Answered step by step

Verified Expert Solution

Question

1 Approved Answer

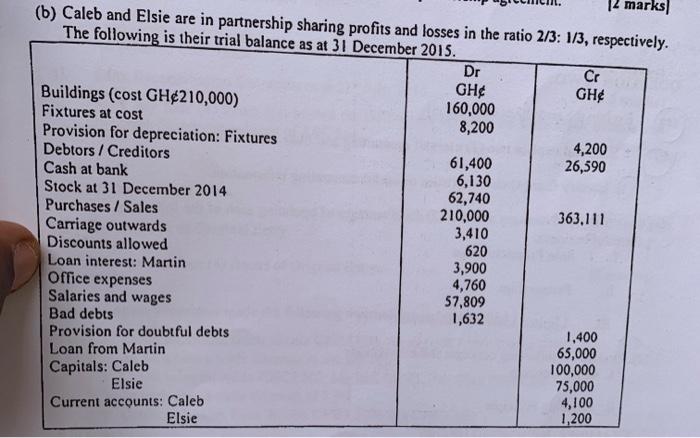

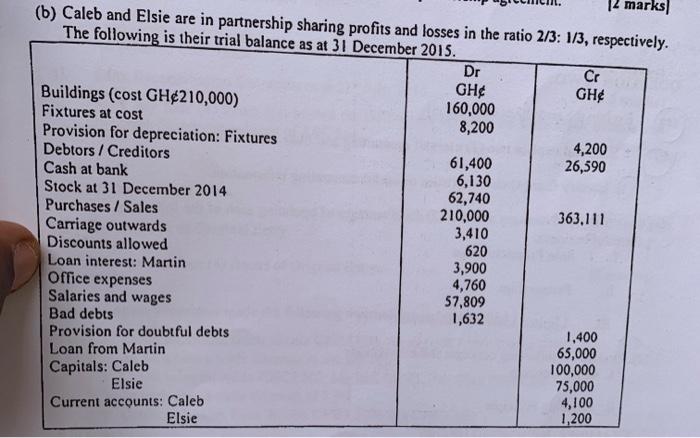

kindly solve all the questions for me 12 marks (b) Caleb and Elsie are in partnership sharing profits and losses in the ratio 2/3: 1/3,

kindly solve all the questions for me

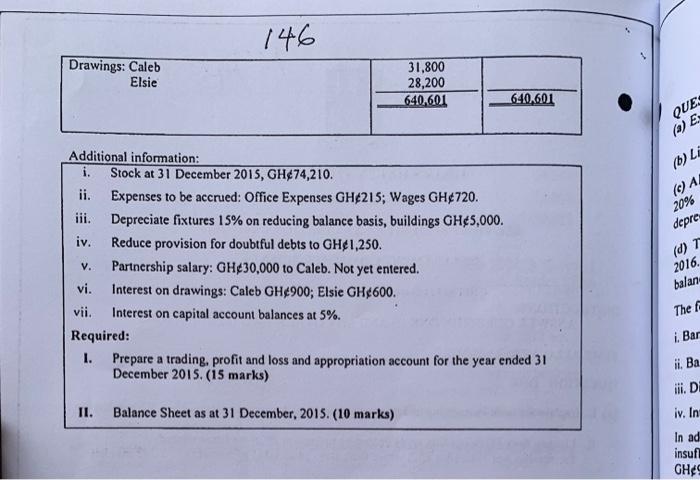

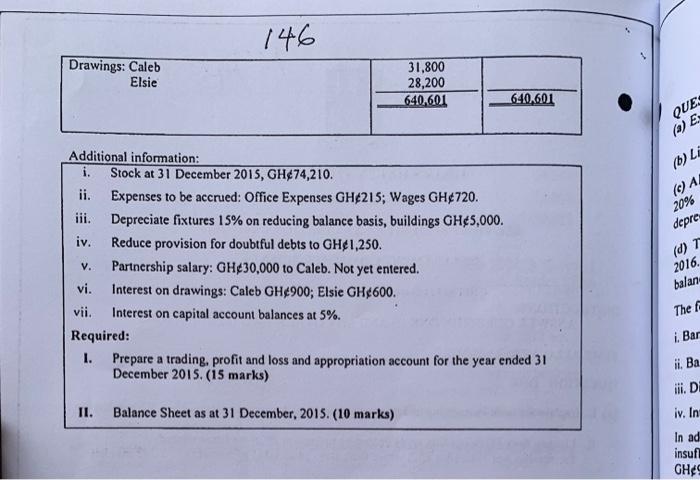

12 marks (b) Caleb and Elsie are in partnership sharing profits and losses in the ratio 2/3: 1/3, respectively. The following is their trial balance as at 31 December 2015. Dr Cr GH Buildings (cost GH210,000) GH Fixtures at cost 160,000 8,200 Provision for depreciation: Fixtures Debtors / Creditors 4,200 61,400 26,590 Cash at bank 6,130 Stock at 31 December 2014 62,740 Purchases / Sales 210,000 363,111 Carriage outwards 3,410 Discounts allowed 620 Loan interest: Martin 3,900 Office expenses 4,760 Salaries and wages 57,809 Bad debts 1,632 Provision for doubtful debts 1,400 Loan from Martin 65,000 Capitals: Caleb 100,000 Elsie 75,000 Current accounts: Caleb 4,100 Elsie 1,200 146 Drawings: Caleb Elsie 31,800 28,200 640.601 640.601 QUES (O) ES (b) LE (c) A 20% Additional information: Stock at 31 December 2015, GH474,210. ii. Expenses to be accrued: Office Expenses GH215; Wages GH720. iii. Depreciate fixtures 15% on reducing balance basis, buildings GH5,000. iv. Reduce provision for doubtful debts to GH1,250. V. Partnership salary: GH30,000 to Caleb. Not yet entered. vi. Interest on drawings: Caleb GH900; Elsie GH600. vii. Interest on capital account balances at 5%. Required: I. Prepare a trading, profit and loss and appropriation account for the year ended 31 December 2015. (15 marks) depre (d) T 2016. balan The i. Bar ii. Ba iii. D II. Balance Sheet as at 31 December, 2015. (10 marks) iv. In ad insuf GHS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started