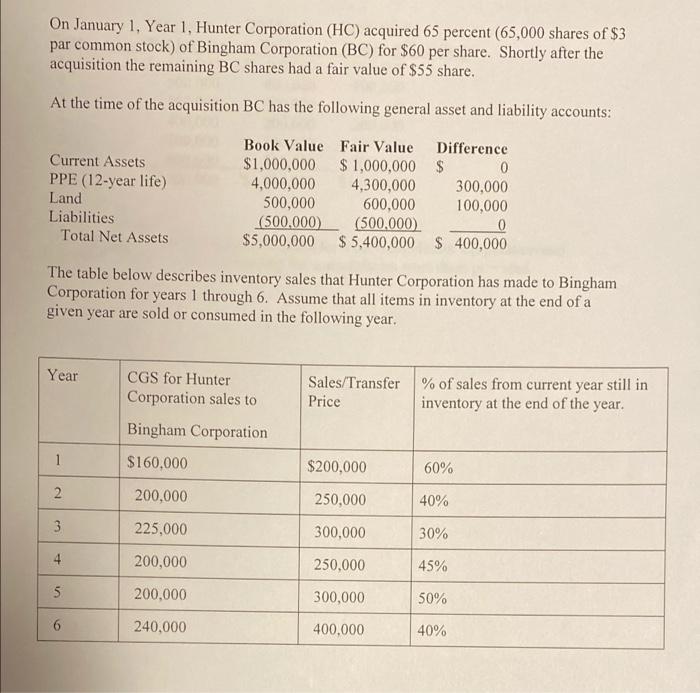

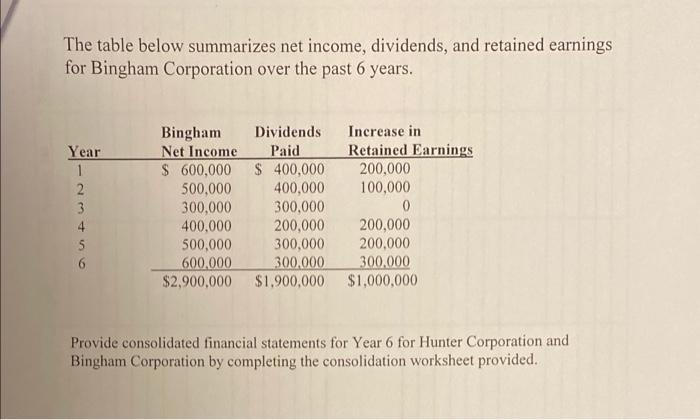

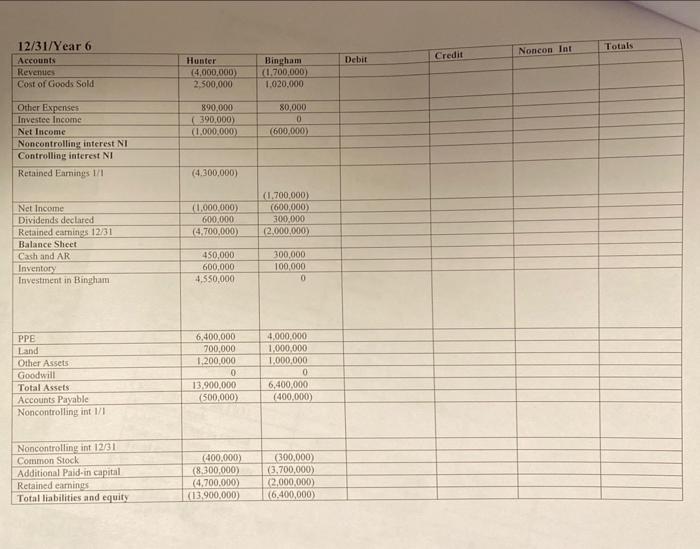

On January 1, Year 1, Hunter Corporation (HC) acquired 65 percent (65,000 shares of $3 par common stock) of Bingham Corporation (BC) for $60 per share. Shortly after the acquisition the remaining BC shares had a fair value of $55 share. At the time of the acquisition BC has the following general asset and liability accounts: Current Assets PPE (12-year life) Land Liabilities Total Net Assets Book Value Fair Value Difference $1,000,000 $1,000,000 $ 0 4,000,000 4,300,000 300,000 500,000 600,000 100,000 (500,000) (500,000) 0 $5,000,000 $5,400,000 $ 400,000 The table below describes inventory sales that Hunter Corporation has made to Bingham Corporation for years 1 through 6. Assume that all items in inventory at the end of a given year are sold or consumed in the following year, Year Sales/Transfer Price % of sales from current year still in inventory at the end of the year. CGS for Hunter Corporation sales to Bingham Corporation $160,000 1 $200,000 60% 2 200,000 250,000 40% 3 3 225,000 300,000 30% 4 200,000 250,000 45% 5 200,000 300,000 50% 6 240,000 400.000 40% The table below summarizes net income, dividends, and retained earnings for Bingham Corporation over the past 6 years. Year 1 2 Bingham Net Income $ 600,000 500,000 300,000 400.000 500,000 600.000 $2,900,000 Dividends Increase in Paid Retained Earnings $ 400,000 200,000 400,000 100,000 300,000 0 200,000 200,000 300,000 200,000 300,000 300.000 $1,900,000 $1,000,000 4 5 6 Provide consolidated financial statements for Year 6 for Hunter Corporation and Bingham Corporation by completing the consolidation worksheet provided. Totals Noncon Int Credit Debit 12/31/Year 6 Accounts Reventies Cost of Goods Sold Hunter (4.000.000) 2.500.000 Bingham (1.700,000) 1.020.000 890.000 (390.000) (1.000.000 80.000 0 (600.000) Other Expenses Investee Income Net Income Noncontrolling interest NI Controlling interest NI Retained Earnings 1/1 (4.300,000) (1.000.000) 600.000 (4.700,000) (1.700.000) (600.000) 300.000 (2.000.000 Net Income Dividends declared Retained earnings 12/31 Balance Sheet Cash and AR Inventory Investment in Bingham 450,000 600,000 4.550.000 300,000 100,000 0 PPE Land Other Assets Goodwill Total Assets Accounts Payable Noncontrolling in 1/1 6,400,000 700,000 1,200,000 0 13,900,000 (500.000) 4.000.000 1,000,000 1.000.000 0 6,400,000 (400,000) Noncontrolling int 12/31 Common Stock Additional Paid.in capital Retained earnings Total liabilities and equity (400,000) (8.300,000) (4.700.000) (13.900,000) (300.000) (3,700,000) (2,000,000) (6,400,000) On January 1, Year 1, Hunter Corporation (HC) acquired 65 percent (65,000 shares of $3 par common stock) of Bingham Corporation (BC) for $60 per share. Shortly after the acquisition the remaining BC shares had a fair value of $55 share. At the time of the acquisition BC has the following general asset and liability accounts: Current Assets PPE (12-year life) Land Liabilities Total Net Assets Book Value Fair Value Difference $1,000,000 $1,000,000 $ 0 4,000,000 4,300,000 300,000 500,000 600,000 100,000 (500,000) (500,000) 0 $5,000,000 $5,400,000 $ 400,000 The table below describes inventory sales that Hunter Corporation has made to Bingham Corporation for years 1 through 6. Assume that all items in inventory at the end of a given year are sold or consumed in the following year, Year Sales/Transfer Price % of sales from current year still in inventory at the end of the year. CGS for Hunter Corporation sales to Bingham Corporation $160,000 1 $200,000 60% 2 200,000 250,000 40% 3 3 225,000 300,000 30% 4 200,000 250,000 45% 5 200,000 300,000 50% 6 240,000 400.000 40% The table below summarizes net income, dividends, and retained earnings for Bingham Corporation over the past 6 years. Year 1 2 Bingham Net Income $ 600,000 500,000 300,000 400.000 500,000 600.000 $2,900,000 Dividends Increase in Paid Retained Earnings $ 400,000 200,000 400,000 100,000 300,000 0 200,000 200,000 300,000 200,000 300,000 300.000 $1,900,000 $1,000,000 4 5 6 Provide consolidated financial statements for Year 6 for Hunter Corporation and Bingham Corporation by completing the consolidation worksheet provided. Totals Noncon Int Credit Debit 12/31/Year 6 Accounts Reventies Cost of Goods Sold Hunter (4.000.000) 2.500.000 Bingham (1.700,000) 1.020.000 890.000 (390.000) (1.000.000 80.000 0 (600.000) Other Expenses Investee Income Net Income Noncontrolling interest NI Controlling interest NI Retained Earnings 1/1 (4.300,000) (1.000.000) 600.000 (4.700,000) (1.700.000) (600.000) 300.000 (2.000.000 Net Income Dividends declared Retained earnings 12/31 Balance Sheet Cash and AR Inventory Investment in Bingham 450,000 600,000 4.550.000 300,000 100,000 0 PPE Land Other Assets Goodwill Total Assets Accounts Payable Noncontrolling in 1/1 6,400,000 700,000 1,200,000 0 13,900,000 (500.000) 4.000.000 1,000,000 1.000.000 0 6,400,000 (400,000) Noncontrolling int 12/31 Common Stock Additional Paid.in capital Retained earnings Total liabilities and equity (400,000) (8.300,000) (4.700.000) (13.900,000) (300.000) (3,700,000) (2,000,000) (6,400,000)