Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly help me with this IAS 7 Cash flow question Galadanci Plc. is a telecommunications company operating in Nigeria. The management of the company presented

Kindly help me with this IAS 7 Cash flow question

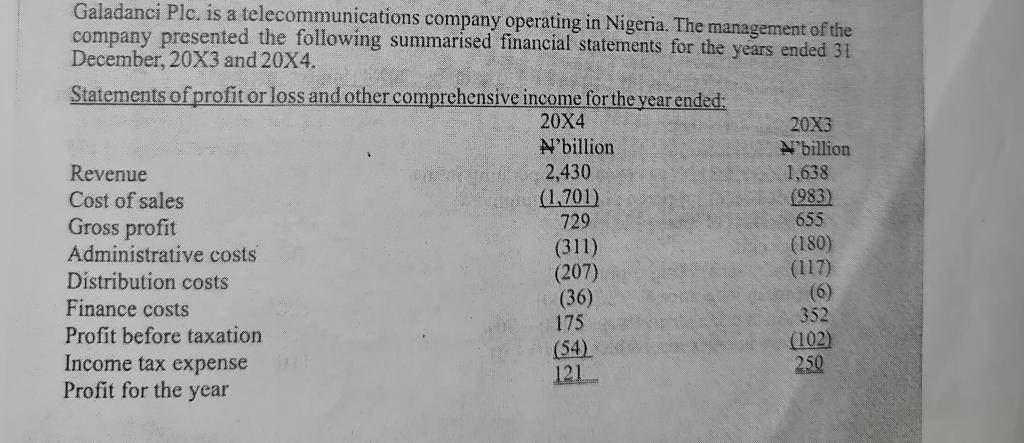

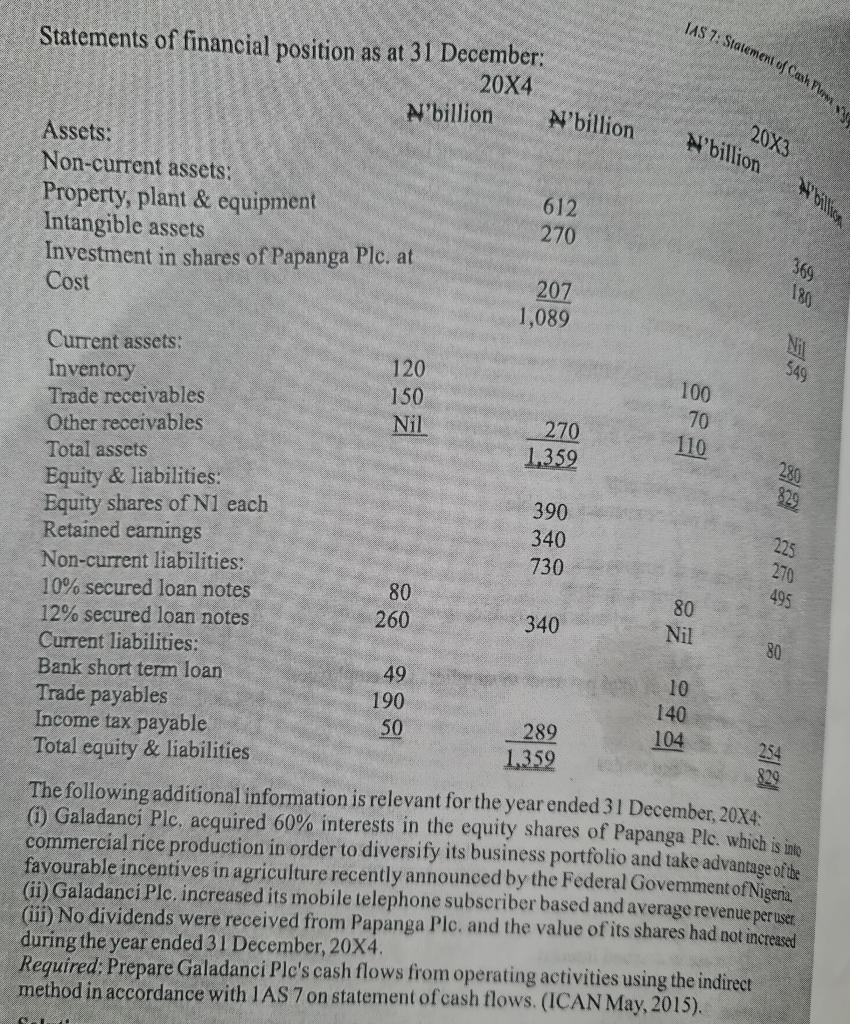

Galadanci Plc. is a telecommunications company operating in Nigeria. The management of the company presented the following summarised financial statements for the years ended 31 December, 20X3 and 20X4. Statements of profit or loss and other comprehensive income for the year ended: 20X4 20X3 N'billion N"billion Revenue 2,430 1,638 Cost of sales (1,701) (983) Gross profit 729 655 (311) (180) Administrative costs Distribution costs (207) (117) (36) (6) Finance costs 175 352 Profit before taxation (54) (102) Income tax expense 250 121 Profit for the year TAS 7: Statement of Cak N'billion N'billion 20X3 Wh 369 180 9 120 549 100 70 110 1.359 280 Statements of financial position as at 31 December: 20X4 N'billion Assets: Non-current assets: Property, plant & equipment 612 Intangible assets 270 Investment in shares of Papanga Plc. at Cost 207 1,089 Current assets: Inventory Trade receivables 150 Other receivables Nil 270 Total assets Equity & liabilities: Equity shares of N1 each 390 Retained earnings 340 Non-current liabilities: 730 10% secured loan notes 80 12% secured loan notes 260 340 Nil Current liabilities: Bank short term loan 49 Trade payables 190 140 Income tax payable 50 289 104 Total equity & liabilities 1.359 The following additional information is relevant for the year ended 31 December, 20X4: (1) Galadanci Ple, acquired 60% interests in the equity shares of Papanga Ple, which is into commercial rice production in order to diversify its business portfolio and take advantage of the favourable incentives in agriculture recently announced by the Federal Government of Nigeria (ii) Galadanci Plc. increased its mobile telephone subscriber based and average revenue per user (iii) No dividends were received from Papanga Ple, and the value of its shares had not increased during the year ended 31 December, 20X4. Required: Prepare Galadanci Plc's cash flows from operating activities using the indirect method in accordance with 1 AS 7 on statement of cash flows.(ICAN May, 2015). 225 270 495 80 254 829Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started