Answered step by step

Verified Expert Solution

Question

1 Approved Answer

kindly provide solution This question has two parts, Part A and Part B. Flowers International Ltd (Flowers ) is an Irish owned global firm that

kindly provide solution

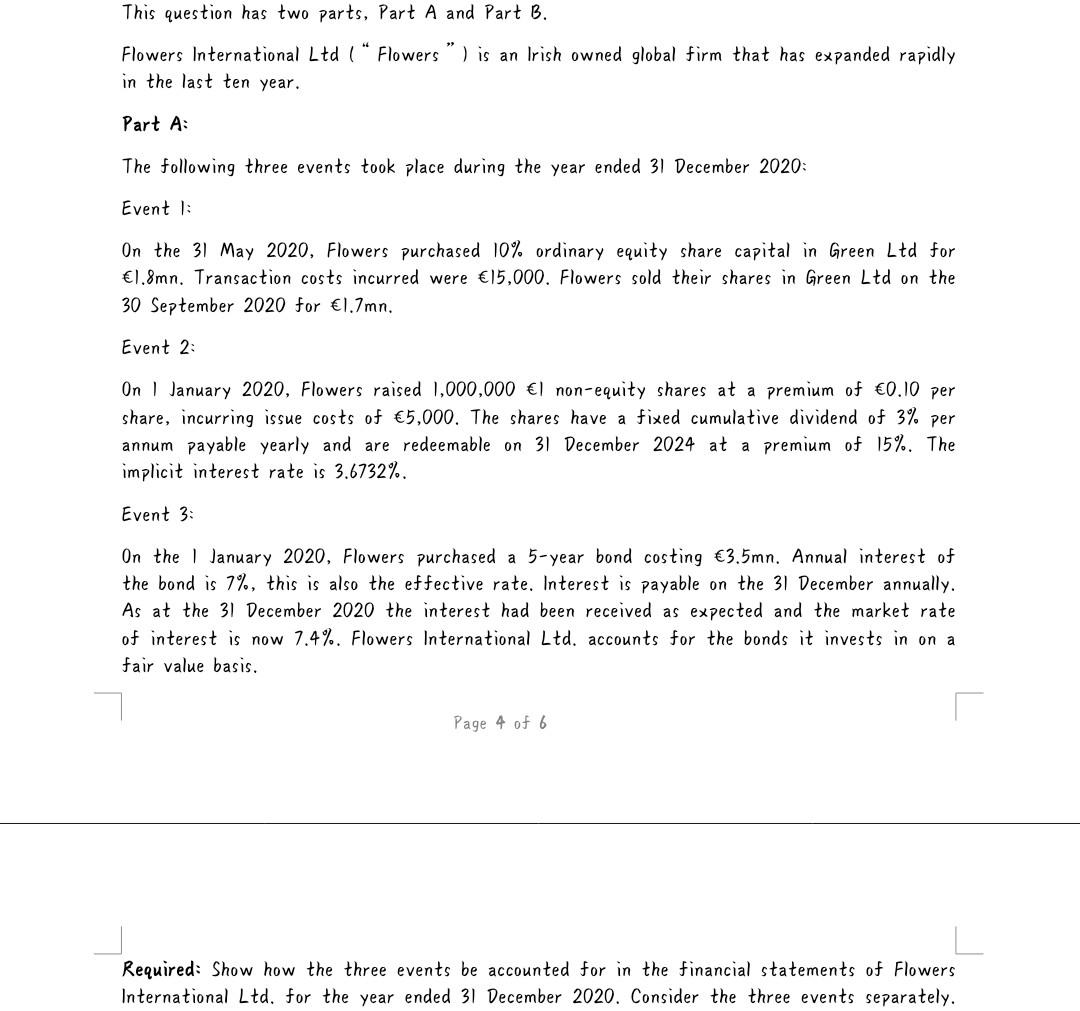

This question has two parts, Part A and Part B. Flowers International Ltd (Flowers" ) is an Irish owned global firm that has expanded rapidly in the last ten year. Part A The following three events took place during the year ended 31 December 2020: Event : On the 31 May 2020, Flowers purchased 10% ordinary equity share capital in Green Ltd for 1.8mn. Transaction costs incurred were 15,000. Flowers sold their shares in Green Ltd on the 30 September 2020 for 1.7mn. Event 2: On January 2020, Flowers raised 1,000,000 non-equity shares at a premium of 0.10 per share, incurring issue costs of 5,000. The shares have a fixed cumulative dividend of 3% per annum payable yearly and are redeemable on 31 December 2024 at a premium of 15%. The implicit interest rate is 3.6732%. Event 3 On the January 2020, Flowers purchased a 5-year bond costing 3.5mn. Annual interest of the bond is 7%, this is also the effective rate. Interest is payable on the 31 December annually. As at the 31 December 2020 the interest had been received as expected and the market rate of interest is now 7.4%. Flowers International Ltd. accounts for the bonds it invests in on a fair value basis. Page 4 of 6 Required: Show how the three events be accounted for in the financial statements of Flowers International Ltd. for the year ended 31 December 2020. Consider the three events separatelyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started