Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly assist with these QUESTION ONE Sampo Master Limited just reported dividends of K230,000 and earning of K760,000. The dividends and earnings are expected to

Kindly assist with these

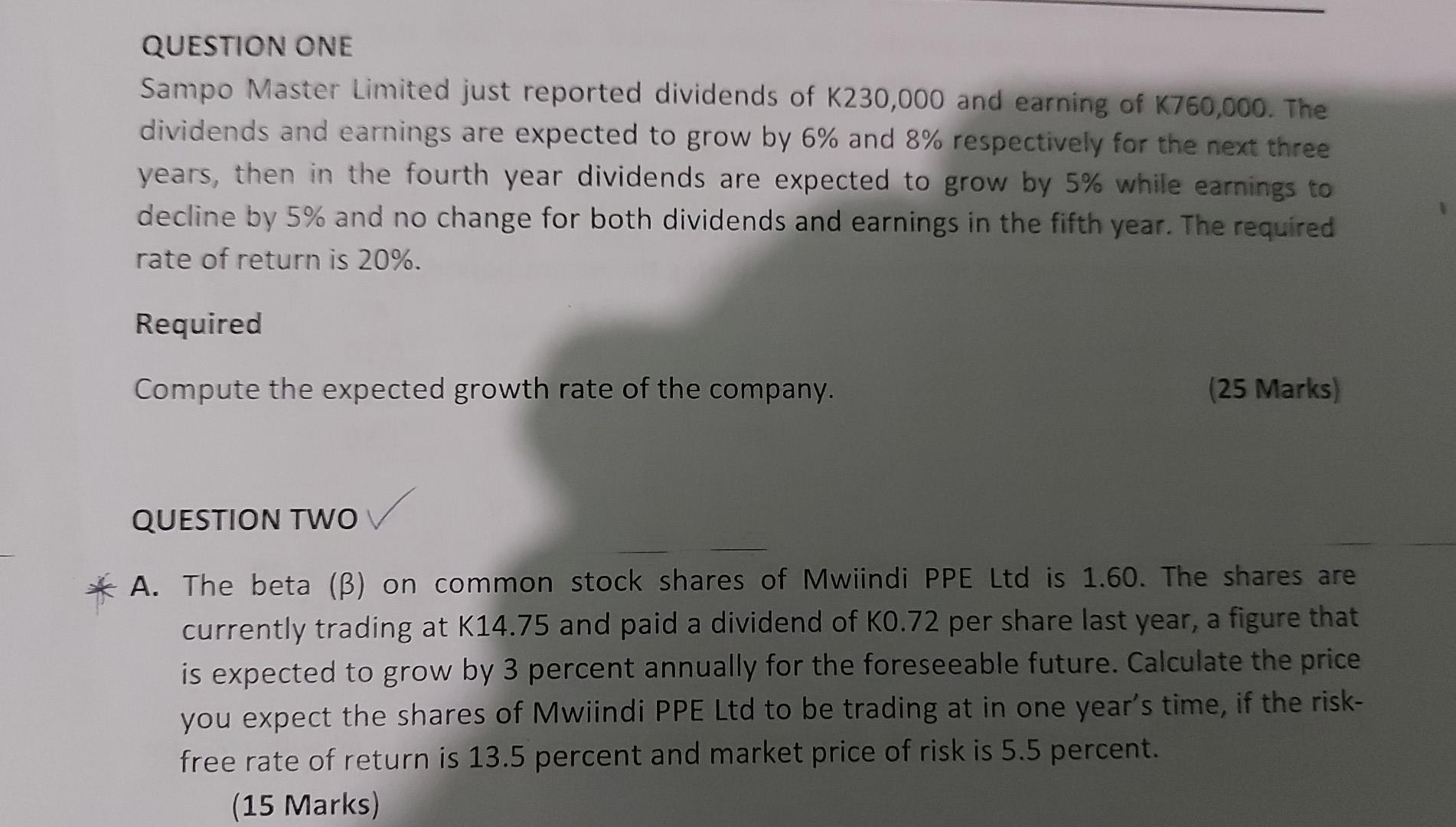

QUESTION ONE Sampo Master Limited just reported dividends of K230,000 and earning of K760,000. The dividends and earnings are expected to grow by 6% and 8% respectively for the next three years, then in the fourth year dividends are expected to grow by 5% while earnings to decline by 5% and no change for both dividends and earnings in the fifth year. The required rate of return is 20%. Required Compute the expected growth rate of the company. (25 Marks QUESTION TWO A. The beta (B) on common stock shares of Mwiindi PPE Ltd is 1.60. The shares are currently trading at K14.75 and paid a dividend of K0.72 per share last year, a figure that is expected to grow by 3 percent annually for the foreseeable future. Calculate the price you expect the shares of Mwiindi PPE Ltd to be trading at in one year's time, if the risk- free rate of return is 13.5 percent and market price of risk is 5.5 percent. (15 Marks) QUESTION ONE Sampo Master Limited just reported dividends of K230,000 and earning of K760,000. The dividends and earnings are expected to grow by 6% and 8% respectively for the next three years, then in the fourth year dividends are expected to grow by 5% while earnings to decline by 5% and no change for both dividends and earnings in the fifth year. The required rate of return is 20%. Required Compute the expected growth rate of the company. (25 Marks QUESTION TWO A. The beta (B) on common stock shares of Mwiindi PPE Ltd is 1.60. The shares are currently trading at K14.75 and paid a dividend of K0.72 per share last year, a figure that is expected to grow by 3 percent annually for the foreseeable future. Calculate the price you expect the shares of Mwiindi PPE Ltd to be trading at in one year's time, if the risk- free rate of return is 13.5 percent and market price of risk is 5.5 percent. (15 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started