Answered step by step

Verified Expert Solution

Question

1 Approved Answer

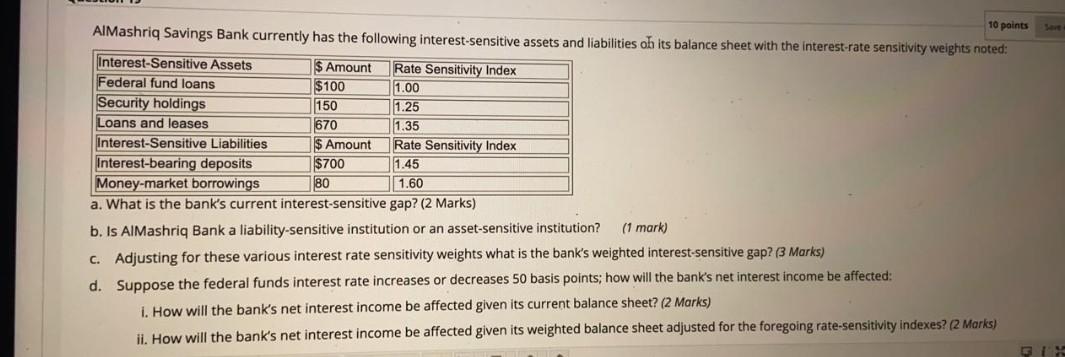

kindly solve as soon as possible 10 paints AlMashriq Savings Bank currently has the following interest-sensitive assets and liabilities oh its balance sheet with the

kindly solve as soon as possible

10 paints AlMashriq Savings Bank currently has the following interest-sensitive assets and liabilities oh its balance sheet with the interest-rate sensitivity weights noted: Interest-Sensitive Assets $ Amount Rate Sensitivity Index Federal fund loans $100 1.00 Security holdings 150 1.25 Loans and leases 670 1.35 Interest-Sensitive Liabilities $ Amount Rate Sensitivity Index Interest-bearing deposits $700 1.45 Money-market borrowings 80 1.60 a. What is the bank's current interest-sensitive gap? (2 Marks) b. Is AlMashriq Bank a liability-sensitive institution or an asset-sensitive institution? (1 mark) C. Adjusting for these various interest rate sensitivity weights what is the bank's weighted interest-sensitive gap? (3 Marks) d. Suppose the federal funds interest rate increases or decreases 50 basis points; how will the bank's net interest income be affected: 1. How will the bank's net interest income be affected given its current balance sheet? (2 Marks) ii. How will the bank's net interest income be affected given its weighted balance sheet adjusted for the foregoing rate-sensitivity indexes? (2 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started