Answered step by step

Verified Expert Solution

Question

1 Approved Answer

kindly explain and answer a-d please preform a-d with work. a) is asking you to implement the variables from b into the equation for show,

kindly explain and answer a-d

please preform a-d with work. a) is asking you to implement the variables from b into the equation for show, b) is asking for the output of the equation given in a

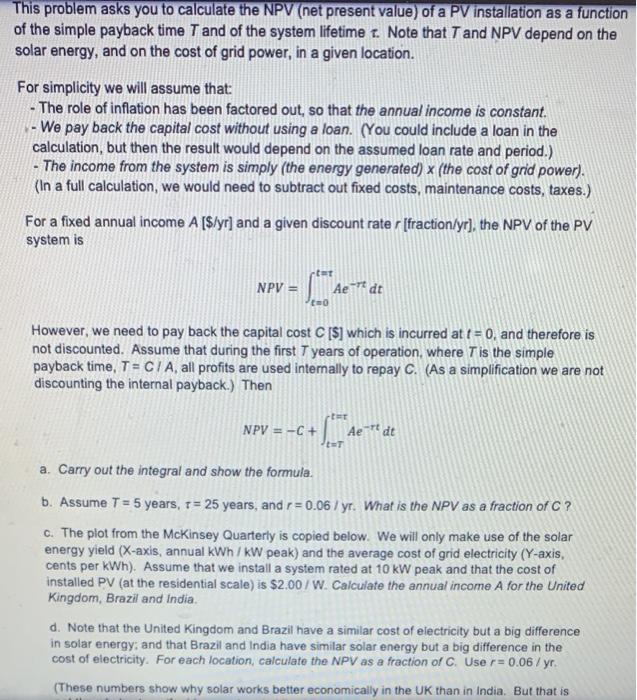

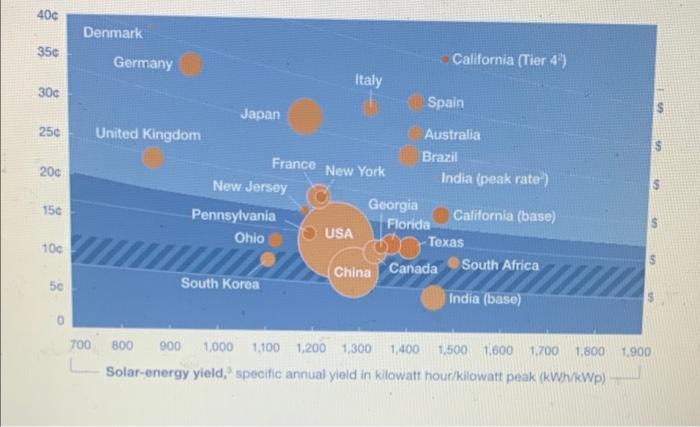

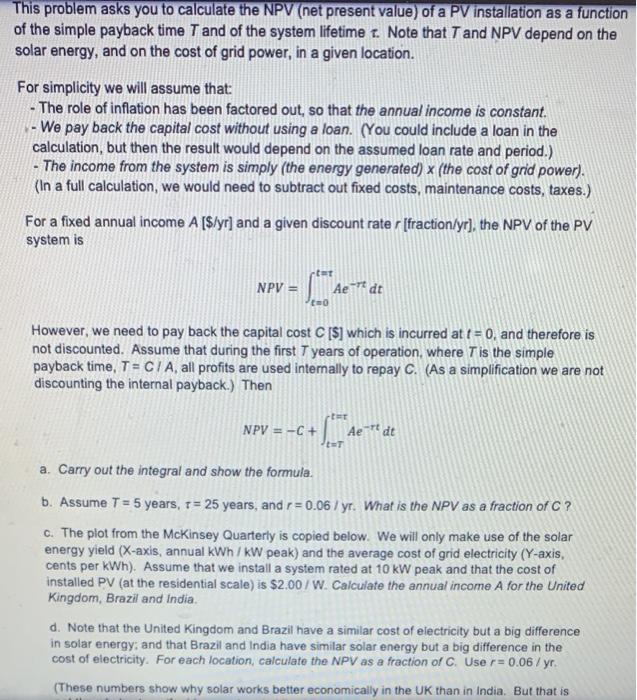

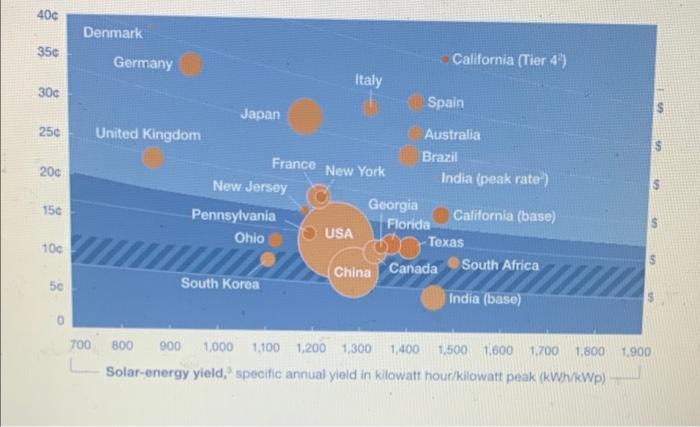

This problem asks you to calculate the NPV (net present value) of a PV installation as a function of the simple payback time T and of the system lifetime. Note that T and NPV depend on the solar energy, and on the cost of grid power, in a given location. For simplicity we will assume that: - The role of inflation has been factored out, so that the annual income is constant. - We pay back the capital cost without using a loan. (You could include a loan in the calculation, but then the result would depend on the assumed loan rate and period.) - The income from the system is simply the energy generated) x (the cost of grid power) (In a full calculation, we would need to subtract out fixed costs, maintenance costs, taxes.) For a fixed annual income A [$/yr) and a given discount rate (fraction/yr), the NPV of the PV system is tot NPV = Aedt However, we need to pay back the capital cost C [S] which is incurred at t = 0, and therefore is not discounted. Assume that during the first years of operation, where is the simple payback time, T = CIA, all profits are used internally to repay C. (As a simplification we are not discounting the internal payback.) Then NPV = -C+ Aedt a. Carry out the integral and show the formula. b. Assume T = 5 years, T = 25 years, and r = 0.06 / yr. What is the NPV as a fraction of C? c. The plot from the McKinsey Quarterly is copied below. We will only make use of the solar energy yield (X-axis, annual kWh/ kW peak) and the average cost of grid electricity (Y-axis, cents per kWh). Assume that we install a system rated at 10 kW peak and that the cost of installed PV (at the residential scale) is $2.00 / W. Calculate the annual income A for the United Kingdom, Brazil and India d. Note that the United Kingdom and Brazil have a similar cost of electricity but a big difference in solar energy, and that Brazil and India have similar solar energy but a big difference in the cost of electricity. For each location, calculate the NPV as a fraction of C. Use r=0.06/yr. (These numbers show why solar works better economically in the UK than in India. But that is 400 Denmark 35 Germany California (Tier 4) Italy 300 Spain Japan $ 250 United Kingdom France New York 200 Australia Brazil India (peak rate) Georgia California (base) Florida Texas South Africa New Jersey Pennsylvania Ohio $ $ 150 USA 100 China Canada South