Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly show workings on Paper. Hi, this is the complete question. QUESTION 5 [9 marks) Emma from Rosehaven Vets is putting together a one-year pet

Kindly show workings on Paper.

Hi, this is the complete question.

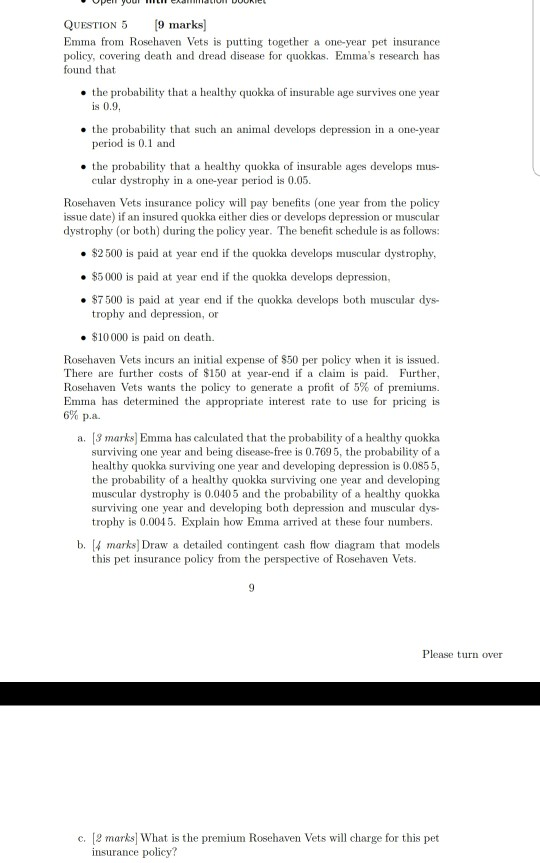

QUESTION 5 [9 marks) Emma from Rosehaven Vets is putting together a one-year pet insurance policy, covering death and dread disease for quokkas. Emma's research has found that the probability that a healthy quokka of insurable age survives one year is 0.9, the probability that such an animal develops depression in a one-year period is 0.1 and the probability that a healthy quokka of insurable ages develops mus- cular dystrophy in a one-year period is 0.05. Rosehaven Vets insurance policy will pay benefits (one year from the policy issue date) if an insured quokka either dies or develops depression or muscular dystrophy (or both) during the policy year. The benefit schedule is as follows: $2 500 is paid at year end if the quokka develops muscular dystrophy, $5000 is paid at year end if the quokka develops depression, $7500 is paid at year end if the quokka develops both muscular dys- trophy and depression, or $10000 is paid on death. Rosehaven Vets incurs an initial expense of $50 per policy when it is issued. There are further costs of $150 at year-end if a claim is paid. Further, Rosehaven Vets wants the policy to generate a profit of 5% of premiums. Emma has determined the appropriate interest rate to use for pricing is 6% p.. a. [3 marks) Emma has calculated that the probability of a healthy quokka surviving one year and being disease-free is 0.7695, the probability of a healthy quokka surviving one year and developing depression is 0.0855, the probability of a healthy quokka surviving one year and developing muscular dystrophy is 0.0405 and the probability of a healthy quokka surviving one year and developing both depression and muscular dys- trophy is 0.0045. Explain how Emma arrived at these four numbers, b. (4 marks) Draw a detailed contingent cash flow diagram that models this pet insurance policy from the perspective of Rosehaven Vets. 9 Please turn over c. [2 marks] What is the premium Rosehaven Vets will charge for this pet insurance policy? QUESTION 5 [9 marks) Emma from Rosehaven Vets is putting together a one-year pet insurance policy, covering death and dread disease for quokkas. Emma's research has found that the probability that a healthy quokka of insurable age survives one year is 0.9, the probability that such an animal develops depression in a one-year period is 0.1 and the probability that a healthy quokka of insurable ages develops mus- cular dystrophy in a one-year period is 0.05. Rosehaven Vets insurance policy will pay benefits (one year from the policy issue date) if an insured quokka either dies or develops depression or muscular dystrophy (or both) during the policy year. The benefit schedule is as follows: $2 500 is paid at year end if the quokka develops muscular dystrophy, $5000 is paid at year end if the quokka develops depression, $7500 is paid at year end if the quokka develops both muscular dys- trophy and depression, or $10000 is paid on death. Rosehaven Vets incurs an initial expense of $50 per policy when it is issued. There are further costs of $150 at year-end if a claim is paid. Further, Rosehaven Vets wants the policy to generate a profit of 5% of premiums. Emma has determined the appropriate interest rate to use for pricing is 6% p.. a. [3 marks) Emma has calculated that the probability of a healthy quokka surviving one year and being disease-free is 0.7695, the probability of a healthy quokka surviving one year and developing depression is 0.0855, the probability of a healthy quokka surviving one year and developing muscular dystrophy is 0.0405 and the probability of a healthy quokka surviving one year and developing both depression and muscular dys- trophy is 0.0045. Explain how Emma arrived at these four numbers, b. (4 marks) Draw a detailed contingent cash flow diagram that models this pet insurance policy from the perspective of Rosehaven Vets. 9 Please turn over c. [2 marks] What is the premium Rosehaven Vets will charge for this pet insurance policyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started