Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly solve the problem in red based on the example problem above (the more explanations of the calculations - the better) Please reply if you

Kindly solve the problem in red based on the example problem above (the more explanations of the calculations - the better) Please reply if you are 100% sure of the correctness to get +1 Many thanks in advance.

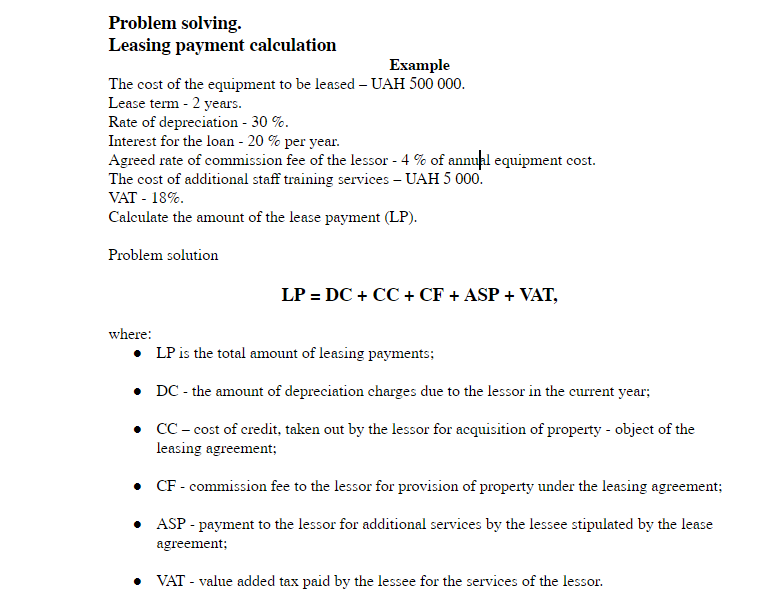

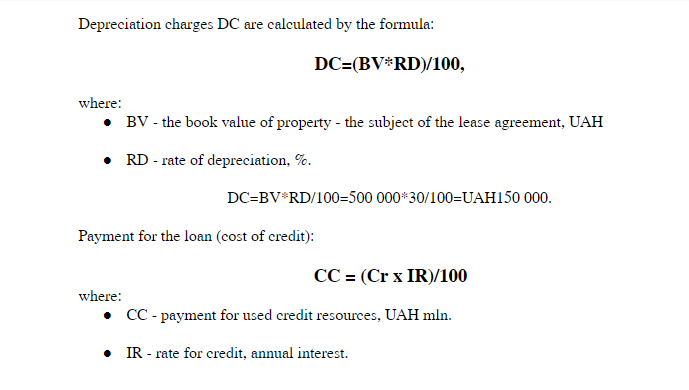

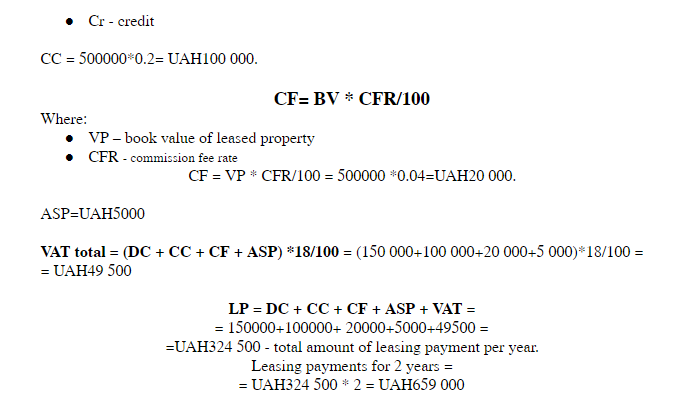

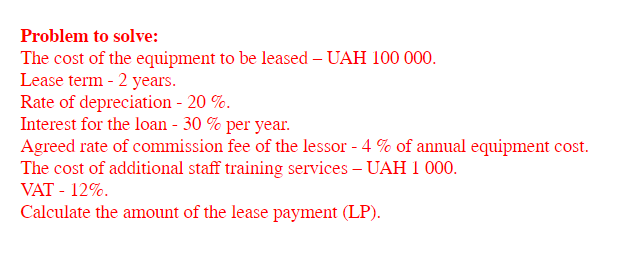

Problem solving. Leasing payment calculation Example The cost of the equipment to be leased - UAH 500 000. Lease term - 2 years. Rate of depreciation - 30 %. Interest for the loan - 20 % per year. Agreed rate of commission fee of the lessor - 4 % of annual equipment cost. The cost of additional staff training services - UAH 5 000. VAT - 18%. Calculate the amount of the lease payment (LP). Problem solution LP = DC + CC + CF + ASP + VAT, where: LP is the total amount of leasing payments; DC - the amount of depreciation charges due to the lessor in the current year; CC - cost of credit, taken out by the lessor for acquisition of property - object of the leasing agreement; CF - commission fee to the lessor for provision of property under the leasing agreement; ASP - payment to the lessor for additional services by the lessee stipulated by the lease agreement; VAT - value added tax paid by the lessee for the services of the lessor. Depreciation charges DC are calculated by the formula: DC=(BVRD)/100, where: BV - the book value of property - the subject of the lease agreement, UAH . RD - rate of depreciation, %. DC=BV RD/100=500 000*30/100=UAH150 000 Payment for the loan (cost of credit): CC = (Cr x IR)/100 where: CC - payment for used credit resources, UAH mln. IR - rate for credit, annual interest. Cr - credit CC = 500000 0.2= UAH100 000. CF=BV CFR/100 Where: VP - book value of leased property CFR-commission fee rate CF = VP * CFR/100 = 500000 *0.04=UAH20 000. ASP=UAH5000 VAT total = (DC + CC + CF + ASP) *18/100 = (150 000+100 000+20 000+5 000) 18/100 = = UAH49 500 LP = DC + CC + CF + ASP + VAT = = 150000+100000+ 20000+5000+49500 = =UAH324 500 - total amount of leasing payment per year. Leasing payments for 2 years = = UAH324 500 * 2 = UAH659 000 Problem to solve: The cost of the equipment to be leased - UAH 100 000. Lease term - 2 years. Rate of depreciation - 20 %. Interest for the loan - 30 % per year. Agreed rate of commission fee of the lessor - 4 % of annual equipment cost. The cost of additional staff training services - UAH 1 000. VAT - 12%. Calculate the amount of the lease payment (LP)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started