Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly calculate the following. Please provide the completer working. What is the relevant cash flow in year 0 (initial outlay)? Calculate the relevant annual level

Kindly calculate the following. Please provide the completer working.

- What is the relevant cash flow in year 0 (initial outlay)?

- Calculate the relevant annual level cash flows from year 1 to year 10

- Payback period

- Discounted payback

- NPV - Cash Flow

- Profitability index

- Internal rate of return (use interpolation & approximation method)

- Annual Depreciation

- Should the company proceed with its plan? Explain your answer. What other factors the company need to take into consideration?

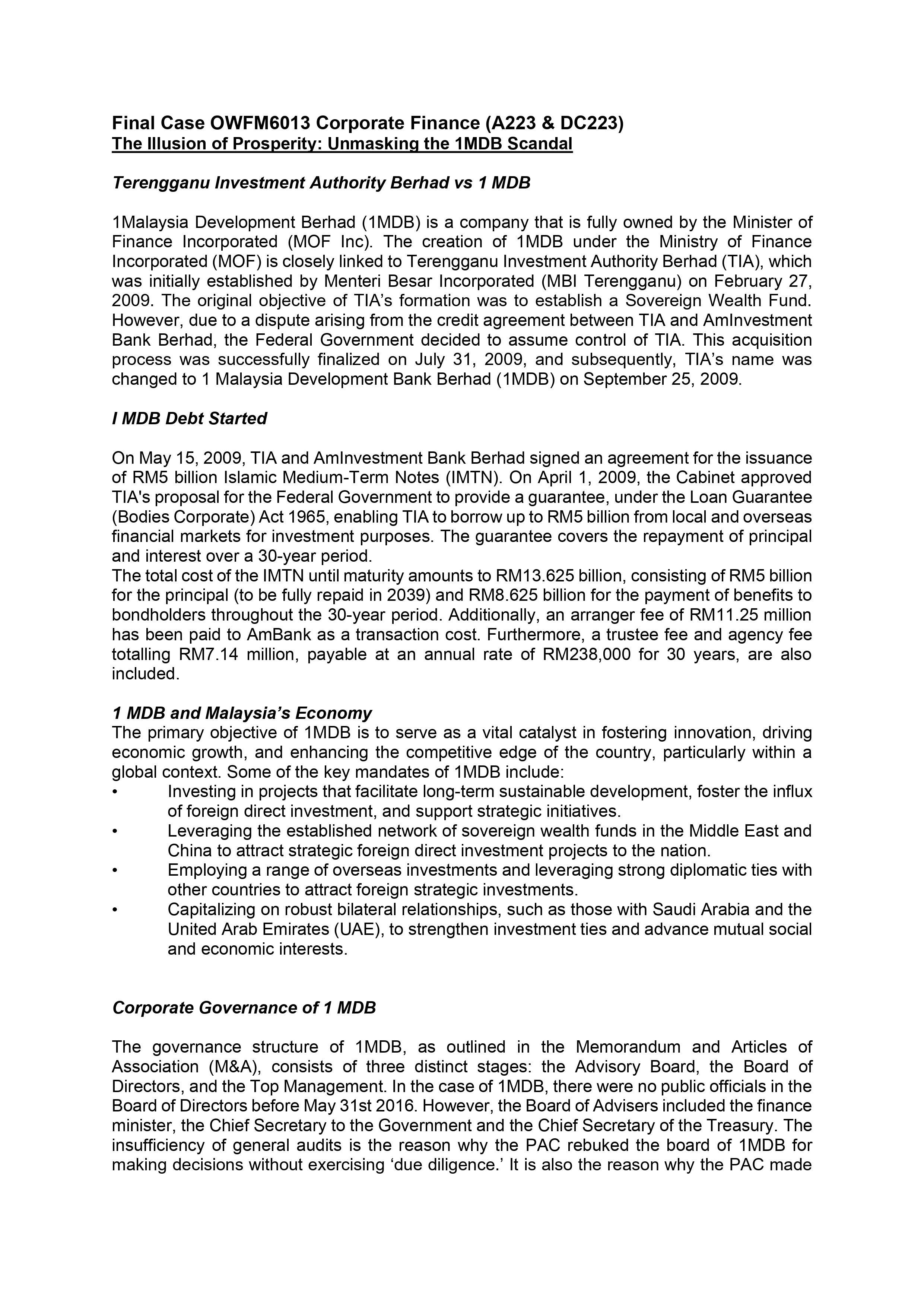

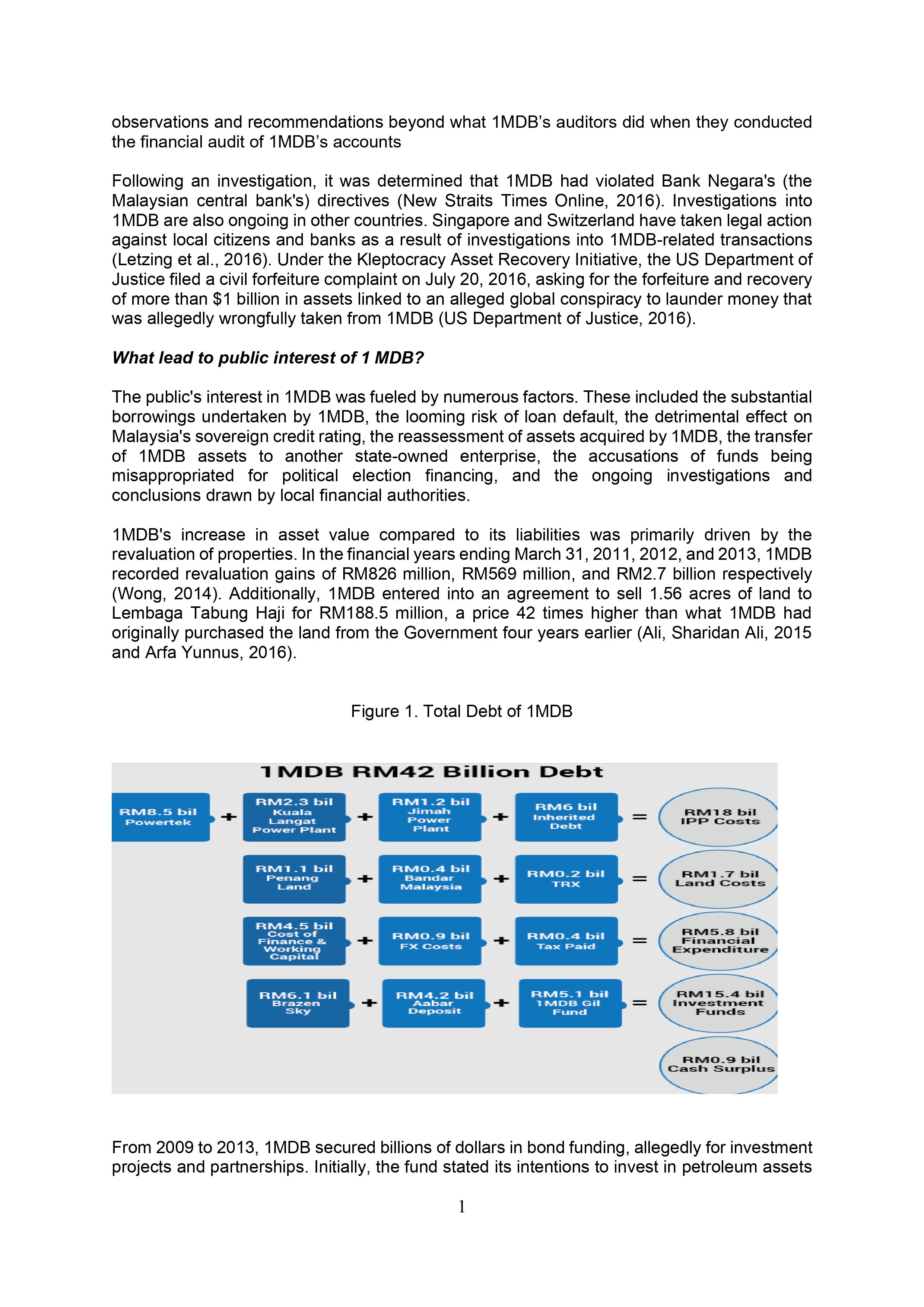

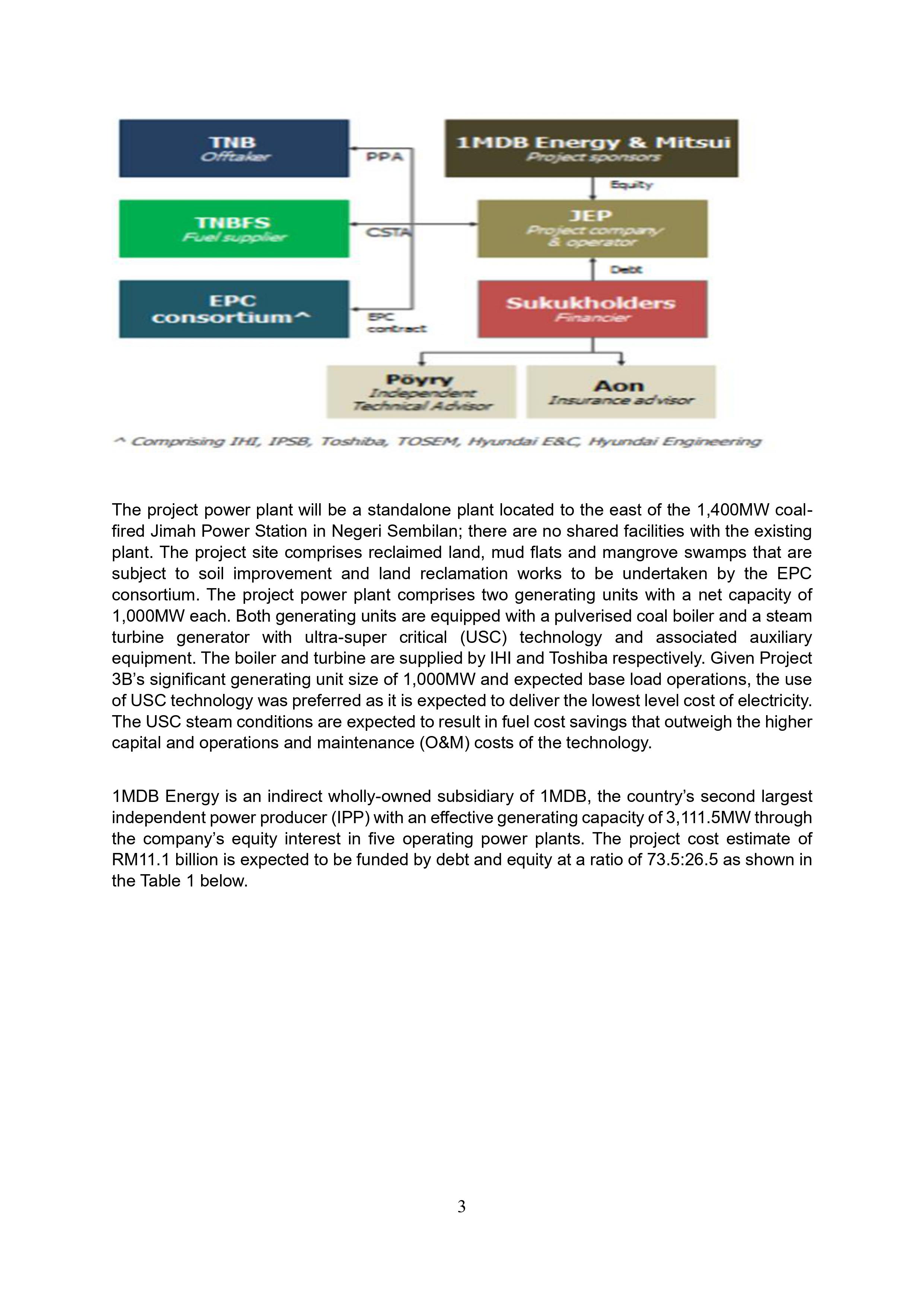

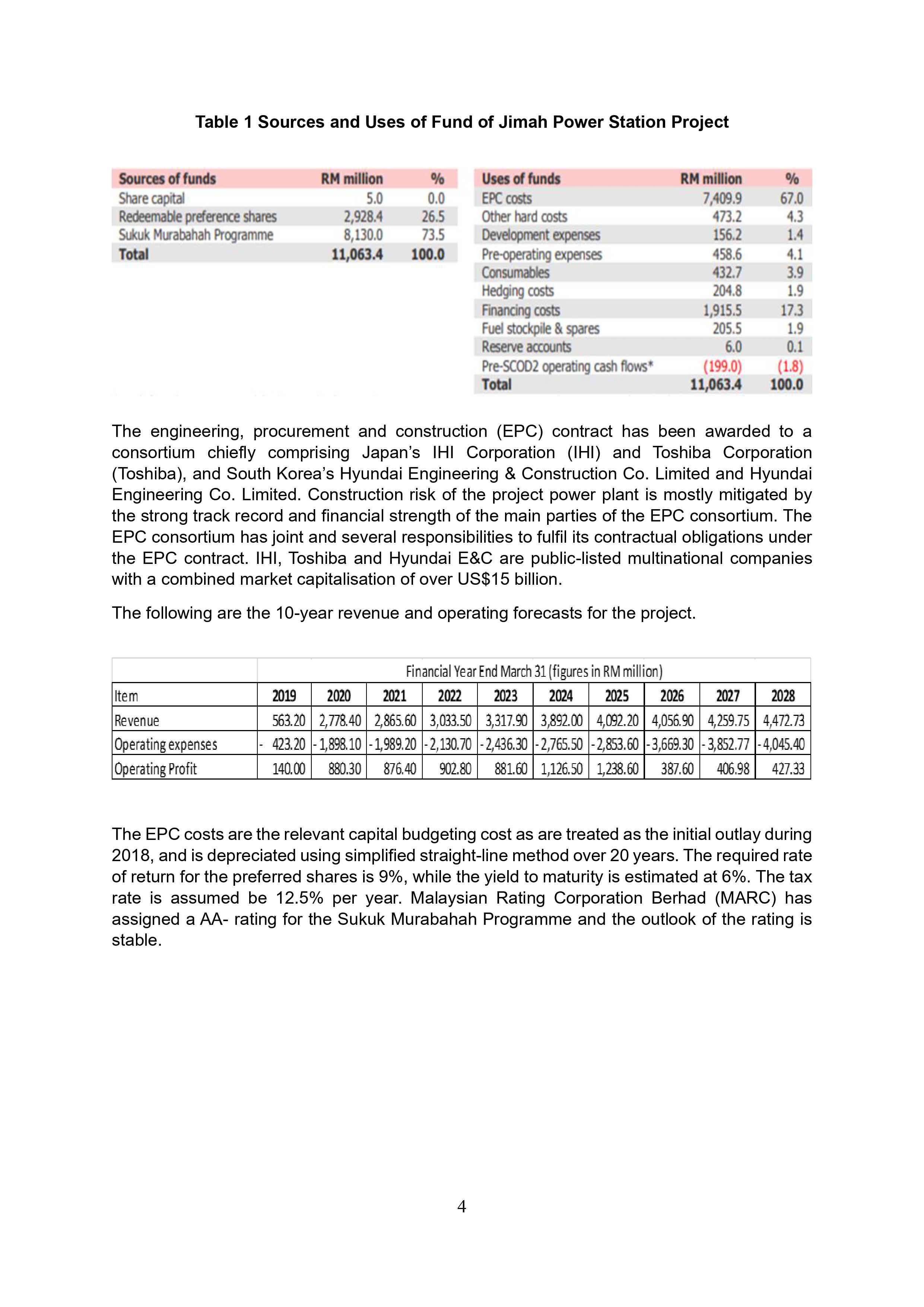

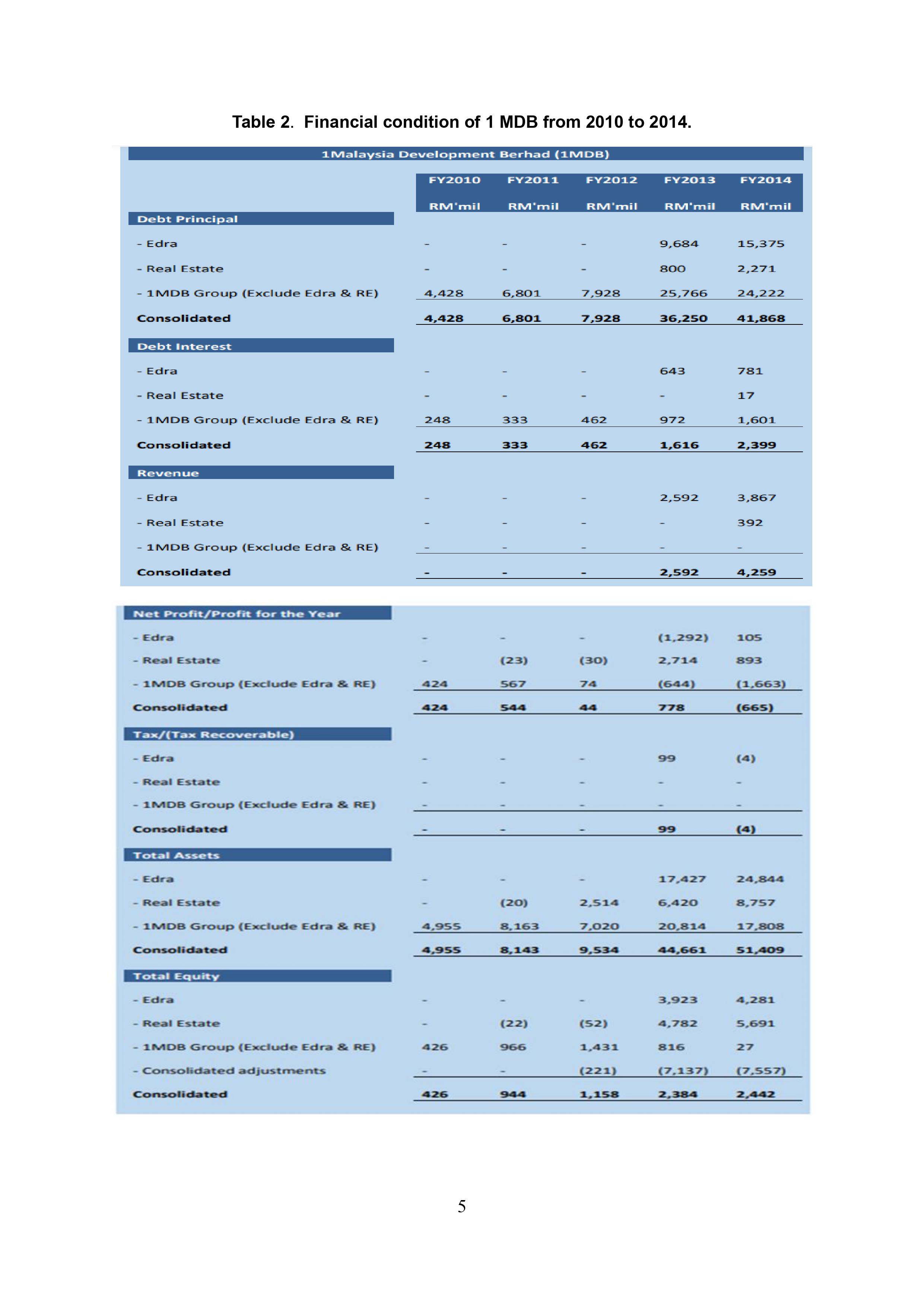

and purchase power plants across different countries. However, the heavy reliance on borrowing quickly accumulated debts of around RM42 billion (S\\$14 billion) as illustrated in Figure 1 above. Jimah Power Point Project Jimah East Power Sdn Bhd (JEP) is the project company of project sponsors 1MDB Energy Group Sdn Bhd (1MDB Energy) and Mitsui \\& Co., Ltd. (Mitsui) which is responsible for developing and operating a new coal-fired power generation facility with a net capacity of 2,000 megawatts (MW). 1MDB Energy is currently dormant and will hold the energy assets of its ultimate parent company 1Malaysia Development Berhad (1MDB) upon completing a corporate restructuring exercise. Post-restructuring, 1MDB Energy and Mitsui will have indirect stakes of \70 and \30 respectively in JEP as shown in Figure 2 below. A power purchase agreement (PPA) was executed between JEP and Tenaga Nasional Berhad (TNB) on July 22, 2014 under which TNB will purchase electricity generated by the project power plant over a 25-year period commencing from the scheduled commercial operation date (SCOD) of its first generating unit on November 15, 2018. The project power plant will be a standalone plant located to the east of the 1,400MW coalfired Jimah Power Station in Negeri Sembilan; there are no shared facilities with the existing plant. The project site comprises reclaimed land, mud flats and mangrove swamps that are subject to soil improvement and land reclamation works to be undertaken by the EPC consortium. The project power plant comprises two generating units with a net capacity of \\( 1,000 \\mathrm{MW} \\) each. Both generating units are equipped with a pulverised coal boiler and a steam turbine generator with ultra-super critical (USC) technology and associated auxiliary equipment. The boiler and turbine are supplied by IHI and Toshiba respectively. Given Project 3B's significant generating unit size of 1,000MW and expected base load operations, the use of USC technology was preferred as it is expected to deliver the lowest level cost of electricity. The USC steam conditions are expected to result in fuel cost savings that outweigh the higher capital and operations and maintenance (O\\&M) costs of the technology. 1MDB Energy is an indirect wholly-owned subsidiary of 1MDB, the country's second largest independent power producer (IPP) with an effective generating capacity of 3,111.5MW through the company's equity interest in five operating power plants. The project cost estimate of RM11.1 billion is expected to be funded by debt and equity at a ratio of 73.5:26.5 as shown in the Table 1 below. Table 1 Sources and Uses of Fund of Jimah Power Station Project The engineering, procurement and construction (EPC) contract has been awarded to a consortium chiefly comprising Japan's IHI Corporation (IHI) and Toshiba Corporation (Toshiba), and South Korea's Hyundai Engineering \\& Construction Co. Limited and Hyundai Engineering Co. Limited. Construction risk of the project power plant is mostly mitigated by the strong track record and financial strength of the main parties of the EPC consortium. The EPC consortium has joint and several responsibilities to fulfil its contractual obligations under the EPC contract. IHI, Toshiba and Hyundai E\\&C are public-listed multinational companies with a combined market capitalisation of over US\\$15 billion. The following are the 10-year revenue and operating forecasts for the project. The EPC costs are the relevant capital budgeting cost as are treated as the initial outlay during 2018 , and is depreciated using simplified straight-line method over 20 years. The required rate of return