kindly do this question, thank you!

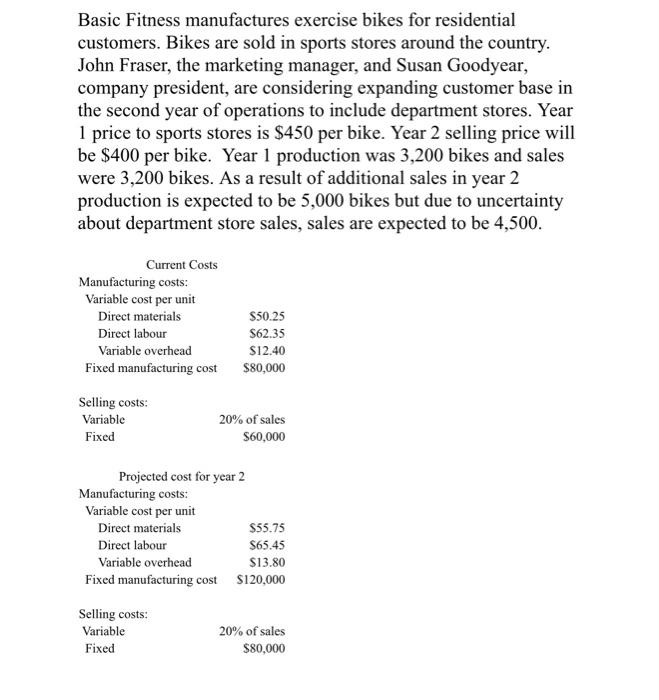

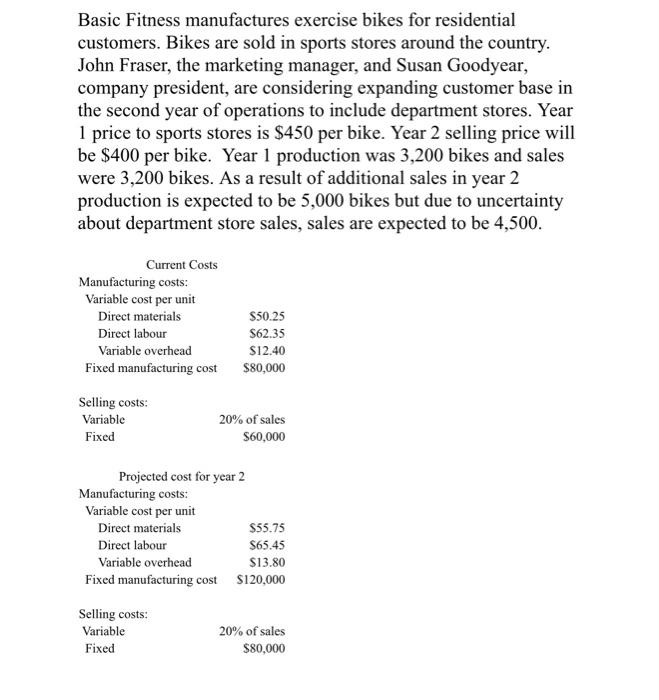

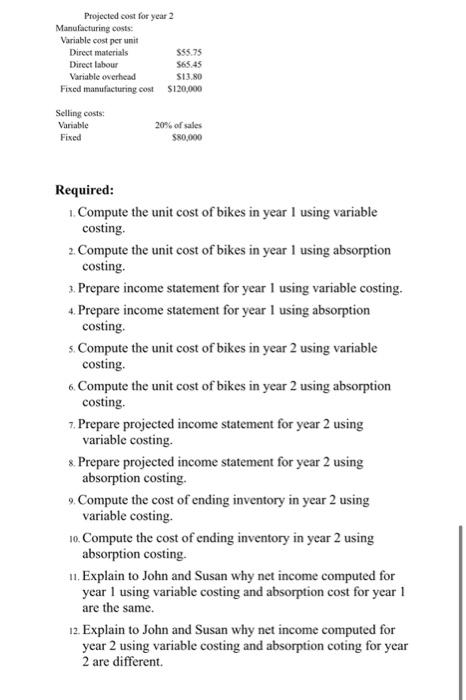

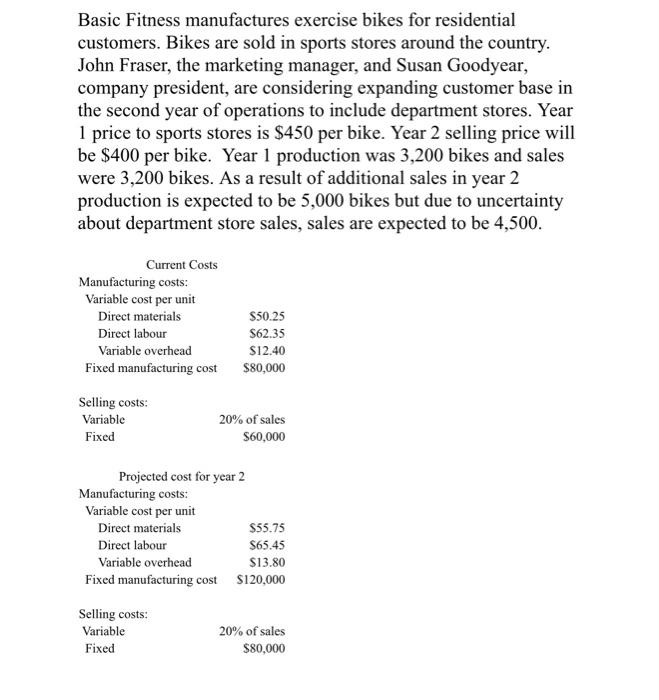

Basic Fitness manufactures exercise bikes for residential customers. Bikes are sold in sports stores around the country. John Fraser, the marketing manager, and Susan Goodyear, company president, are considering expanding customer base in the second year of operations to include department stores. Year 1 price to sports stores is $450 per bike. Year 2 selling price will be $400 per bike. Year 1 production was 3,200 bikes and sales were 3,200 bikes. As a result of additional sales in year 2 production is expected to be 5,000 bikes but due to uncertainty about department store sales, sales are expected to be 4,500. Current Costs Manufacturing costs: Variable cost per unit Direct materials Direct labour Variable overhead Fixed manufacturing cost S50.25 $62.35 $12.40 $80,000 Selling costs: Variable Fixed 20% of sales $60,000 Projected cost for year 2 Manufacturing costs: Variable cost per unit Direct materials $55.75 Direct labour $65.45 Variable overhead $13.80 Fixed manufacturing cost $120,000 Selling costs: Variable Fixed 20% of sales $80,000 Projected cost for year 2 Manufacturing costs Variable cost per unit Direct materials $55.75 Direct labour 565.45 Variable overhead S13.80 Fixed manufacturing cost $120,000 Selling costs: Variable Fixed 20% of sales $80,000 Required: 1. Compute the unit cost of bikes in year I using variable costing. 2. Compute the unit cost of bikes in year 1 using absorption costing. 3. Prepare income statement for year I using variable costing. 4. Prepare income statement for year I using absorption costing 5. Compute the unit cost of bikes in year 2 using variable costing. 6. Compute the unit cost of bikes in year 2 using absorption costing. 7. Prepare projected income statement for year 2 using variable costing. & Prepare projected income statement for year 2 using absorption costing Compute the cost of ending inventory in year 2 using variable costing. 10. Compute the cost of ending inventory in year 2 using absorption costing. 11. Explain to John and Susan why net income computed for year I using variable costing and absorption cost for year 1 are the same. 12. Explain to John and Susan why net income computed for year 2 using variable costing and absorption coting for year 2 are different