kindly solve the question

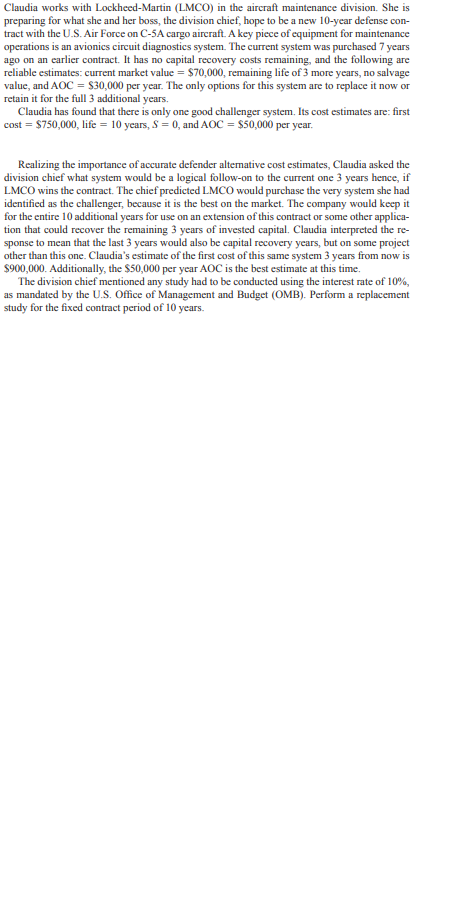

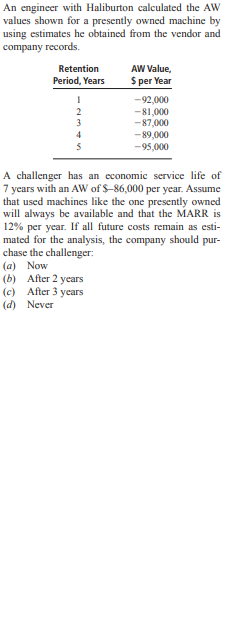

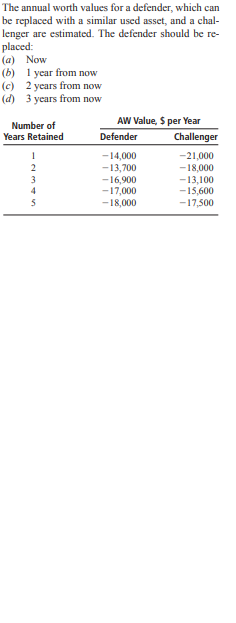

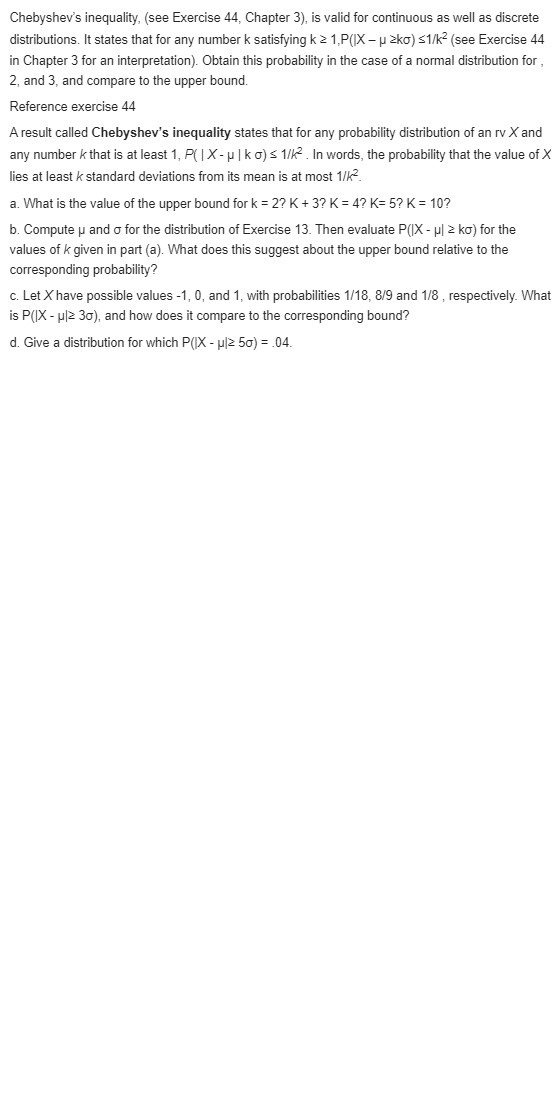

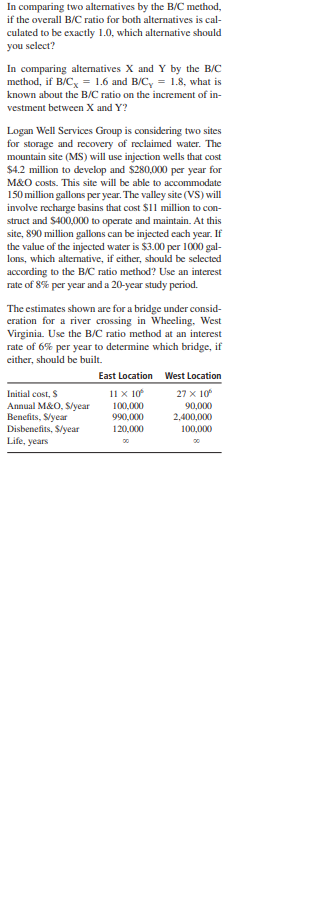

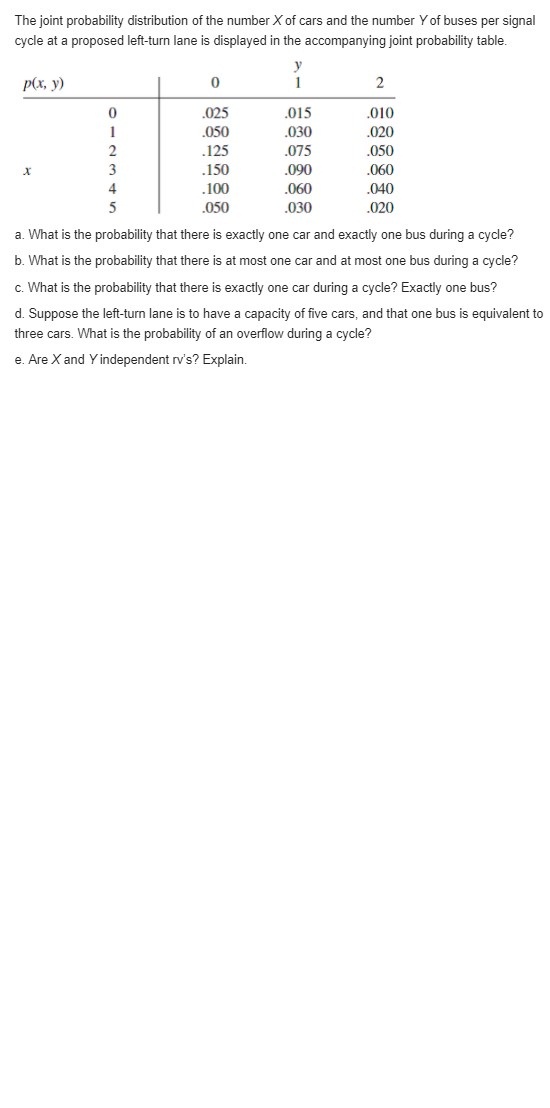

Determine the cost of equity capital to Hy-Lok USA if the company sells 500,000 shares of its preferred stock at a 5% discount from its price of $130. The stock carries a $10 per year dividend. The initial public offering price for the common stock of SW Refining is $23 per share, and it will pay a first-year dividend of $0.92 per share. If the appreciation rate in dividends is anticipated to be 3.2% per year, determine the cost of equity capital for the stock offering. The cost of debt capital is lower after taxes than before taxes. The cost of equity capital is more dif- ficult to estimate using the dividend method or the CAPM model, for example, yet the after-tax and before-tax cost of equity capital is the same. Why are the after-tax rates not the same for both types of financing?Claudia works with Lockheed-Martin (LMCO) in the aircraft maintenance division. She is preparing for what she and her boss, the division chief, hope to be a new 10-year defense con- tract with the U.S. Air Force on C-5A cargo aircraft. A key piece of equipment for maintenance operations is an avionics circuit diagnostics system. The current system was purchased 7 years ago on an earlier contract. It has no capital recovery costs remaining, and the following are reliable estimates: current market value = $70,000, remaining life of 3 more years, no salvage value, and AOC = $30,000 per year. The only options for this system are to replace it now or retain it for the full 3 additional years. Claudia has found that there is only one good challenger system. Its cost estimates are: first cost = $750,000, life = 10 years, S = 0, and AOC = $50,000 per year. Realizing the importance of accurate defender alternative cost estimates, Claudia asked the division chief what system would be a logical follow-on to the current one 3 years hence, if LMCO wins the contract. The chief predicted LMCO would purchase the very system she had identified as the challenger, because it is the best on the market. The company would keep it for the entire 10 additional years for use on an extension of this contract