for the preferred shares is \9, while the yield to maturity is estimated at \6. The tax rate is assumed be \12.5 per year. Malaysian Rating Corporation Berhad (MARC) has assigned a AA- rating for the Sukuk Murabahah Programme and the outlook of the rating is stable. Final Case OWFM6013 Corporate Finance (A223 \\& DC223) The Illusion of Prosperity: Unmasking the 1MDB Scandal Terengganu Investment Authority Berhad vs 1 MDB 1Malaysia Development Berhad (1MDB) is a company that is fully owned by the Minister of Finance Incorporated (MOF Inc). The creation of 1MDB under the Ministry of Finance Incorporated (MOF) is closely linked to Terengganu Investment Authority Berhad (TIA), which was initially established by Menteri Besar Incorporated (MBI Terengganu) on February 27, 2009. The original objective of TIA's formation was to establish a Sovereign Wealth Fund. However, due to a dispute arising from the credit agreement between TIA and Amlnvestment Bank Berhad, the Federal Government decided to assume control of TIA. This acquisition process was successfully finalized on July 31, 2009, and subsequently, TIA's name was changed to 1 Malaysia Development Bank Berhad (1MDB) on September 25, 2009. I MDB Debt Started On May 15, 2009, TIA and Amlnvestment Bank Berhad signed an agreement for the issuance of RM5 billion Islamic Medium-Term Notes (IMTN). On April 1, 2009, the Cabinet approved TIA's proposal for the Federal Government to provide a guarantee, under the Loan Guarantee (Bodies Corporate) Act 1965, enabling TIA to borrow up to RM5 billion from local and overseas financial markets for investment purposes. The guarantee covers the repayment of principal and interest over a 30-year period. The total cost of the IMTN until maturity amounts to RM13.625 billion, consisting of RM5 billion for the principal (to be fully repaid in 2039) and RM8.625 billion for the payment of benefits to bondholders throughout the 30-year period. Additionally, an arranger fee of RM11.25 million has been paid to AmBank as a transaction cost. Furthermore, a trustee fee and agency fee totalling RM7.14 million, payable at an annual rate of RM238,000 for 30 years, are also included. 1 MDB and Malaysia's Economy The primary objective of \\( 1 \\mathrm{MDB} \\) is to serve as a vital catalyst in fostering innovation, driving economic growth, and enhancing the competitive edge of the country, particularly within a global context. Some of the key mandates of 1MDB include: Investing in projects that facilitate long-term sustainable development, foster the influx of foreign direct investment, and support strategic initiatives. Leveraging the established network of sovereign wealth funds in the Middle East and China to attract strategic foreign direct investment projects to the nation. Employing a range of overseas investments and leveraging strong diplomatic ties with other countries to attract foreign strategic investments. Capitalizing on robust bilateral relationships, such as those with Saudi Arabia and the United Arab Emirates (UAE), to strengthen investment ties and advance mutual social and economic interests. Corporate Governance of 1 MDB The governance structure of \\( 1 \\mathrm{MDB} \\), as outlined in the Memorandum and Articles of Association (M\\&A), consists of three distinct stages: the Advisory Board, the Board of Directors, and the Top Management. In the case of \\( 1 \\mathrm{MDB} \\), there were no public officials in the Board of Directors before May 31st 2016. However, the Board of Advisers included the finance minister, the Chief Secretary to the Government and the Chief Secretary of the Treasury. The insufficiency of general audits is the reason why the PAC rebuked the board of 1MDB for making decisions without exercising 'due diligence.' It is also the reason why the PAC made Table 2. Financial condition of 1 MDB from 2010 to 2014. observations and recommendations beyond what 1MDB's auditors did when they conducted the financial audit of 1MDB's accounts Following an investigation, it was determined that 1MDB had violated Bank Negara's (the Malaysian central bank's) directives (New Straits Times Online, 2016). Investigations into \\( 1 \\mathrm{MDB} \\) are also ongoing in other countries. Singapore and Switzerland have taken legal action against local citizens and banks as a result of investigations into 1MDB-related transactions (Letzing et al., 2016). Under the Kleptocracy Asset Recovery Initiative, the US Department of Justice filed a civil forfeiture complaint on July 20,2016 , asking for the forfeiture and recovery of more than \\( \\$ 1 \\) billion in assets linked to an alleged global conspiracy to launder money that was allegedly wrongfully taken from 1MDB (US Department of Justice, 2016). What lead to public interest of 1 MDB? The public's interest in 1MDB was fueled by numerous factors. These included the substantial borrowings undertaken by \\( 1 \\mathrm{MDB} \\), the looming risk of loan default, the detrimental effect on Malaysia's sovereign credit rating, the reassessment of assets acquired by \\( 1 \\mathrm{MDB} \\), the transfer of 1MDB assets to another state-owned enterprise, the accusations of funds being misappropriated for political election financing, and the ongoing investigations and conclusions drawn by local financial authorities. 1MDB's increase in asset value compared to its liabilities was primarily driven by the revaluation of properties. In the financial years ending March 31, 2011, 2012, and 2013, 1MDB recorded revaluation gains of RM826 million, RM569 million, and RM2.7 billion respectively (Wong, 2014). Additionally, 1MDB entered into an agreement to sell 1.56 acres of land to Lembaga Tabung Haji for RM188.5 million, a price 42 times higher than what 1MDB had originally purchased the land from the Government four years earlier (Ali, Sharidan Ali, 2015 and Arfa Yunnus, 2016). Figure 1. Total Debt of 1MDB From 2009 to 2013, 1MDB secured billions of dollars in bond funding, allegedly for investment projects and partnerships. Initially, the fund stated its intentions to invest in petroleum assets The total value of the assets owned by 1 MDB Group as of 31 Mar 2014 was RM51,409.43 million which included the investments in energy related assets, the assets in portfolio investment and SPC, the assets in real estate investments and other assets. While the liabilities is reported to be RM42 billion (see Figure 1). Table 2 above display financial condition of 1 MDB from 2010 to 2014. The raising concern of the financial issue raised by people is being highlighted in the report by Bernama in 2014 1Malaysia Development Bhd (1MDB) has given an assurance that all its investments were prudent and professionally managed. -Some of the loans are long-term in nature but we believe this financial commitment can be met. We are also in the process of adding and unlocking value to the assets that we have acquired, II 1MDB chairman Tan Sri Lodin Wok Kamaruddin told reporters today. Dispelling misconceptions about 1MDB's ability to repay loans, he said 1MDB was looking at restructuring its loans to address the mismatching longterm investment projects and short-term loans. He said its ventures in the Tun Razak Exchange (TRX) and Bandar Malaysia projects as well as in the energy sector were long-term in nature with long-term gestation periods and purchase power plants across different countries. However, the heavy reliance on borrowing quickly accumulated debts of around RM42 billion (S\\$14 billion) as illustrated in Figure 1 above. Jimah Power Point Project Jimah East Power Sdn Bhd (JEP) is the project company of project sponsors 1MDB Energy Group Sdn Bhd (1MDB Energy) and Mitsui \\& Co., Ltd. (Mitsui) which is responsible for developing and operating a new coal-fired power generation facility with a net capacity of 2,000 megawatts (MW). 1MDB Energy is currently dormant and will hold the energy assets of its ultimate parent company 1Malaysia Development Berhad (1MDB) upon completing a corporate restructuring exercise. Post-restructuring, 1MDB Energy and Mitsui will have indirect stakes of \70 and \30 respectively in JEP as shown in Figure 2 below. A power purchase agreement (PPA) was executed between JEP and Tenaga Nasional Berhad (TNB) on July 22, 2014 under which TNB will purchase electricity generated by the project power plant over a 25-year period commencing from the scheduled commercial operation date (SCOD) of its first generating unit on November 15, 2018. The project power plant will be a standalone plant located to the east of the 1,400MW coalfired Jimah Power Station in Negeri Sembilan; there are no shared facilities with the existing plant. The project site comprises reclaimed land, mud flats and mangrove swamps that are subject to soil improvement and land reclamation works to be undertaken by the EPC consortium. The project power plant comprises two generating units with a net capacity of \\( 1,000 \\mathrm{MW} \\) each. Both generating units are equipped with a pulverised coal boiler and a steam turbine generator with ultra-super critical (USC) technology and associated auxiliary equipment. The boiler and turbine are supplied by IHI and Toshiba respectively. Given Project 3B's significant generating unit size of 1,000MW and expected base load operations, the use of USC technology was preferred as it is expected to deliver the lowest level cost of electricity. The USC steam conditions are expected to result in fuel cost savings that outweigh the higher capital and operations and maintenance (O\\&M) costs of the technology. 