kindly find out the "Current Ratio, Gross profit ratio, net profit ratio, debt to asset ratio, debt to equity ratio, fixed asset turnover ratio, asset turnover ratio, return on asset(Roa), return on investment(Roi), operating expenses ratio, non performing loan ratio".

*Kindly find all the ratios and show me the calculation.

*If you can't answer all then please don't answer"

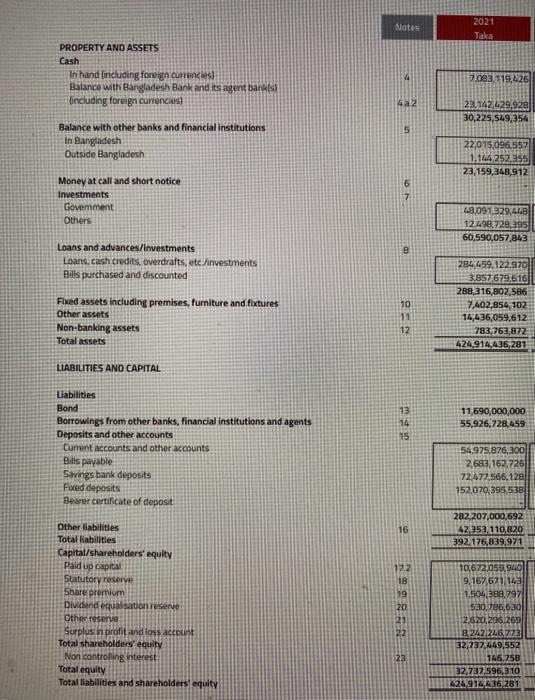

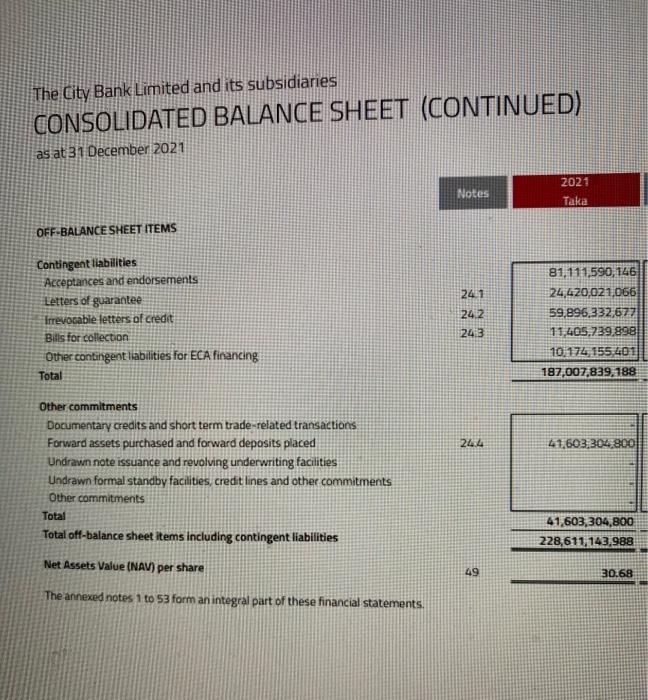

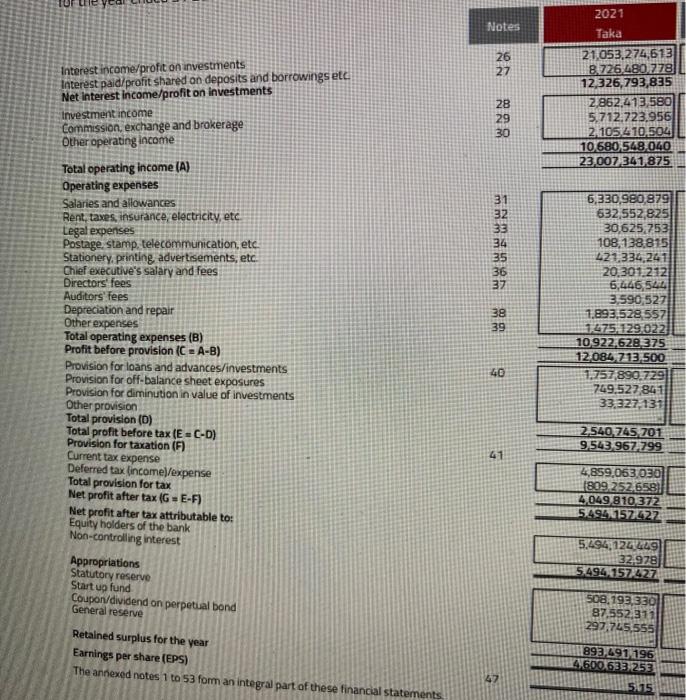

PROPERTY AND ASSETS Cash In hasd including foregen currencios) Batance with Bangladech Bank and its agent bank(s) (including toregn currencies) Balance with other banks and financial institutions in Bangladesh Outside Aargiadesh Money at call and short notice investments Govemment others Loans and advances/investments Loans, cach crodits, overdiafts, etc./imvestments Balls purchased and discounted Fixed assets including premises, furniture and fixtures Other assets Non-banking assets Total assets LABILITIES AND CAPITAL. Labilides Band Borrowings from other banks, financial institutions and agents Deposits and other accounts Cument accounts and other accounts Bilis payable Siving bank deposits Foced deposits Bearer certificate of deposit Other liabilities Total liabilities Capital/shareholders equity Paid up capital Stabutory reserye 5 hare encmium Dividind equal sation reserve Qthoo reserve Surplus in profitandios acceunt Totai shareholders equity Non controiling interest: Total equity Total liabilities and stareholders' equity The City BankLimited and its subsidiaries CONSOLIDATED BALANCE SHEET (CONTINUED) as at 31 December 2021 OFF-BALANCESHEET ITEMS Contingent liabilities Acceptances and endorsements Letters of guarantee Irrevocabie fetters of credit Bulsfor collection Other contingent labilities for ECA firancing Total Other commitments Documentary credits and short term trade-related transactions Forward assets purchased and forward deposits placed Undrawn note issuance and revolving underwriting facilities Undrawn formal standby faclities, credit lines and other commitments Other commitments Total Total off-balance sheet items including contingent liabilities Net Assets Value (NAV) per share The annexed notes 1 to 53 form an integral part of these financial statements. Interest incomerprofic on investments Interest paid/profit shared on deposits and borrowingsetc. Net interest income/profit on investments investmentincome Commission, exchange and brokerage Other operating income Total operating income (A) Operating expenses Salaries and allowances Rent, taxes, insurance, electricity, etc Legal expentses Postage, stamp, telecommunication, ete. Stationery, printing advertisements, etc. Chief executive's salary and fees Directors fees Auditers' fees Depreciation and repair Other expenses Total operating expenses (B) Profit before provision (C=AB) Provision for loans and advances/investments Provision for off-balance sheet exposures Provision for diminution in value of investments Other provision Total provision (D) Total profit before tax (E=CD) Provision for taxation (F) Current tax expense Deferred tax (income)/expense Total provision for tax Net profit after tax (G=EF) Net profit after tax attributable to: Equity holders of the bank Non-controlling interest Appropriations Statitory reserve Start ug fund Coupon/dividend on perpetial bond General reserve Retained surplus for the year Earnings per share (EPS) The annexed notes 1 to 53 form an integral part of these financial statements