Kindly provide well explained answers to the question below. Ensure precision in your answers please.

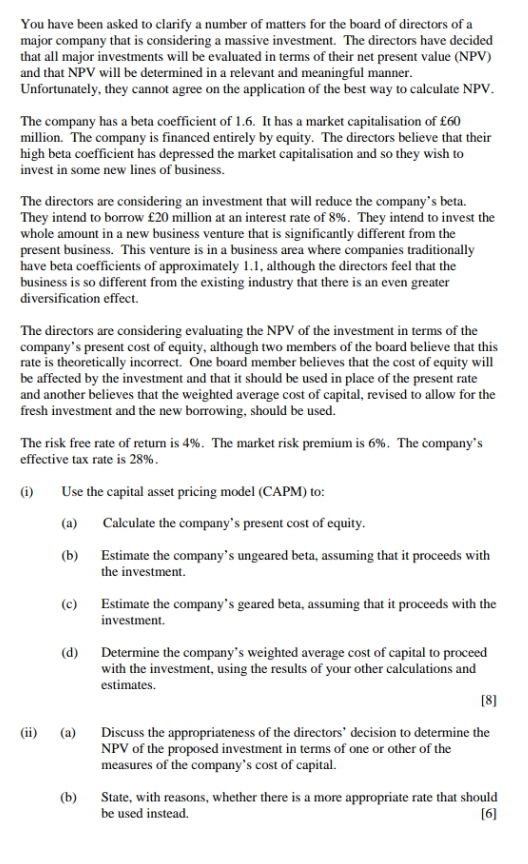

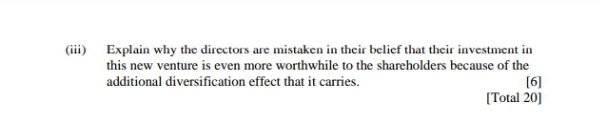

You have been asked to clarify a number of matters for the board of directors of a major company that is considering a massive investment. The directors have decided that all major investments will be evaluated in terms of their net present value (NPV) and that NPV will be determined in a relevant and meaningful manner. Unfortunately, they cannot agree on the application of the best way to calculate NPV. The company has a beta coefficient of 1.6. It has a market capitalisation of $60 million. The company is financed entirely by equity. The directors believe that their high beta coefficient has depressed the market capitalisation and so they wish to invest in some new lines of business. The directors are considering an investment that will reduce the company's beta. They intend to borrow f20 million at an interest rate of 8%. They intend to invest the whole amount in a new business venture that is significantly different from the present business. This venture is in a business area where companies traditionally have beta coefficients of approximately 1.1, although the directors feel that the business is so different from the existing industry that there is an even greater diversification effect. The directors are considering evaluating the NPV of the investment in terms of the company's present cost of equity, although two members of the board believe that this rate is theoretically incorrect. One board member believes that the cost of equity will be affected by the investment and that it should be used in place of the present rate and another believes that the weighted average cost of capital, revised to allow for the fresh investment and the new borrowing, should be used. The risk free rate of return is 4%. The market risk premium is 6%. The company's effective tax rate is 28%. (i) Use the capital asset pricing model (CAPM) to: (a) Calculate the company's present cost of equity. (b) Estimate the company's ungeared beta, assuming that it proceeds with the investment. (c) Estimate the company's geared beta, assuming that it proceeds with the investment. (d) Determine the company's weighted average cost of capital to proceed with the investment, using the results of your other calculations and estimates. [8] (ii) (a) Discuss the appropriateness of the directors' decision to determine the NPV of the proposed investment in terms of one or other of the measures of the company's cost of capital. (b) State, with reasons, whether there is a more appropriate rate that should be used instead. [6](iii) Explain why the directors are mistaken in their belief that their investment in this new venture is even more worthwhile to the shareholders because of the additional diversification effect that it carries. [6] [Total 20]