Answered step by step

Verified Expert Solution

Question

1 Approved Answer

kindly solve part c and part d, but urgent. Question 2 20marks a) Why some investors prefer capital gain and some dividend? Explain how stock

kindly solve part c and part d, but urgent.

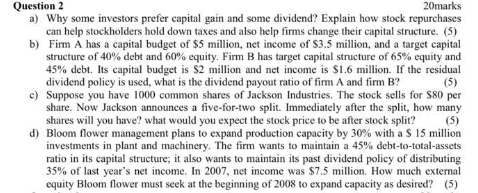

Question 2 20marks a) Why some investors prefer capital gain and some dividend? Explain how stock repurchases can help stockholders hold down taxes and also help firms change their capital structure. (5) b) Firm A has a capital budget of $5 million, net income of $3.5 million, and a target capital structure of 40% debt and 60% equity. Firm B has target capital structure of 65% equity and 45% debt. Its capital budget is $2 million and net income is $1.6 million. If the residual dividend policy is used, what is the dividend payout ratio of firm A and firm B? (5) c) Suppose you have 1000 common shares of Jackson Industries. The stock sells for $80 per share. Now Jackson announces a five-for-two split. Immediately after the split, how many shares will you have? what would you expect the stock price to be after stock split? (5) d) Bloom flower management plans to expand production capacity by 30% with a $ 15 million investments in plant and machinery. The firm wants to maintain a 45% debt-to-total-assets ratio in its capital structure, it also wants to maintain its past dividend policy of distributing 35% of last year's net income. In 2007, net income was $7.5 million. How much external equity Bloom flower must seek at the beginning of 2008 to expand capacity as desiredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started