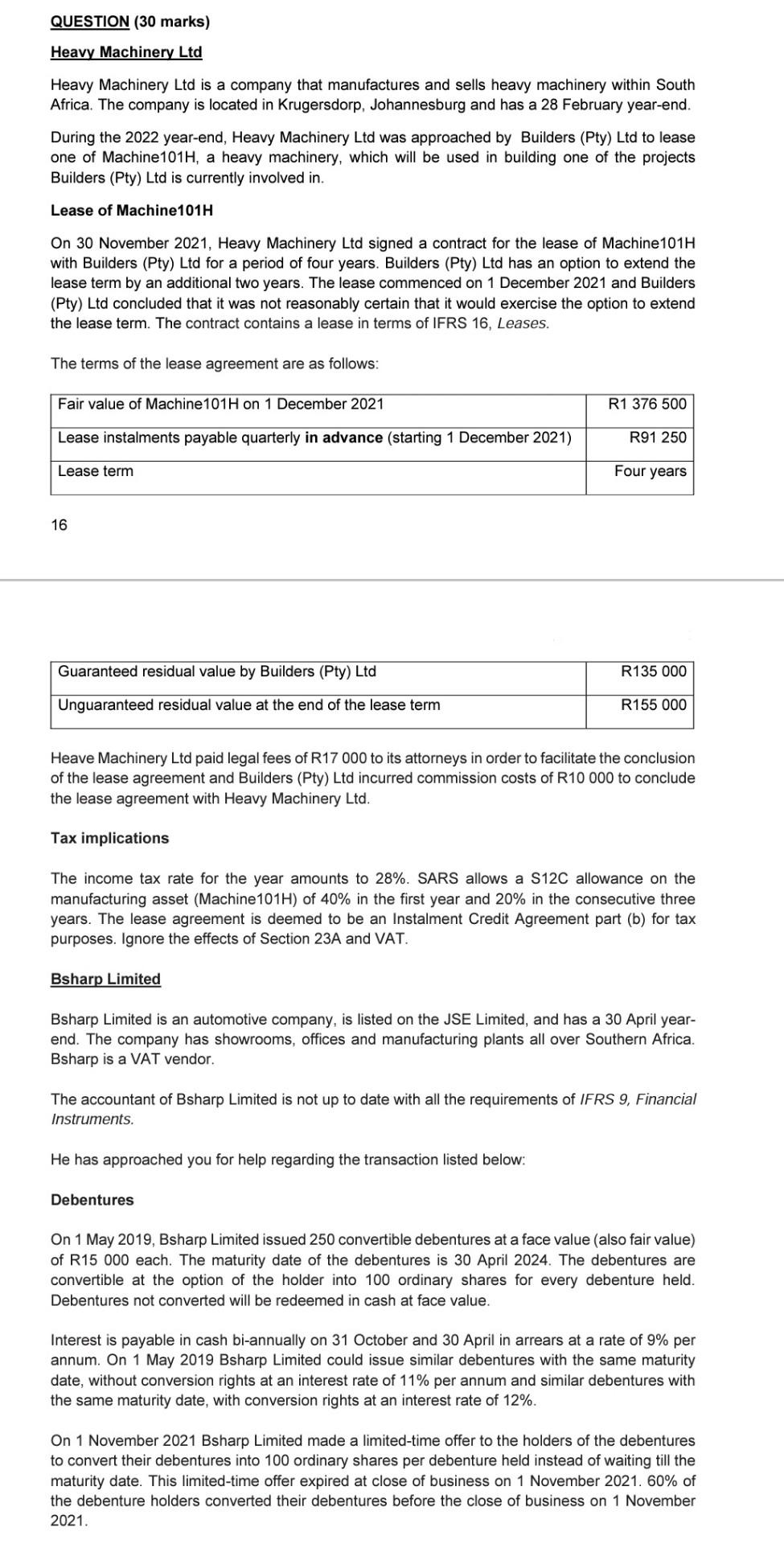

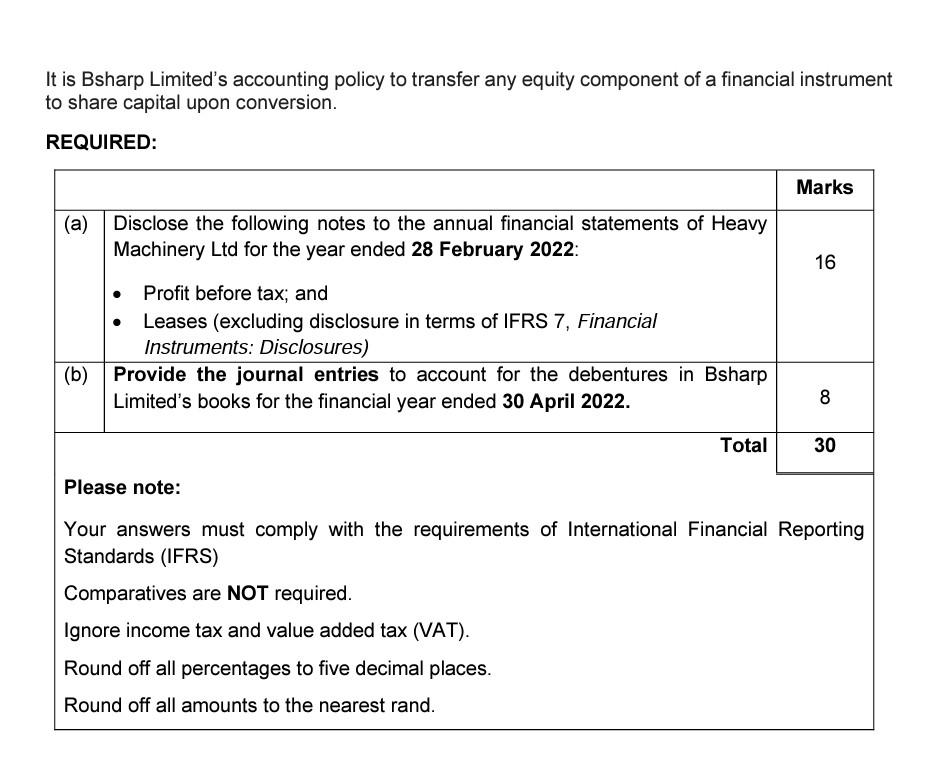

QUESTION (30 marks) Heavy Machinery Ltd Heavy Machinery Ltd is a company that manufactures and sells heavy machinery within South Africa. The company is located in Krugersdorp, Johannesburg and has a 28 February year-end. During the 2022 year-end, Heavy Machinery Ltd was approached by Builders (Pty) Ltd to lease one of Machine101H, a heavy machinery, which will be used in building one of the projects Builders (Pty) Ltd is currently involved in. Lease of Machine101H On 30 November 2021, Heavy Machinery Ltd signed a contract for the lease of Machine 101H with Builders (Pty) Ltd for a period of four years. Builders (Pty) Ltd has an option to extend the lease term by an additional two years. The lease commenced on 1 December 2021 and Builders (Pty) Ltd concluded that it was not reasonably certain that it would exercise the option to extend the lease term. The contract contains a lease in terms of IFRS 16, Leases. The terms of the lease agreement are as follows: Fair value of Machine 101H on 1 December 2021 R1 376 500 Lease instalments payable quarterly in advance (starting 1 December 2021) R91 250 Lease term Four years 16 Guaranteed residual value by Builders (Pty) Ltd R135 000 Unguaranteed residual value at the end of the lease term R155 000 Heave Machinery Ltd paid legal fees of R17 000 to its attorneys in order to facilitate the conclusion of the lease agreement and Builders (Pty) Ltd incurred commission costs of R10 000 to conclude the lease agreement with Heavy Machinery Ltd. Tax implications The income tax rate for the year amounts to 28%. SARS allows a S12C allowance on the manufacturing asset (Machine 101H) of 40% in the first year and 20% in the consecutive three years. The lease agreement is deemed to be an Instalment Credit Agreement part (b) for tax purposes. Ignore the effects of Section 23A and VAT. Bsharp Limited Bsharp Limited is an automotive company, is listed on the JSE Limited, and has a 30 April year- end. The company has showrooms, offices and manufacturing plants all over Southern Africa. Bsharp is a VAT vendor. The accountant of Bsharp Limited is not up to date with all the requirements of IFRS 9, Financial Instruments. He has approached you for help regarding the transaction listed below: Debentures On 1 May 2019, Bsharp Limited issued 250 convertible debentures at a face value (also fair value) of R15 000 each. The maturity date of the debentures is 30 April 2024. The debentures are convertible at the option of the holder into 100 ordinary shares for every debenture held. Debentures not converted will be redeemed in cash at face value. Interest is payable in cash bi-annually on 31 October and 30 April in arrears at a rate of 9% per annum. On 1 May 2019 Bsharp Limited could