Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly show step by step cal Question One. Grohney & Co Associates expect receive 350,000 in 225 days. The company is in a paradox of

Kindly show step by step cal

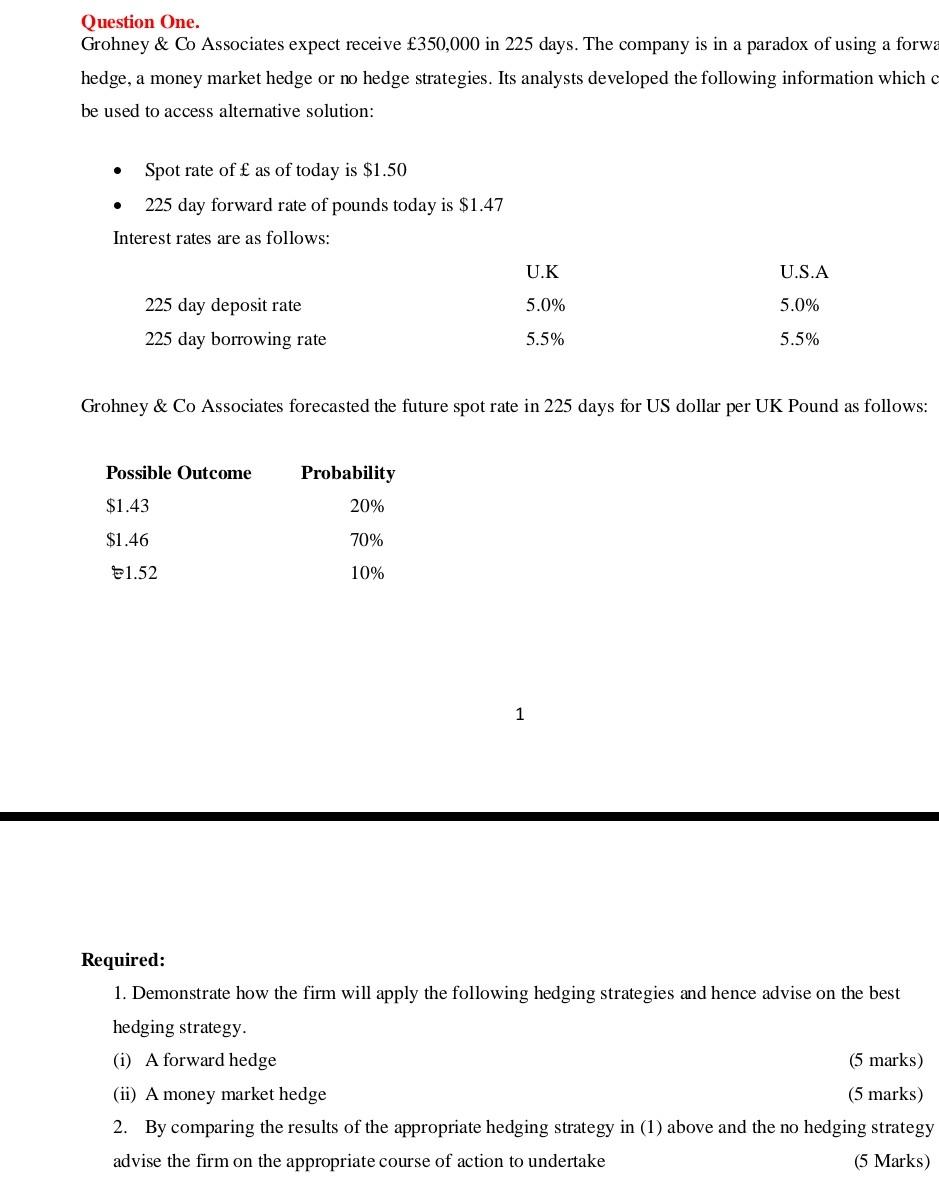

Question One. Grohney \& Co Associates expect receive 350,000 in 225 days. The company is in a paradox of using a forwa hedge, a money market hedge or no hedge strategies. Its analysts developed the following information which c be used to access alternative solution: - Spot rate of as of today is $1.50 - 225 day forward rate of pounds today is $1.47 Interest rates are as follows: Grohney \& Co Associates forecasted the future spot rate in 225 days for US dollar per UK Pound as follows: 1 Required: 1. Demonstrate how the firm will apply the following hedging strategies and hence advise on the best hedging strategy. (i) A forward hedge (5 marks) (ii) A money market hedge (5 marks) 2. By comparing the results of the appropriate hedging strategy in (1) above and the no hedging strategy advise the firm on the appropriate course of action to undertakeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started