Answered step by step

Verified Expert Solution

Question

1 Approved Answer

kindly provide answers!! This question has three parts, Part A, Part B and Part C. O'Connell Ltd has three cash generating divisions. As 31 December

kindly provide answers!!

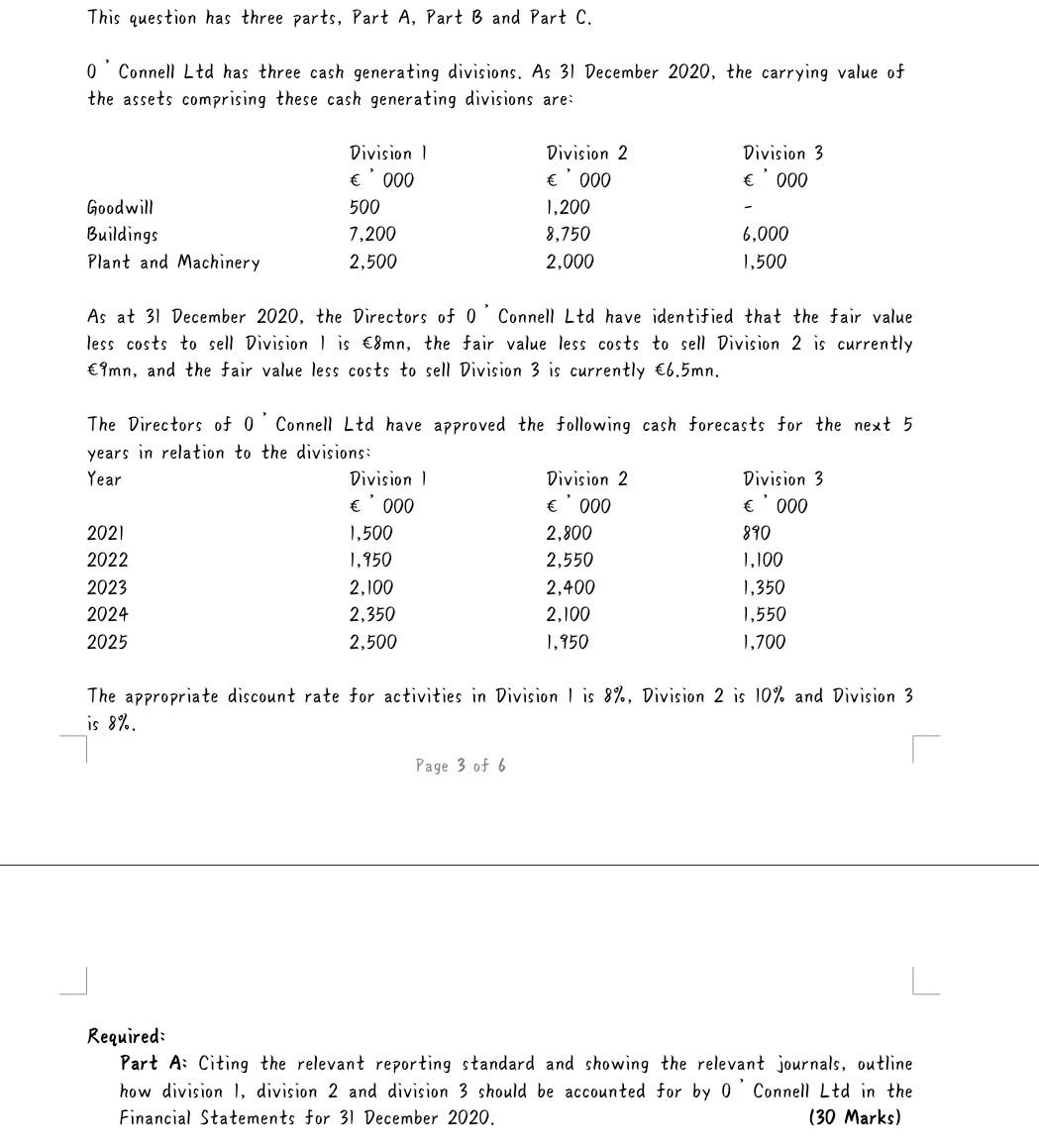

This question has three parts, Part A, Part B and Part C. O'Connell Ltd has three cash generating divisions. As 31 December 2020, the carrying value of the assets comprising these cash generating divisions are: Division 3 '000 Goodwill Buildings Plant and Machinery Division 1 '000 500 7,200 2,500 Division 2 .000 1,200 8,750 2,000 6,000 1,500 As at 31 December 2020, the Directors of O'Connell Ltd have identified that the fair value less costs to sell Division 1 is 8mn, the fair value less costs to sell Division 2 is currently 9mn, and the fair value less costs to sell Division 3 is currently 6.5mn. 000 The Directors of 0 Connell Ltd have approved the following cash forecasts for the next 5 years in relation to the divisions: Year Division 1 Division 2 Division 3 '000 000 2021 1,500 2,800 890 2022 1,950 2,550 1,100 2023 2,100 2,400 1,350 2024 2,350 2,100 1,550 2025 2,500 1,950 1,700 The appropriate discount rate for activities in Division 1 is 8%, Division 2 is 10% and Division 3 is 8%. Page 3 of 6 Required: Part 4: Citing the relevant reporting standard and showing the relevant journals, outline how division 1, division 2 and division 3 should be accounted for by O'Connell Ltd in the Financial Statements for 31 December 2020. (30 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started