Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly solve on excel Shahtaj Textile Mills is a listed company at Pakistan Stock Exchange (PSX). The principal business of the company is to manufacture

Kindly solve on excel

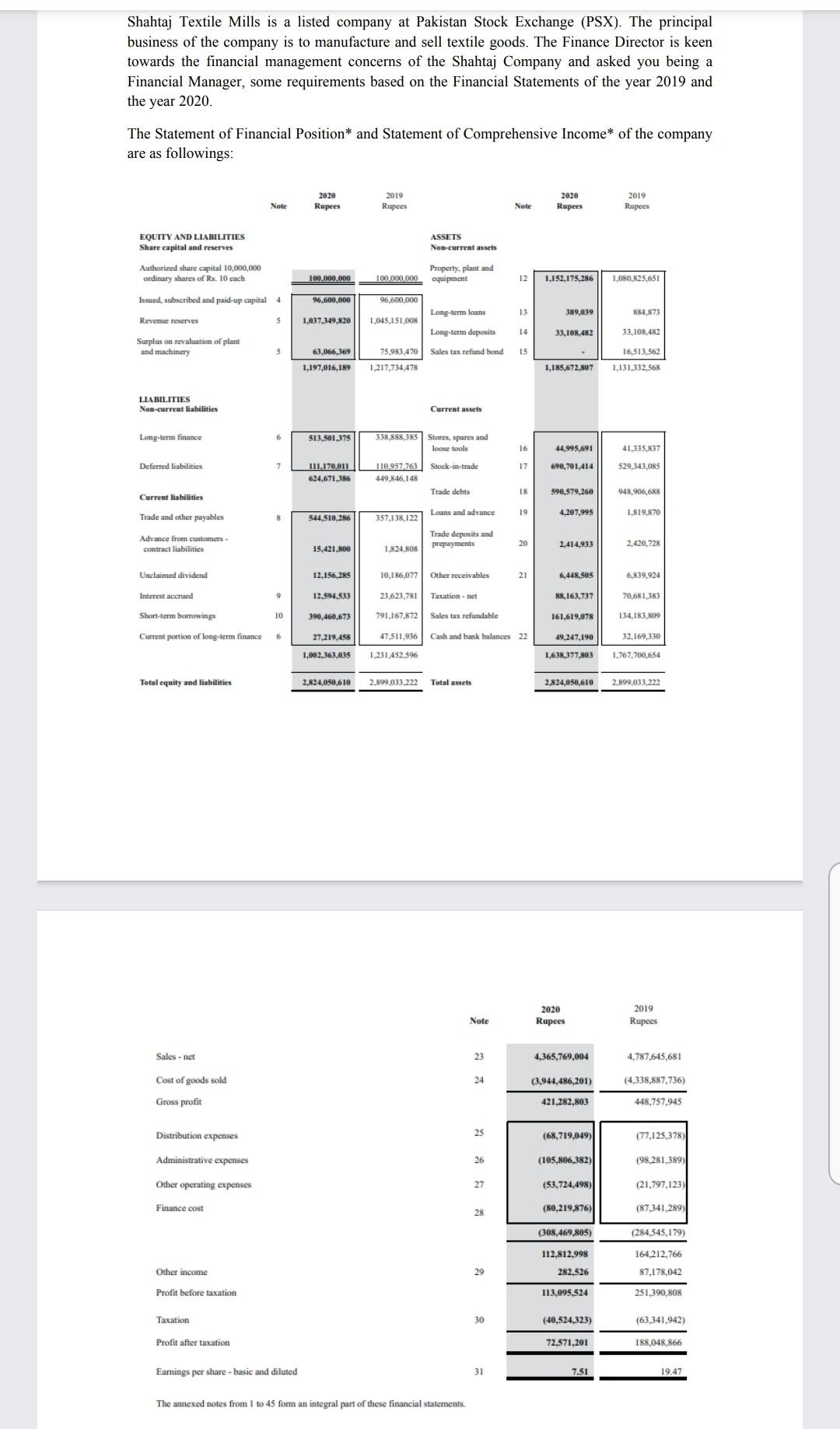

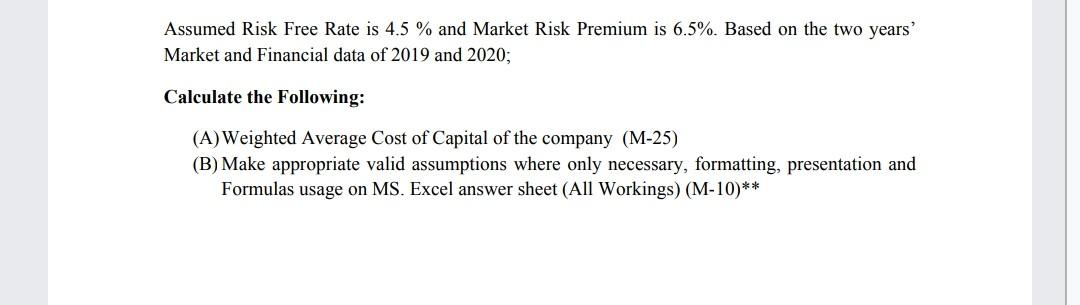

Shahtaj Textile Mills is a listed company at Pakistan Stock Exchange (PSX). The principal business of the company is to manufacture and sell textile goods. The Finance Director is keen towards the financial management concerns of the Shahtaj Company and asked you being a Financial Manager, some requirements based on the Financial Statements of the year 2019 and the year 2020 The Statement of Financial Position* and Statement of Comprehensive Income* of the company are as followings: 2020 Rupees 2019 Rupees 2020 Rupees 2019 Rupees Note Note EQUITY AND LIABILITIES Share capital and reserves ASSETS Non-current assets Authorized share capital 10,000,000 ordinary shares of Rs. 10 each Property, plant and 100.000.000 100.000.000 equipment 12 1.152.175.286 1,080,825,651 Issued, subscribed and paid-up capital 4 96,600,000 96,600,000 Long-term loans 13 389,039 884,873 Revenue reserves 5 1,037.349.820 1.045,151,00 Long-term deposits 14 33,108,482 33,108,482 Surplus on revaluation of plant and machinery 5 63.066_369 75.983.470 Sales tax refund bond 15 16,513,562 1.197,016,189 1,217,734.478 1.185,672.807 1,131,332,568 LIABILITIES Non-current liabilities Current assets Long-term finance 6 513.501,375 338,888385 Stores, spares and loose tools 16 44,995.691 41.335,837 Deferred liabilities 7 Stock-in-tradis 17 690,701,414 529,343,085 111.170.011 624.671386 110.957.763 449.846,148 Trade debts 18 590,579,260 948.906.685 Current liabilities Trade and other puyables Loans and advance 19 4,207,995 L819,870 8 544.510.286 357,138,122 Advance from customers contract liabilities Trade deposits and prepayments 20 15.421.800 2,420,728 1.824.808 2,414,933 Unclaimed dividend 12.156,285 10,186,077 Other receivables 21 6,448,503 6,839.924 Interest accrued 9 12.594.533 23.623,781 Taxation.net 88,161.737 70.681.383 Short-term borrowings 10 390.460.673 791,167,872 Sales tax refundable 161,619,078 134,183,809 Current portion of long-term finance 27,219.458 47,511,936 Cash and bunk