Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly please show workings on paper. Question 5 [15 marks] Today is 1 January 2018. Alec is 85 years old. Alec is considering paying a

Kindly please show workings on paper.

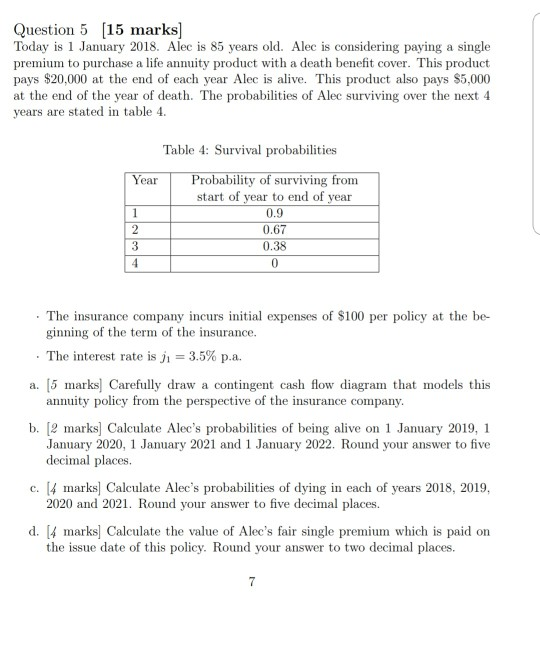

Question 5 [15 marks] Today is 1 January 2018. Alec is 85 years old. Alec is considering paying a single premium to purchase a life annuity product with a death benefit cover. This product pays $20,000 at the end of each year Alec is alive. This product also pays $5,000 at the end of the year of death. The probabilities of Alec surviving over the next 4 years are stated in table 4. Year Table 4: Survival probabilities Probability of surviving from start of year to end of year 0.9 0.67 0.38 0 2 3 4 The insurance company incurs initial expenses of $100 per policy at the be ginning of the term of the insurance. The interest rate is ji = 3.5% p.a. a. [5 marks] Carefully draw a contingent cash flow diagram that models this annuity policy from the perspective of the insurance company. b. [2 marks] Calculate Alec's probabilities of being alive on 1 January 2019, 1 January 2020, 1 January 2021 and 1 January 2022. Round your answer to five decimal places c. (4 marks] Calculate Alec's probabilities of dying in each of years 2018, 2019, 2020 and 2021. Round your answer to five decimal places. d. [4 marks] Calculate the value of Alec's fair single premium which is paid on the issue date of this policy. Round your answer to two decimal places. 7Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started