issue similar debentures with the same maturity date, without conversion rights at an interest rate of 11% per annum and similar debentures with the same maturity date, with conversion rights at an interest rate of 12%. On 1 November 2021 Bsharp Limited made a limited-time offer to the holders of the debentures to convert their debentures into 100 ordinary shares per debenture held instead of waiting till the maturity date. This limited-time offer expired at close of business on 1 November 2021. 60% of the debenture holders converted their debentures before the close of business on 1 November 2021. It is Bsharp Limited's accounting policy to transfer any equity component of a financial instrument to share capital upon conversion. REQUIRED: Marks (a) Disclose the following notes to the annual financial statements of Heavy Machinery Ltd for the year ended 28 February 2022 16 , Profit before tax; and Leases (excluding disclosure in terms of IFRS 7, Financial Instruments: Disclosures) (b) Provide the journal entries to account for the debentures in Bsharp Limited's books for the financial year ended 30 April 2022. 8 Total 30 Please note: Your answers must comply with the requirements of International Financial Reporting Standards (IFRS) Comparatives are NOT required. Ignore income tax and value added tax (VAT). Round off all percentages to five decimal places. Round off all amounts to the nearest rand. QUESTION (30 marks) Heavy Machinery Ltd Heavy Machinery Ltd is a company that manufactures and sells heavy machinery within South Africa. The company is located in Krugersdorp, Johannesburg and has a 28 February year-end. During the 2022 year-end, Heavy Machinery Ltd was approached by Builders (Pty) Ltd to lease one of Machine101H, a heavy machinery, which will be used in building one of the projects Builders (Pty) Ltd is currently involved in. Lease of Machine101H On 30 November 2021, Heavy Machinery Ltd signed a contract for the lease of Machine 101H with Builders (Pty) Ltd for a period of four years. Builders (Pty) Ltd has an option to extend the lease term by an additional two years. The lease commenced on 1 December 2021 and Builders (Pty) Ltd concluded that it was not reasonably certain that it would exercise the option to extend the lease term. The contract contains a lease in terms of IFRS 16, Leases. The terms of the lease agreement are as follows: Fair value of Machine 101H on 1 December 2021 R1 376 500 Lease instalments payable quarterly in advance (starting 1 December 2021) R91 250 Lease term Four years 16 Guaranteed residual value by Builders (Pty) Ltd R135 000 Unguaranteed residual value at the end of the lease term R155 000 Heave Machinery Ltd paid legal fees of R17 000 to its attorneys in order to facilitate the conclusion of the lease agreement and Builders (Pty) Ltd incurred commission costs of R10 000 to conclude the lease agreement with Heavy Machinery Ltd. Tax implications The income tax rate for the year amounts to 28%. SARS allows a S12C allowance on the manufacturing asset (Machine 101H) of 40% in the first year and 20% in the consecutive three years. The lease agreement is deemed to be an Instalment Credit Agreement part (b) for tax purposes. Ignore the effects of Section 23A and VAT. Bsharp Limited Bsharp Limited is an automotive company, is listed on the JSE Limited, and has a 30 April year- end. The company has showrooms, offices and manufacturing plants all over Southern Africa. Bsharp is a VAT vendor. The accountant of Bsharp Limited is not up to date with all the requirements of IFRS 9, Financial Instruments. He has approached you for help regarding the transaction listed below: Debentures On 1 May 2019, Bsharp Limited issued 250 convertible debentures at a face value (also fair value) of R15 000 each. The maturity date of the debentures is 30 April 2024. The debentures are convertible at the option of the holder into 100 ordinary shares for every debenture held. Debentures not converted will be redeemed in cash at face value. Interest is payable in cash bi-annually on 31 October and 30 April in arrears at a rate of 9% per annum. On 1 May 2019 Bsharp Limited could issue similar debentures with the same maturity date, without conversion rights at an interest rate of 11% per annum and similar debentures with the same maturity date, with conversion rights at an interest rate of 12%. On 1 November 2021 Bsharp Limited made a limited-time offer to the holders of the debentures to convert their debentures into 100 ordinary shares per debenture held instead of waiting till the maturity date. This limited-time offer expired at close of business on 1 November 2021. 60% of the debenture holders converted their debentures before the close of business on 1 November 2021. It is Bsharp Limited's accounting policy to transfer any equity component of a financial instrument to share capital upon conversion. REQUIRED: Marks (a) Disclose the following notes to the annual financial statements of Heavy Machinery Ltd for the year ended 28 February 2022 16 , Profit before tax; and Leases (excluding disclosure in terms of IFRS 7, Financial Instruments: Disclosures) (b) Provide the journal entries to account for the debentures in Bsharp Limited's books for the financial year ended 30 April 2022. 8 Total 30 Please note: Your answers must comply with the requirements of International Financial Reporting Standards (IFRS) Comparatives are NOT required. Ignore income tax and value added tax (VAT). Round off all percentages to five decimal places. Round off all amounts to the nearest randStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started