1MDB Energy is an indirect wholly-owned subsidiary of 1MDB, the country's second largest independent power producer (IPP) with an effective generating capacity of 3,111.5MW through the company's equity interest in five operating power plants. The project cost estimate of RM11.1 billion is expected to be funded by debt and equity at a ratio of 73.5:26.5 as shown in the Table 1 below. Table 1 Sources and Uses of Fund of Jimah Power Station Project The engineering, procurement and construction (EPC) contract has been awarded to a consortium chiefly comprising Japan's IHI Corporation (IHI) and Toshiba Corporation (Toshiba), and South Korea's Hyundai Engineering \\& Construction Co. Limited and Hyundai Engineering Co. Limited. Construction risk of the project power plant is mostly mitigated by the strong track record and financial strength of the main parties of the EPC consortium. The EPC consortium has joint and several responsibilities to fulfil its contractual obligations under the EPC contract. IHI, Toshiba and Hyundai E\\&C are public-listed multinational companies with a combined market capitalisation of over US\\$15 billion. The following are the 10-year revenue and operating forecasts for the project. The EPC costs are the relevant capital budgeting cost as are treated as the initial outlay during 2018 , and is depreciated using simplified straight-line method over 20 years. The required rate of return for the preferred shares is \9, while the yield to maturity is estimated at \6. The tax rate is assumed be \12.5 per year. Malaysian Rating Corporation Berhad (MARC) has assigned a AA- rating for the Sukuk Murabahah Programme and the outlook of the rating is stable. Final Case OWFM6013 Corporate Finance (A223 \\& DC223) The Illusion of Prosperity: Unmasking the 1MDB Scandal Terengganu Investment Authority Berhad vs 1 MDB 1Malaysia Development Berhad (1MDB) is a company that is fully owned by the Minister of Finance Incorporated (MOF Inc). The creation of 1MDB under the Ministry of Finance Incorporated (MOF) is closely linked to Terengganu Investment Authority Berhad (TIA), which was initially established by Menteri Besar Incorporated (MBI Terengganu) on February 27, 2009. The original objective of TIA's formation was to establish a Sovereign Wealth Fund. However, due to a dispute arising from the credit agreement between TIA and Amlnvestment Bank Berhad, the Federal Government decided to assume control of TIA. This acquisition process was successfully finalized on July 31, 2009, and subsequently, TIA's name was changed to 1 Malaysia Development Bank Berhad (1MDB) on September 25, 2009. I MDB Debt Started On May 15, 2009, TIA and Amlnvestment Bank Berhad signed an agreement for the issuance of RM5 billion Islamic Medium-Term Notes (IMTN). On April 1, 2009, the Cabinet approved TIA's proposal for the Federal Government to provide a guarantee, under the Loan Guarantee (Bodies Corporate) Act 1965, enabling TIA to borrow up to RM5 billion from local and overseas financial markets for investment purposes. The guarantee covers the repayment of principal and interest over a 30-year period. The total cost of the IMTN until maturity amounts to RM13.625 billion, consisting of RM5 billion for the principal (to be fully repaid in 2039) and RM8.625 billion for the payment of benefits to bondholders throughout the 30-year period. Additionally, an arranger fee of RM11.25 million has been paid to AmBank as a transaction cost. Furthermore, a trustee fee and agency fee totalling RM7.14 million, payable at an annual rate of RM238,000 for 30 years, are also included. 