Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly give detailed calculations for the Q1) Calculate Free cash flow: Answer: -800 39 51.68 Q2) Adjusted Net Present Value: Answer: EUR -14.44m (PV of

Kindly give detailed calculations for the

Q1) Calculate Free cash flow:

Answer: -800 39 51.68

Q2) Adjusted Net Present Value:

Answer: EUR -14.44m (PV of dividends to parent, PV of tax shield: 14.50, PV of subsidized loan: 18.33)

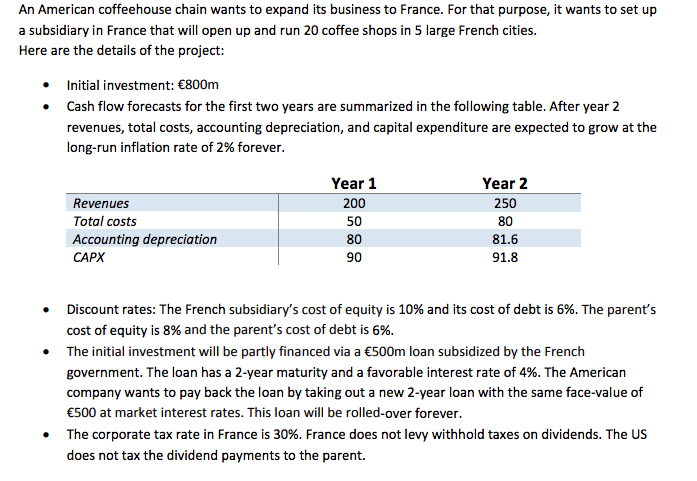

An American coffeehouse chain wants to expand its business to France. For that purpose, it wants to set up a subsidiary in France that will open up and run 20 coffee shops in 5 large French cities. Here are the details of the project: Initial investment: 800m Cash flow forecasts for the first two years are summarized in the following table. After year 2 revenues, total costs, accounting depreciation, and capital expenditure are expected to grow at the long-run inflation rate of 2% forever Revenues Total costs Accounting depreciation CAPX Year 1 200 50 80 90 Year 2 250 80 81.6 91.8 Discount rates: The French subsidiary's cost of equity is 10% and its cost of debt is 6%. The parent's cost of equity is 8% and the parent's cost of debt is 6%. The initial investment will be partly financed via a 500m loan subsidized by the French government. The loan has a 2-year maturity and a favorable interest rate of 4%. The American company wants to pay back the loan by taking out a new 2-year loan with the same face-value of 500 at market interest rates. This loan will be rolled-over forever he corporate tax rate in France is 30%. France does not levy withhold taxes on dividends. The US does not tax the dividend payments to the parentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started