balances 22 49,247,190 32,169,130 1,002,363,035 1,231,452,596 1,6,38,377,803 1,767,700,654 Total equity and liabilities 2.824.050.610 2,899,033.222 Total assets 2.834,050.610 2899.033.222 2020 Rupees 2019 Rupees Note Sales - net 23 4.365.769,004 4,787,645,681 Cost of goods sold 24 (3,944,486,201) (4,338,887,736) Gross profit 421,282,803 448,757.945 Distribution expenses 25 (68,719,049) (77,125,378) Administrative expenses 26 (105,806,382) (98,281.389) Other operating expenses 27 (53,724,498) (21,797,123) Finance cost 28 (80.219,876) (87,341,289) (308,469,805) (284,545, 179) 112,812.998 164.212.766 Other income 29 282,526 87,178,042 Profit before taxation 113,095.524 251.390,808 Taxation 30 (40.524,323) (63,341,942) Profit after taxation 72,571,201 188.048,866 Earnings per share-basic and diluted 31 7.51 19.47 The annexed notes from 1 to 45 form an integral part of these financial statements. Assumed Risk Free Rate is 4.5 % and Market Risk Premium is 6.5%. Based on the two years' Market and Financial data of 2019 and 2020; Calculate the Following: (A)Weighted Average Cost of Capital of the company (M-25) (B) Make appropriate valid assumptions where only necessary, formatting, presentation and Formulas usage on MS. Excel answer sheet (All Workings) (M-10)** Shahtaj Textile Mills is a listed company at Pakistan Stock Exchange (PSX). The principal business of the company is to manufacture and sell textile goods. The Finance Director is keen towards the financial management concerns of the Shahtaj Company and asked you being a Financial Manager, some requirements based on the Financial Statements of the year 2019 and the year 2020 The Statement of Financial Position* and Statement of Comprehensive Income* of the company are as followings: 2020 Rupees 2019 Rupees 2020 Rupees 2019 Rupees Note Note EQUITY AND LIABILITIES Share capital and reserves ASSETS Non-current assets Authorized share capital 10,000,000 ordinary shares of Rs. 10 each Property, plant and 100.000.000 100.000.000 equipment 12 1.152.175.286 1,080,825,651 Issued, subscribed and paid-up capital 4 96,600,000 96,600,000 Long-term loans 13 389,039 884,873 Revenue reserves 5 1,037.349.820 1.045,151,00 Long-term deposits 14 33,108,482 33,108,482 Surplus on revaluation of plant and machinery 5 63.066_369 