Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly Rewrite the same answer in Ms word so that I can copy written answer in ms word Current Tax Worksheet for the year ended

Kindly Rewrite the same answer in Ms word so that I can copy written answer in ms word

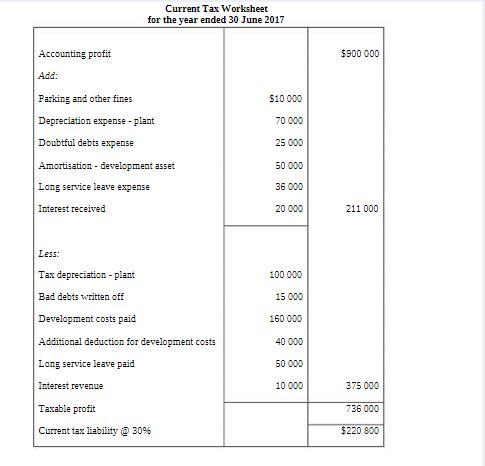

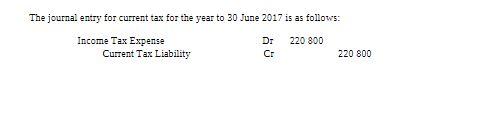

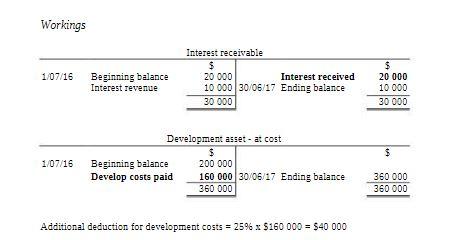

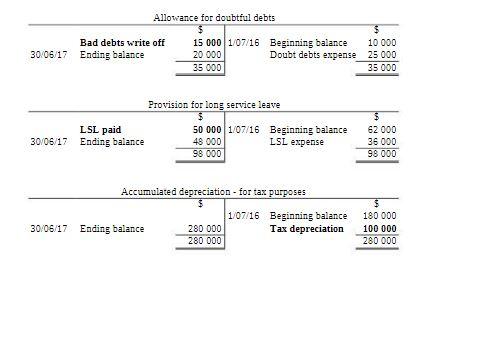

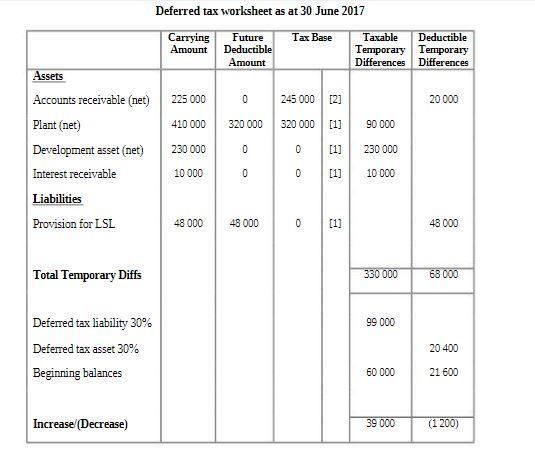

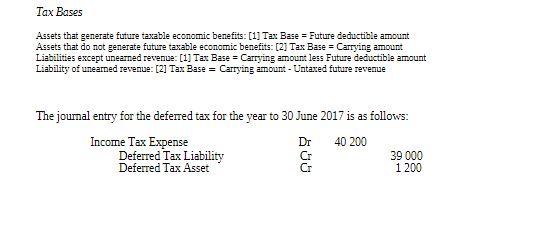

Current Tax Worksheet for the year ended 30 June 2017 The journal entry for current tax for the year to 30 June 2017 is as follows: Workings Additional deduction for development costs =25%$160000=$40000 Allowance for doubtiul debts \begin{tabular}{llr|llr} \hline & & $ & & & $ \\ 30,06/17 & Bad debts write off Ending balance & 15000 & 1/07/16 & Beginning balance & 10000 \\ & & 20000 & & Doubt debts expense & 25000 \\ \hline & 35000 & & 35000 \\ \hline \end{tabular} Provision for long service leave \begin{tabular}{llr|llr} \hline & & $ & & & \\ \hline \multirow{3}{*}{30/06/17} & LSL paid & 50000 & 1/07/16 & Beginning balance & 62000 \\ & Ending balance & 48000 & LSL expense & 36000 \\ \hline & & 98000 & & 98000 \\ \hline \end{tabular} Accumulated depreciation - for tax purposes Deferred tax worksheet as at 30 June 2017 Tax Bases Assets that generate future taxable economic benefits: [1] Tax Base = Future deductible amount Assets that do not generate future taxable economic benefits: [2] Tax Base = Carrying amount Liabilities except unearned revenue: [1] Tax Base = Carrying amount less Future deductible amount Liability of unearned revenue: [2] Tax Base = Carrying amount - Untaxed future revenue The journal entry for the deferred tax for the year to 30 June 2017 is as followsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started