"Kindly show solution for my reference thank you"

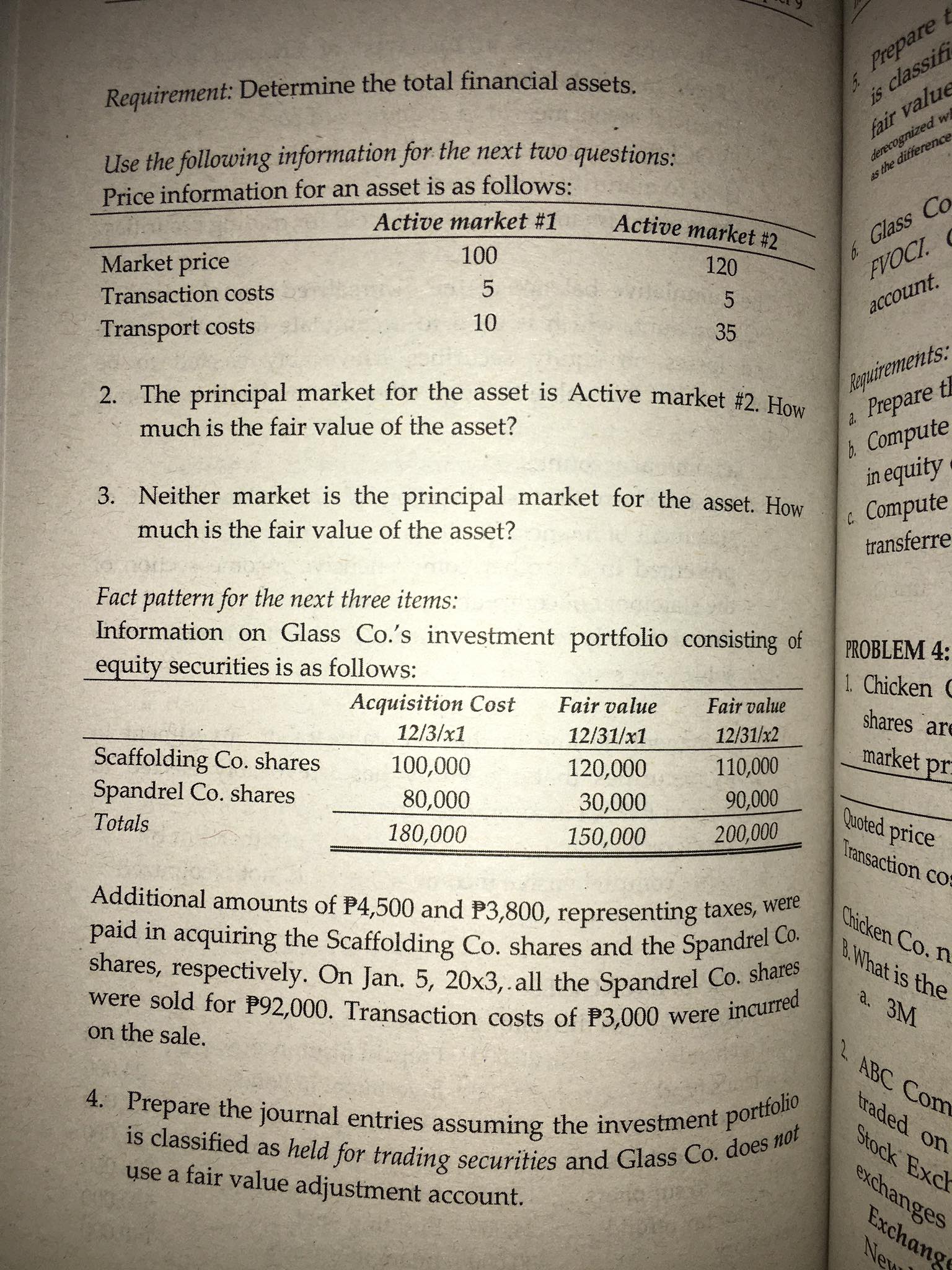

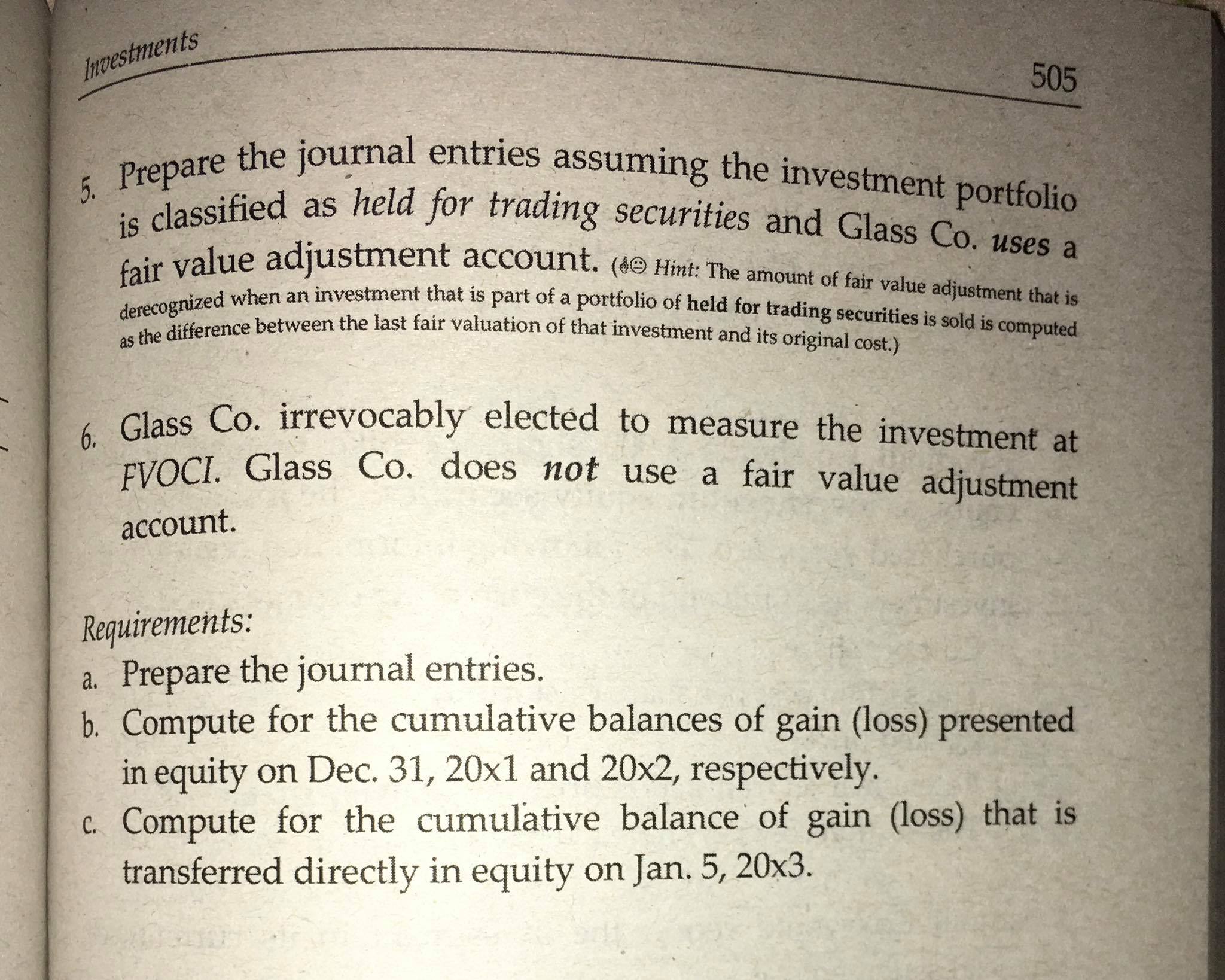

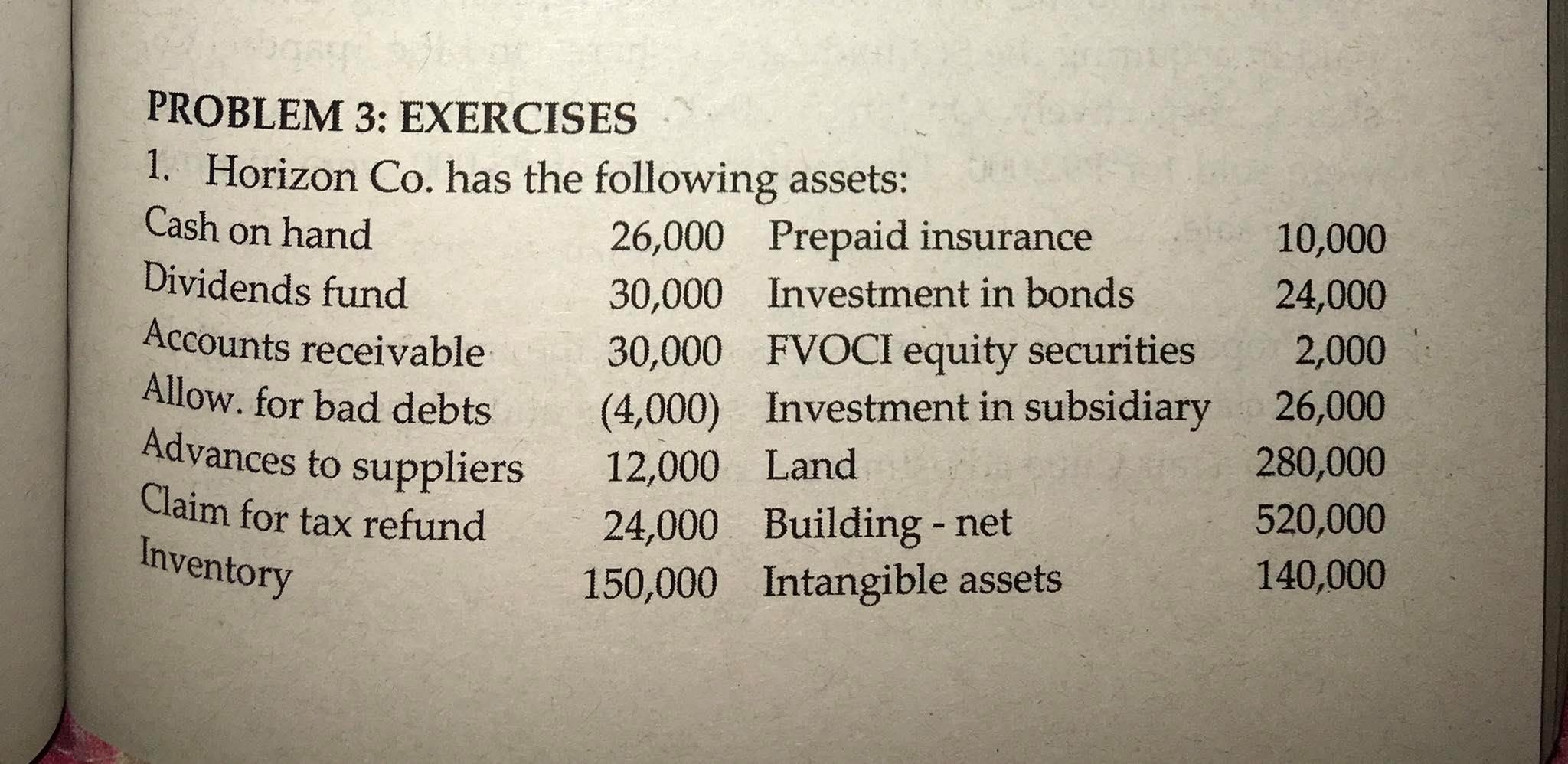

Prepare is classif Requirement: Determine the total financial assets. fair value derecognized w Use the following information for the next two questions: as the difference Price information for an asset is as follows: Active market #1 Active market #2 6. Glass Co Market price 100 120 FVOCI. Transaction costs 5 5 account. Transport costs 10 35 Requirements. 2. The principal market for the asset is Active market #2. How a. Prepare t much is the fair value of the asset? . Compute in equity 3. Neither market is the principal market for the asset. How c Compute much is the fair value of the asset? transferre Fact pattern for the next three items: Information on Glass Co.'s investment portfolio consisting of PROBLEM 4: equity securities is as follows: 1. Chicken Acquisition Cost Fair value Fair value 