1 MDB and Malaysia's Economy The primary objective of \\( 1 \\mathrm{MDB} \\) is to serve as a vital catalyst in fostering innovation, driving economic growth, and enhancing the competitive edge of the country, particularly within a global context. Some of the key mandates of 1MDB include: Investing in projects that facilitate long-term sustainable development, foster the influx of foreign direct investment, and support strategic initiatives. Leveraging the established network of sovereign wealth funds in the Middle East and China to attract strategic foreign direct investment projects to the nation. Employing a range of overseas investments and leveraging strong diplomatic ties with other countries to attract foreign strategic investments. Capitalizing on robust bilateral relationships, such as those with Saudi Arabia and the United Arab Emirates (UAE), to strengthen investment ties and advance mutual social and economic interests. Corporate Governance of 1 MDB The governance structure of \\( 1 \\mathrm{MDB} \\), as outlined in the Memorandum and Articles of Association (M\\&A), consists of three distinct stages: the Advisory Board, the Board of Directors, and the Top Management. In the case of \\( 1 \\mathrm{MDB} \\), there were no public officials in the Board of Directors before May 31st 2016. However, the Board of Advisers included the finance minister, the Chief Secretary to the Government and the Chief Secretary of the Treasury. The insufficiency of general audits is the reason why the PAC rebuked the board of 1MDB for making decisions without exercising 'due diligence.' It is also the reason why the PAC made Table 2. Financial condition of 1 MDB from 2010 to 2014. observations and recommendations beyond what 1MDB's auditors did when they conducted the financial audit of 1MDB's accounts Following an investigation, it was determined that 1MDB had violated Bank Negara's (the Malaysian central bank's) directives (New Straits Times Online, 2016). Investigations into \\( 1 \\mathrm{MDB} \\) are also ongoing in other countries. Singapore and Switzerland have taken legal action against local citizens and banks as a result of investigations into 1MDB-related transactions (Letzing et al., 2016). Under the Kleptocracy Asset Recovery Initiative, the US Department of Justice filed a civil forfeiture complaint on July 20,2016 , asking for the forfeiture and recovery of more than \\( \\$ 1 \\) billion in assets linked to an alleged global conspiracy to launder money that was allegedly wrongfully taken from 1MDB (US Department of Justice, 2016). What lead to public interest of 1 MDB? The public's interest in 1MDB was fueled by numerous factors. These included the substantial borrowings undertaken by \\( 1 \\mathrm{MDB} \\), the looming risk of loan default, the detrimental effect on Malaysia's sovereign credit rating, the reassessment of assets acquired by \\( 1 \\mathrm{MDB} \\), the transfer of 1MDB assets to another state-owned enterprise, the accusations of funds being misappropriated for political election financing, and the ongoing investigations and conclusions drawn by local financial authorities. 1MDB's increase in asset value compared to its liabilities was primarily driven by the revaluation of properties. In the financial years ending March 31, 2011, 2012, and 2013, 1MDB recorded revaluation gains of RM826 million, RM569 million, and RM2.7 billion respectively (Wong, 2014). Additionally, 1MDB entered into an agreement to sell 1.56 acres of land to Lembaga Tabung Haji for RM188.5 million, a price 42 times higher than what 1MDB had originally purchased the land from the Government four years earlier (Ali, Sharidan Ali, 2015 and Arfa Yunnus, 2016). Figure 1. Total Debt of 1MDB From 2009 to 2013, 1MDB secured billions of dollars in bond funding, allegedly for investment projects and partnerships. Initially, the fund stated its intentions to invest in petroleum assets The total value of the assets owned by 1 MDB Group as of 31 Mar 2014 was RM51,409.43 million which included the investments in energy related assets, the assets in portfolio investment and SPC, the assets in real estate investments and other assets. While the liabilities is reported to be RM42 billion (see Figure 1). Table 2 above display financial condition of 1 MDB from 2010 to 2014. The raising concern of the financial issue raised by people is being highlighted in the report by Bernama in 2014 1Malaysia Development Bhd (1MDB) has given an assurance that all its investments were prudent and professionally managed. -Some of the loans are long-term in nature but we believe this financial commitment can be met. We are also in the process of adding and unlocking value to the assets that we have acquired, II 1MDB chairman Tan Sri Lodin Wok Kamaruddin told reporters today. Dispelling misconceptions about 1MDB's ability to repay loans, he said 1MDB was looking at restructuring its loans to address the mismatching longterm investment projects and short-term loans. He said its ventures in the Tun Razak Exchange (TRX) and Bandar Malaysia projects as well as in the energy sector were long-term in nature with long-term gestation periods