75.983.470 Sales tax refund bond 15 16,513,562 1.197,016,189 1,217,734.478 1.185,672.807 1,131,332,568 LIABILITIES Non-current liabilities Current assets Long-term finance 6 513.501,375 338,888385 Stores, spares and loose tools 16 44,995.691 41.335,837 Deferred liabilities 7 Stock-in-tradis 17 690,701,414 529,343,085 111.170.011 624.671386 110.957.763 449.846,148 Trade debts 18 590,579,260 948.906.685 Current liabilities Trade and other puyables Loans and advance 19 4,207,995 L819,870 8 544.510.286 357,138,122 Advance from customers contract liabilities Trade deposits and prepayments 20 15.421.800 2,420,728 1.824.808 2,414,933 Unclaimed dividend 12.156,285 10,186,077 Other receivables 21 6,448,503 6,839.924 Interest accrued 9 12.594.533 23.623,781 Taxation.net 88,161.737 70.681.383 Short-term borrowings 10 390.460.673 791,167,872 Sales tax refundable 161,619,078 134,183,809 Current portion of long-term finance 27,219.458 47,511,936 Cash and bunk balances 22 49,247,190 32,169,130 1,002,363,035 1,231,452,596 1,6,38,377,803 1,767,700,654 Total equity and liabilities 2.824.050.610 2,899,033.222 Total assets 2.834,050.610 2899.033.222 2020 Rupees 2019 Rupees Note Sales - net 23 4.365.769,004 4,787,645,681 Cost of goods sold 24 (3,944,486,201) (4,338,887,736) Gross profit 421,282,803 448,757.945 Distribution expenses 25 (68,719,049) (77,125,378) Administrative expenses 26 (105,806,382) (98,281.389) Other operating expenses 27 (53,724,498) (21,797,123) Finance cost 28 (80.219,876) (87,341,289) (308,469,805) (284,545, 179) 112,812.998 164.212.766 Other income 29 282,526 87,178,042 Profit before taxation 113,095.524 251.390,808 Taxation 30 (40.524,323) (63,341,942) Profit after taxation 72,571,201 188.048,866 Earnings per share-basic and diluted 31 7.51 19.47 The annexed notes from 1 to 45 form an integral part of these financial statements. Assumed Risk Free Rate is 4.5 % and Market Risk Premium is 6.5%. Based on the two years' Market and Financial data of 2019 and 2020; Calculate the Following: (A)Weighted Average Cost of Capital of the company (M-25) (B) Make appropriate valid assumptions where only necessary, formatting, presentation and Formulas usage on MS. Excel answer sheet (All Workings) (M-10)**Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started