Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly read the case exercises below in conjunction with the company's most recent annual report, audited financial statement and/or any other relevant source of information.

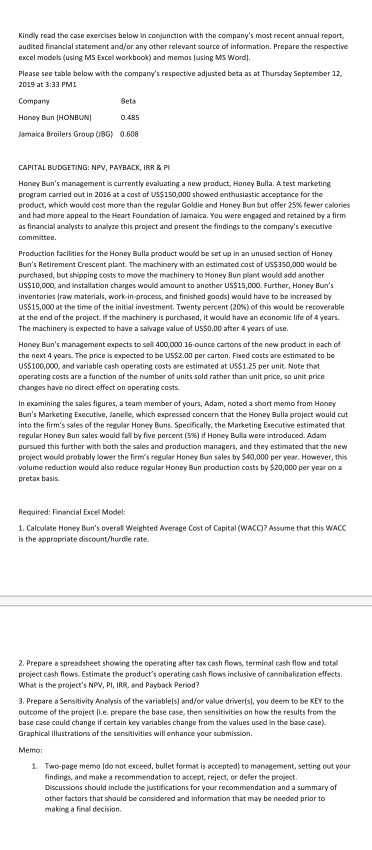

Kindly read the case exercises below in conjunction with the company's most recent annual report, audited financial statement and/or any other relevant source of information. Prepare the respective excel models (using MS Excel Workbook) and memos (using MS Word). Please see table below with the company's respective adjusted beta as at Thursday September 12, 2019 at 3:33 PMI Company Beta Honey Bun (HONBUNI 0.485 Jamaica Broilers Group UBG) 0.608 CAPITAL BUDGETING: NPV, PAYBACK, IRR & PI Honey Run's management is currently evaluating a new product, Honey Bula. A test marketing program carried out in 2016 at a cost of US$150,000 showed enthusiast acceptance for the product, which would cost more than the regular Goldie and Honey Bun but offer 25% fewer calories and had more appeal to the Heart Foundation of JamaicaYou were engaged and retained by a firm as financial analysts to analyze this project and present the findings to the company's executive Production facilities for the Honey Bulla product would be set up in an unused section of Honey Bun's Retirement Crescent plant. The machinery with an estimated cost of US$350,000 would be purchased, but shipping costs to move the machinery to Honey Bun plant would add another US$10,000, and installation charges would amount to another US$15,000. Further, Honey Bun's inventaris raw materials, work in process, and finished goods would have to be increased by US$15.000 at the time of the initial investment. Twenty percent (20%) of this would be recoverable at the end of the project. If the machinery is purchased, it would have an economic life of 4 years. The machinery is expected to have a salvage value of US$0.00 after 4 years of use. Honey Bun's management expects to sell 400,000 16 ounce cartons of the new product in each of the next 4 years. The price is expected to be US$2.00 per carton. Fixed costs are estimated to be US$100,000, and variable cash operating costs are estimated at US$1.25 per unit. Note that operating costs are a function of the number of units sold rather than unit price, so unit price changes have no direct effect on operating costs. in examining the sales figures, a team member of yours, Adam, noted a short memo from Honey Bun's Marketing Executive, Janelle, which expressed concern that the Honey Bulla project would cut into the firm's sales of the regular Honey Buns. Specifically, the Marketing Executive estimated that regular Honey Bun sales would all by five percent (SM) If Honey Bulls were introduced. Adam pursued this further with both the sales and production managers, and they estimated that the new project would probably lower the firm's regular Honey Bun sales by $40,000 per year. However, this volume reduction would also reduce regular Honey Bun production costs by $20,000 per year on a pretax basis Required: Financial Excel Model: 1. Calculate Honey Bun's overal Weighted Average Cost of Capital (WACO? Assume that this WACC is the appropriate discount/hurdle rate. 2. Prepare a spreadsheet showing the operating after tax cash flow terminal cash flow and total project cash flows. Estimate the product's operating cash flows inclusive of cannibalization effects What is the project's NPV, PL, IRR. and Payback Period? 3. Prepare a Sensitivity Analysis of the variables and/or value drivers, you deem to be Key to the outcome of the project le prepare the base case, then sensitivities on how the results from the base case could change if certain key variables change from the values used in the base case) Graphical illustrations of the sensitivities will enhance your submission. Memo: 1. Two-page memo do not exceed, bullet format is accepted) to management, setting out your findings and make a recommendation to accept reject, or defer the project Discussions should include the justifications for your recommendation and a summary of