and purchase power plants across different countries. However, the heavy reliance on borrowing quickly accumulated debts of around RM42 billion (S\\$14 billion) as illustrated in Figure 1 above. Jimah Power Point Project Jimah East Power Sdn Bhd (JEP) is the project company of project sponsors 1MDB Energy Group Sdn Bhd (1MDB Energy) and Mitsui \\& Co., Ltd. (Mitsui) which is responsible for developing and operating a new coal-fired power generation facility with a net capacity of 2,000 megawatts (MW). 1MDB Energy is currently dormant and will hold the energy assets of its ultimate parent company 1Malaysia Development Berhad (1MDB) upon completing a corporate restructuring exercise. Post-restructuring, 1MDB Energy and Mitsui will have indirect stakes of \70 and \30 respectively in JEP as shown in Figure 2 below. A power purchase agreement (PPA) was executed between JEP and Tenaga Nasional Berhad (TNB) on July 22, 2014 under which TNB will purchase electricity generated by the project power plant over a 25-year period commencing from the scheduled commercial operation date (SCOD) of its first generating unit on November 15, 2018. The project power plant will be a standalone plant located to the east of the 1,400MW coalfired Jimah Power Station in Negeri Sembilan; there are no shared facilities with the existing plant. The project site comprises reclaimed land, mud flats and mangrove swamps that are subject to soil improvement and land reclamation works to be undertaken by the EPC consortium. The project power plant comprises two generating units with a net capacity of \\( 1,000 \\mathrm{MW} \\) each. Both generating units are equipped with a pulverised coal boiler and a steam turbine generator with ultra-super critical (USC) technology and associated auxiliary equipment. The boiler and turbine are supplied by IHI and Toshiba respectively. Given Project 3B's significant generating unit size of 1,000MW and expected base load operations, the use of USC technology was preferred as it is expected to deliver the lowest level cost of electricity. The USC steam conditions are expected to result in fuel cost savings that outweigh the higher capital and operations and maintenance (O\\&M) costs of the technology. 1MDB Energy is an indirect wholly-owned subsidiary of 1MDB, the country's second largest independent power producer (IPP) with an effective generating capacity of 3,111.5MW through the company's equity interest in five operating power plants. The project cost estimate of RM11.1 billion is expected to be funded by debt and equity at a ratio of 73.5:26.5 as shown in the Table 1 below. Table 1 Sources and Uses of Fund of Jimah Power Station Project The engineering, procurement and construction (EPC) contract has been awarded to a consortium chiefly comprising Japan's IHI Corporation (IHI) and Toshiba Corporation (Toshiba), and South Korea's Hyundai Engineering \\& Construction Co. Limited and Hyundai Engineering Co. Limited. Construction risk of the project power plant is mostly mitigated by the strong track record and financial strength of the main parties of the EPC consortium. The EPC consortium has joint and several responsibilities to fulfil its contractual obligations under the EPC contract. IHI, Toshiba and Hyundai E\\&C are public-listed multinational companies with a combined market capitalisation of over US\\$15 billion. The following are the 10-year revenue and operating forecasts for the project. The EPC costs are the relevant capital budgeting cost as are treated as the initial outlay during 2018 , and is depreciated using simplified straight-line method over 20 years. The required rate of return for the preferred shares is \9, while the yield to maturity is estimated at \6. The tax rate is assumed be \12.5 per year. Malaysian Rating Corporation Berhad (MARC) has assigned a AA- rating for the Sukuk Murabahah Programme and the outlook of the rating is stable. Final Case OWFM6013 Corporate Finance (A223 \\& DC223) The Illusion of Prosperity: Unmasking the 1MDB Scandal Terengganu Investment Authority Berhad vs 1 MDB 1Malaysia Development Berhad (1MDB) is a company that is fully owned by the Minister of Finance Incorporated (MOF Inc). The creation of 1MDB under the Ministry of Finance Incorporated (MOF) is closely linked to Terengganu Investment Authority Berhad (TIA), which was initially established by Menteri Besar Incorporated (MBI Terengganu) on February 27, 2009. The original objective of TIA's formation was to establish a Sovereign Wealth Fund. However, due to a dispute arising from the credit agreement between TIA and Amlnvestment Bank Berhad, the Federal Government decided to assume control of TIA. This acquisition process was successfully finalized on July 31, 2009, and subsequently, TIA's name was changed to 1 Malaysia Development Bank Berhad (1MDB) on September 25, 2009. I MDB Debt Started On May 15, 2009, TIA and Amlnvestment Bank Berhad signed an agreement for the issuance of RM5 billion Islamic Medium-Term Notes (IMTN). On April 1, 2009, the Cabinet approved TIA's proposal for the Federal Government to provide a guarantee, under the Loan Guarantee (Bodies Corporate) Act 1965, enabling TIA to borrow up to RM5 billion from local and overseas financial markets for investment purposes. The guarantee covers the repayment of principal and interest over a 30-year period. The total cost of the IMTN until maturity amounts to RM13.625 billion, consisting of RM5 billion for the principal (to be fully repaid in 2039) and RM8.625 billion for the payment of benefits to bondholders throughout the 30-year period. Additionally, an arranger fee of RM11.25 million has been paid to AmBank as a transaction cost. Furthermore, a trustee fee and agency fee totalling RM7.14 million, payable at an annual rate of RM238,000 for 30 years, are also included. 1 MDB and Malaysia's Economy The primary objective of \\( 1 \\mathrm{MDB} \\) is to serve as a vital catalyst in fostering innovation, driving economic growth, and enhancing the competitive edge of the country, particularly within a global context. Some of the key mandates of 1MDB include: Investing in projects that facilitate long-term sustainable development, foster the influx of foreign direct investment, and support strategic initiatives. Leveraging the established network of sovereign wealth funds in the Middle East and China to attract strategic foreign direct investment projects to the nation. Employing a range of overseas investments and leveraging strong diplomatic ties with other countries to attract foreign strategic investments. Capitalizing on robust bilateral relationships, such as those with Saudi Arabia and the United Arab Emirates (UAE), to strengthen investment ties and advance mutual social and economic interests. Corporate Governance of 1 MDB The governance structure of \\( 1 \\mathrm{MDB} \\), as outlined in the Memorandum and Articles of Association (M\\&A), consists of three distinct stages: the Advisory Board, the Board of Directors, and the Top Management. In the case of \\( 1 \\mathrm{MDB} \\), there were no public officials in the Board of Directors before May 31st 2016. However, the Board of Advisers included the finance minister, the Chief Secretary to the Government and the Chief Secretary of the Treasury. The insufficiency of general audits is the reason why the PAC rebuked