Answered step by step

Verified Expert Solution

Question

1 Approved Answer

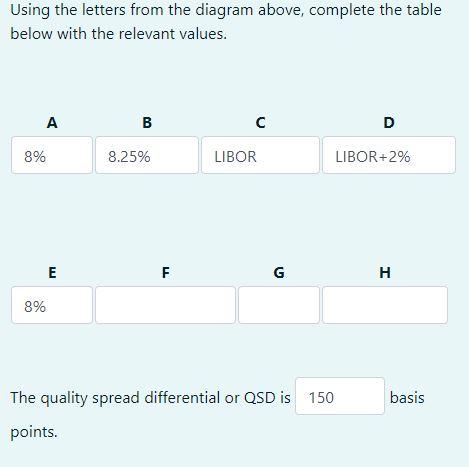

kindly provide the answer of F,G and H ... remaining all are correct you just understnd the question and answer these three . provide correct

kindly provide the answer of F,G and H ... remaining all are correct you just understnd the question and answer these three . provide correct answer to get thumbs up

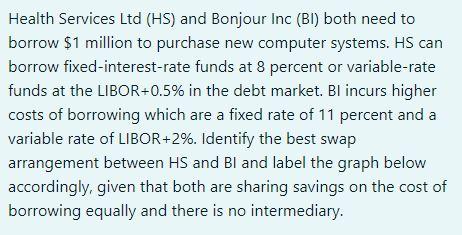

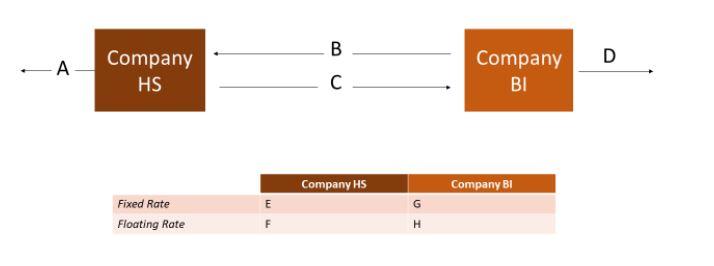

Health Services Ltd (HS) and Bonjour Inc (BI) both need to borrow $1 million to purchase new computer systems. HS can borrow fixed-interest-rate funds at 8 percent or variable-rate funds at the LIBOR+0.5% in the debt market. Bl incurs higher costs of borrowing which are a fixed rate of 11 percent and a variable rate of LIBOR+2%. Identify the best swap arrangement between HS and Bl and label the graph below accordingly, given that both are sharing savings on the cost of borrowing equally and there is no intermediary. B D -A Company HS Company BI Company HS Company BI G Fixed Rate Floating Rate E F H Using the letters from the diagram above, complete the table below with the relevant values. A B D 8% 8.25% LIBOR LIBOR+2% E F G H 8% basis The quality spread differential or QSD is 150 pointsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started