Korea India (base) 700 1.900 800 900 1,000 1,100 1,200 1,300 1,400 1.500 1.600 1.700 1.800 Solar-energy yield, specific annual yield in kilowatt hour/kilowatt peak (kWh/kWp) This problem asks you to calculate the NPV (net present value) of a PV installation as a function of the simple payback time T and of the system lifetime. Note that T and NPV depend on the solar energy, and on the cost of grid power, in a given location. For simplicity we will assume that: - The role of inflation has been factored out, so that the annual income is constant. - We pay back the capital cost without using a loan. (You could include a loan in the calculation, but then the result would depend on the assumed loan rate and period.) - The income from the system is simply the energy generated) x (the cost of grid power) (In a full calculation, we would need to subtract out fixed costs, maintenance costs, taxes.) For a fixed annual income A [$/yr) and a given discount rate (fraction/yr), the NPV of the PV system is tot NPV = Aedt However, we need to pay back the capital cost C [S] which is incurred at t = 0, and therefore is not discounted. Assume that during the first years of operation, where is the simple payback time, T = CIA, all profits are used internally to repay C. (As a simplification we are not discounting the internal payback.) Then NPV = -C+ Aedt a. Carry out the integral and show the formula. b. Assume T = 5 years, T = 25 years, and r = 0.06 / yr. What is the NPV as a fraction of C? c. The plot from the McKinsey Quarterly is copied below. We will only make use of the solar energy yield (X-axis, annual kWh/ kW peak) and the average cost of grid electricity (Y-axis, cents per kWh). Assume that we install a system rated at 10 kW peak and that the cost of installed PV (at the residential scale) is $2.00 / W. Calculate the annual income A for the United Kingdom, Brazil and India d. Note that the United Kingdom and Brazil have a similar cost of electricity but a big difference in solar energy, and that Brazil and India have similar solar energy but a big difference in the cost of electricity. For each location, calculate the NPV as a fraction of C. Use r=0.06/yr. (These numbers show why solar works better economically in the UK than in India. But that is 400 Denmark 35 Germany California (Tier 4) Italy 300 Spain Japan $ 250 United Kingdom France New York 200 Australia Brazil India (peak rate) Georgia California (base) Florida Texas South Africa New Jersey Pennsylvania Ohio $ $ 150 USA 100 China Canada South Korea India (base) 700 1.900 800 900 1,000 1,100 1,200 1,300 1,400 1.500 1.600 1.700 1.800 Solar-energy yield, specific annual yield in kilowatt hour/kilowatt peak (kWh/kWp) for part d there is a correction- instead please rewrite the formula so that NPV= C * (the rest of the formula). this will show you the discounted return for each $ invested

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started