the board of 1MDB for making decisions without exercising 'due diligence.' It is also the reason why the PAC made Table 2. Financial condition of 1 MDB from 2010 to 2014. observations and recommendations beyond what 1MDB's auditors did when they conducted the financial audit of 1MDB's accounts Following an investigation, it was determined that 1MDB had violated Bank Negara's (the Malaysian central bank's) directives (New Straits Times Online, 2016). Investigations into \\( 1 \\mathrm{MDB} \\) are also ongoing in other countries. Singapore and Switzerland have taken legal action against local citizens and banks as a result of investigations into 1MDB-related transactions (Letzing et al., 2016). Under the Kleptocracy Asset Recovery Initiative, the US Department of Justice filed a civil forfeiture complaint on July 20,2016 , asking for the forfeiture and recovery of more than \\( \\$ 1 \\) billion in assets linked to an alleged global conspiracy to launder money that was allegedly wrongfully taken from 1MDB (US Department of Justice, 2016). What lead to public interest of 1 MDB? The public's interest in 1MDB was fueled by numerous factors. These included the substantial borrowings undertaken by \\( 1 \\mathrm{MDB} \\), the looming risk of loan default, the detrimental effect on Malaysia's sovereign credit rating, the reassessment of assets acquired by \\( 1 \\mathrm{MDB} \\), the transfer of 1MDB assets to another state-owned enterprise, the accusations of funds being misappropriated for political election financing, and the ongoing investigations and conclusions drawn by local financial authorities. 1MDB's increase in asset value compared to its liabilities was primarily driven by the revaluation of properties. In the financial years ending March 31, 2011, 2012, and 2013, 1MDB recorded revaluation gains of RM826 million, RM569 million, and RM2.7 billion respectively (Wong, 2014). Additionally, 1MDB entered into an agreement to sell 1.56 acres of land to Lembaga Tabung Haji for RM188.5 million, a price 42 times higher than what 1MDB had originally purchased the land from the Government four years earlier (Ali, Sharidan Ali, 2015 and Arfa Yunnus, 2016). Figure 1. Total Debt of 1MDB From 2009 to 2013, 1MDB secured billions of dollars in bond funding, allegedly for investment projects and partnerships. Initially, the fund stated its intentions to invest in petroleum assets The total value of the assets owned by 1 MDB Group as of 31 Mar 2014 was RM51,409.43 million which included the investments in energy related assets, the assets in portfolio investment and SPC, the assets in real estate investments and other assets. While the liabilities is reported to be RM42 billion (see Figure 1). Table 2 above display financial condition of 1 MDB from 2010 to 2014. The raising concern of the financial issue raised by people is being highlighted in the report by Bernama in 2014 1Malaysia Development Bhd (1MDB) has given an assurance that all its investments were prudent and professionally managed. -Some of the loans are long-term in nature but we believe this financial commitment can be met. We are also in the process of adding and unlocking value to the assets that we have acquired, II 1MDB chairman Tan Sri Lodin Wok Kamaruddin told reporters today. Dispelling misconceptions about 1MDB's ability to repay loans, he said 1MDB was looking at restructuring its loans to address the mismatching longterm investment projects and short-term loans. He said its ventures in the Tun Razak Exchange (TRX) and Bandar Malaysia projects as well as in the energy sector were long-term in nature with long-term gestation periods and purchase power plants across different countries. However, the heavy reliance on borrowing quickly accumulated debts of around RM42 billion (S\\$14 billion) as illustrated in Figure 1 above. Jimah Power Point Project Jimah East Power Sdn Bhd (JEP) is the project company of project sponsors 1MDB Energy Group Sdn Bhd (1MDB Energy) and Mitsui \\& Co., Ltd. (Mitsui) which is responsible for developing and operating a new coal-fired power generation facility with a net capacity of 2,000 megawatts (MW). 1MDB Energy is currently dormant and will hold the energy assets of its ultimate parent company 1Malaysia Development Berhad (1MDB) upon completing a corporate restructuring exercise. Post-restructuring, 1MDB Energy and Mitsui will have indirect stakes of \70 and \30 respectively in JEP as shown in Figure 2 below. A power purchase agreement (PPA) was executed between JEP and Tenaga Nasional Berhad (TNB) on July 22, 2014 under which TNB will purchase electricity generated by the project power plant over a 25-year period commencing from the scheduled commercial operation date (SCOD) of its first generating unit on November 15, 2018. The project power plant will be a standalone plant located to the east of the 1,400MW coalfired Jimah Power Station in Negeri Sembilan; there are no shared facilities with the existing plant. The project site comprises reclaimed land, mud flats and mangrove swamps that are subject to soil improvement and land reclamation works to be undertaken by the EPC consortium. The project power plant comprises two generating units with a net capacity of \\( 1,000 \\mathrm{MW} \\) each. Both generating units are equipped with a pulverised coal boiler and a steam turbine generator with ultra-super critical (USC) technology and associated auxiliary equipment. The boiler and turbine are supplied by IHI and Toshiba respectively. Given Project 3B's significant generating unit size of 1,000MW and expected base load operations, the use of USC technology was preferred as it is expected to deliver the lowest level cost of electricity. The USC steam conditions are expected to result in fuel cost savings that outweigh the higher capital and operations and maintenance (O\\&M) costs of the technology. 1MDB Energy is an indirect wholly-owned subsidiary of 1MDB, the country's second largest independent power producer (IPP) with an effective generating capacity of 3,111.5MW through the company's equity interest in five operating power plants. The project cost estimate of RM11.1 billion is expected to be funded by debt and equity at a ratio of 73.5:26.5 as shown in the Table 1 below. Table 1 Sources and Uses of Fund of Jimah Power Station Project The engineering, procurement and construction (EPC) contract has been awarded to a consortium chiefly comprising Japan's IHI Corporation (IHI) and Toshiba Corporation (Toshiba), and South Korea's Hyundai Engineering \\& Construction Co. Limited and Hyundai Engineering Co. Limited. Construction risk of the project power plant is mostly mitigated by the strong track record and financial strength of the main parties of the EPC consortium. The EPC consortium has joint and several responsibilities to fulfil its contractual obligations under the EPC contract. IHI, Toshiba and Hyundai E\\&C are public-listed multinational companies with a combined market capitalisation of over US\\$15 billion. The following are the 10-year revenue and operating forecasts for the project. The EPC costs are the relevant capital budgeting cost as are treated as the initial outlay during 2018 , and is depreciated using simplified straight-line method over 20 years. The required rate of return for the preferred shares is \9, while the yield to