12/3/x1 12/31/x1 12/31/x2 shares ar Scaffolding Co. shares 100,000 120,000 110,000 market pr Spandrel Co. shares 80,000 30,000 90,000 Totals 180,000 150,000 200,000 Quoted price Transaction co Additional amounts of P4,500 and P3,800, representing taxes, were paid in acquiring the Scaffolding Co. shares and the Spandrel Co. Chicken Co. n shares, respectively. On Jan. 5, 20x3, all the Spandrel Co. shares B. What is the were sold for P92,000. Transaction costs of P3,000 were incurred a. 3M on the sale. 2. ABC Com 4. Prepare the journal entries assuming the investment portfolio traded on is classified as held for trading securities and Glass Co. does not Stock Exc use a fair value adjustment account. exchanges Exchang NewInvestments 505 5. Prepare the journal entries assuming the investment portfolio is classified as held for trading securities and Glass Co. uses a fair value adjustment account. (&) Hint: The amount of fair value adjustment that is derecognized when an investment that is part of a portfolio of held for trading securities is sold is computed as the difference between the last fair valuation of that investment and its original cost.) 6. Glass Co. irrevocably elected to measure the investment at FVOCI. Glass Co. does not use a fair value adjustment account. Requirements: a. Prepare the journal entries. b. Compute for the cumulative balances of gain (loss) presented in equity on Dec. 31, 20x1 and 20x2, respectively. c. Compute for the cumulative balance of gain (loss) that is transferred directly in equity on Jan. 5, 20x3.PROBLEM 3: EXERCISES 1. Horizon Co. has the following assets: Cash on hand 26,000 Prepaid insurance 10,000 Dividends fund 30,000 Investment in bonds 24,000 Accounts receivable 30,000 FVOCI equity securities 2,000 Allow. for bad debts (4,000) Investment in subsidiary 26,000 Advances to suppliers 12,000 Land 280,000 Claim for tax refund 24,000 Building - net 520,000 Inventory 150,000 Intangible assets 140,000