other factors that should be considered and information that may be needed prior to making a final decision Kindly read the case exercises below in conjunction with the company's most recent annual report, audited financial statement and/or any other relevant source of information. Prepare the respective excel models (using MS Excel Workbook) and memos (using MS Word). Please see table below with the company's respective adjusted beta as at Thursday September 12, 2019 at 3:33 PMI Company Beta Honey Bun (HONBUNI 0.485 Jamaica Broilers Group UBG) 0.608 CAPITAL BUDGETING: NPV, PAYBACK, IRR & PI Honey Run's management is currently evaluating a new product, Honey Bula. A test marketing program carried out in 2016 at a cost of US$150,000 showed enthusiast acceptance for the product, which would cost more than the regular Goldie and Honey Bun but offer 25% fewer calories and had more appeal to the Heart Foundation of JamaicaYou were engaged and retained by a firm as financial analysts to analyze this project and present the findings to the company's executive Production facilities for the Honey Bulla product would be set up in an unused section of Honey Bun's Retirement Crescent plant. The machinery with an estimated cost of US$350,000 would be purchased, but shipping costs to move the machinery to Honey Bun plant would add another US$10,000, and installation charges would amount to another US$15,000. Further, Honey Bun's inventaris raw materials, work in process, and finished goods would have to be increased by US$15.000 at the time of the initial investment. Twenty percent (20%) of this would be recoverable at the end of the project. If the machinery is purchased, it would have an economic life of 4 years. The machinery is expected to have a salvage value of US$0.00 after 4 years of use. Honey Bun's management expects to sell 400,000 16 ounce cartons of the new product in each of the next 4 years. The price is expected to be US$2.00 per carton. Fixed costs are estimated to be US$100,000, and variable cash operating costs are estimated at US$1.25 per unit. Note that operating costs are a function of the number of units sold rather than unit price, so unit price changes have no direct effect on operating costs. in examining the sales figures, a team member of yours, Adam, noted a short memo from Honey Bun's Marketing Executive, Janelle, which expressed concern that the Honey Bulla project would cut into the firm's sales of the regular Honey Buns. Specifically, the Marketing Executive estimated that regular Honey Bun sales would all by five percent (SM) If Honey Bulls were introduced. Adam pursued this further with both the sales and production managers, and they estimated that the new project would probably lower the firm's regular Honey Bun sales by $40,000 per year. However, this volume reduction would also reduce regular Honey Bun production costs by $20,000 per year on a pretax basis Required: Financial Excel Model: 1. Calculate Honey Bun's overal Weighted Average Cost of Capital (WACO? Assume that this WACC is the appropriate discount/hurdle rate. 2. Prepare a spreadsheet showing the operating after tax cash flow terminal cash flow and total project cash flows. Estimate the product's operating cash flows inclusive of cannibalization effects What is the project's NPV, PL, IRR. and Payback Period? 3. Prepare a Sensitivity Analysis of the variables and/or value drivers, you deem to be Key to the outcome of the project le prepare the base case, then sensitivities on how the results from the base case could change if certain key variables change from the values used in the base case) Graphical illustrations of the sensitivities will enhance your submission. Memo: 1. Two-page memo do not exceed, bullet format is accepted) to management, setting out your findings and make a recommendation to accept reject, or defer the project Discussions should include the justifications for your recommendation and a summary of other factors that should be considered and information that may be needed prior to making a final decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started