maturity is estimated at \6. The tax rate is assumed be \12.5 per year. Malaysian Rating Corporation Berhad (MARC) has assigned a AA- rating for the Sukuk Murabahah Programme and the outlook of the rating is stable. Final Case OWFM6013 Corporate Finance (A223 \\& DC223) The Illusion of Prosperity: Unmasking the 1MDB Scandal Terengganu Investment Authority Berhad vs 1 MDB 1Malaysia Development Berhad (1MDB) is a company that is fully owned by the Minister of Finance Incorporated (MOF Inc). The creation of 1MDB under the Ministry of Finance Incorporated (MOF) is closely linked to Terengganu Investment Authority Berhad (TIA), which was initially established by Menteri Besar Incorporated (MBI Terengganu) on February 27, 2009. The original objective of TIA's formation was to establish a Sovereign Wealth Fund. However, due to a dispute arising from the credit agreement between TIA and Amlnvestment Bank Berhad, the Federal Government decided to assume control of TIA. This acquisition process was successfully finalized on July 31, 2009, and subsequently, TIA's name was changed to 1 Malaysia Development Bank Berhad (1MDB) on September 25, 2009. I MDB Debt Started On May 15, 2009, TIA and Amlnvestment Bank Berhad signed an agreement for the issuance of RM5 billion Islamic Medium-Term Notes (IMTN). On April 1, 2009, the Cabinet approved TIA's proposal for the Federal Government to provide a guarantee, under the Loan Guarantee (Bodies Corporate) Act 1965, enabling TIA to borrow up to RM5 billion from local and overseas financial markets for investment purposes. The guarantee covers the repayment of principal and interest over a 30-year period. The total cost of the IMTN until maturity amounts to RM13.625 billion, consisting of RM5 billion for the principal (to be fully repaid in 2039) and RM8.625 billion for the payment of benefits to bondholders throughout the 30-year period. Additionally, an arranger fee of RM11.25 million has been paid to AmBank as a transaction cost. Furthermore, a trustee fee and agency fee totalling RM7.14 million, payable at an annual rate of RM238,000 for 30 years, are also included. 1 MDB and Malaysia's Economy The primary objective of \\( 1 \\mathrm{MDB} \\) is to serve as a vital catalyst in fostering innovation, driving economic growth, and enhancing the competitive edge of the country, particularly within a global context. Some of the key mandates of 1MDB include: Investing in projects that facilitate long-term sustainable development, foster the influx of foreign direct investment, and support strategic initiatives. Leveraging the established network of sovereign wealth funds in the Middle East and China to attract strategic foreign direct investment projects to the nation. Employing a range of overseas investments and leveraging strong diplomatic ties with other countries to attract foreign strategic investments. Capitalizing on robust bilateral relationships, such as those with Saudi Arabia and the United Arab Emirates (UAE), to strengthen investment ties and advance mutual social and economic interests. Corporate Governance of 1 MDB The governance structure of \\( 1 \\mathrm{MDB} \\), as outlined in the Memorandum and Articles of Association (M\\&A), consists of three distinct stages: the Advisory Board, the Board of Directors, and the Top Management. In the case of \\( 1 \\mathrm{MDB} \\), there were no public officials in the Board of Directors before May 31st 2016. However, the Board of Advisers included the finance minister, the Chief Secretary to the Government and the Chief Secretary of the Treasury. The insufficiency of general audits is the reason why the PAC rebuked the board of 1MDB for making decisions without exercising 'due diligence.' It is also the reason why the PAC made Table 2. Financial condition of 1 MDB from 2010 to 2014. observations and recommendations beyond what 1MDB's auditors did when they conducted the financial audit of 1MDB's accounts Following an investigation, it was determined that 1MDB had violated Bank Negara's (the Malaysian central bank's) directives (New Straits Times Online, 2016). Investigations into \\( 1 \\mathrm{MDB} \\) are also ongoing in other countries. Singapore and Switzerland have taken legal action against local citizens and banks as a result of investigations into 1MDB-related transactions (Letzing et al., 2016). Under the Kleptocracy Asset Recovery Initiative, the US Department of Justice filed a civil forfeiture complaint on July 20,2016 , asking for the forfeiture and recovery of more than \\( \\$ 1 \\) billion in assets linked to an alleged global conspiracy to launder money that was allegedly wrongfully taken from 1MDB (US Department of Justice, 2016). What lead to public interest of 1 MDB? The public's interest in 1MDB was fueled by numerous factors. These included the substantial borrowings undertaken by \\( 1 \\mathrm{MDB} \\), the looming risk of loan default, the detrimental effect on Malaysia's sovereign credit rating, the reassessment of assets acquired by \\( 1 \\mathrm{MDB} \\), the transfer of 1MDB assets to another state-owned enterprise, the accusations of funds being misappropriated for political election financing, and the ongoing investigations and conclusions drawn by local financial authorities. 1MDB's increase in asset value compared to its liabilities was primarily driven by the revaluation of properties. In the financial years ending March 31, 2011, 2012, and 2013, 1MDB recorded revaluation gains of RM826 million, RM569 million, and RM2.7 billion respectively (Wong, 2014). Additionally, 1MDB entered into an agreement to sell 1.56 acres of land to Lembaga Tabung Haji for RM188.5 million, a price 42 times higher than what 1MDB had originally purchased the land from the Government four years earlier (Ali, Sharidan Ali, 2015 and Arfa Yunnus, 2016). Figure 1. Total Debt of 1MDB From 2009 to 2013, 1MDB secured billions of dollars in bond funding, allegedly for investment projects and partnerships. Initially, the fund stated its intentions to invest in petroleum assets The total value of the assets owned by 1 MDB Group as of 31 Mar 2014 was RM51,409.43 million which included the investments in energy related assets, the assets in portfolio investment and SPC, the assets in real estate investments and other assets. While the liabilities is reported to be RM42 billion (see Figure 1). Table 2 above display financial condition of 1 MDB from 2010 to 2014. The raising concern of the financial issue raised by people is being highlighted in the report by Bernama in 2014 1Malaysia Development Bhd (1MDB) has given an assurance that all its investments were prudent and professionally managed. -Some of the loans are long-term in nature but we believe this financial commitment can be met. We are also in the process of adding and unlocking value to the assets that we have acquired, II 1MDB chairman Tan Sri Lodin Wok Kamaruddin told reporters today. Dispelling misconceptions about 1MDB's ability to repay loans, he said 1MDB was looking at restructuring its loans to address the mismatching longterm investment projects and short-term loans. He said its ventures in the Tun Razak Exchange (TRX) and Bandar Malaysia projects as well as in the energy sector were long-term in nature with long-term gestation periods Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started