or some other applica- tion that could recover the remaining 3 years of invested capital. Claudia interpreted the re- sponse to mean that the last 3 years would also be capital recovery years, but on some project other than this one. Claudia's estimate of the first cost of this same system 3 years from now is $900,000. Additionally, the $50,000 per year AOC is the best estimate at this time. The division chief mentioned any study had to be conducted using the interest rate of 10%, as mandated by the U.S. Office of Management and Budget (OMB). Perform a replacement study for the fixed contract period of 10 years.An engineer with Haliburton calculated the AW values shown for a presently owned machine by using estimates he obtained from the vendor and company records. Retention AW Value. Period, Years $ per Year - 92,000 -81,000 -87,000 -89 000 -95,000 A challenger has an economic service life of 7 years with an AW of $-86,000 per year. Assume that used machines like the one presently owned will always be available and that the MARK is 12% per year. If all future costs remain as esti- mated for the analysis, the company should pur- chase the challenger: (a) Now (b) After 2 years (c) After 3 years (d) NeverThe annual worth values for a defender, which can be replaced with a similar used asset, and a chal- longer are estimated. The defender should be re- placed: (a) Now (b) 1 year from now (c) 2 years from now (a) 3 years from now Number of AW Value, $ per Year Years Retained Defender Challenger -14,000 -21,000 -13,700 -18,000 -16,900 -13,100 -17,000 -15,600 -18,000 -17,500Chebyshev's inequality, (see Exercise 44, Chapter 3), is valid for continuous as well as discrete distributions. It states that for any number k satisfying k 2 1, P(IX - p 2ko) =1/k (see Exercise 44 in Chapter 3 for an interpretation). Obtain this probability in the case of a normal distribution for , 2, and 3, and compare to the upper bound. Reference exercise 44 A result called Chebyshev's inequality states that for any probability distribution of an rv X and any number k that is at least 1, P( | X - p | k o) $ 1/k2 . In words, the probability that the value of X lies at least k standard deviations from its mean is at most 1/12. a. What is the value of the upper bound for k = 2? K + 3? K = 4? K= 5? K = 10? b. Compute p and o for the distribution of Exercise 13. Then evaluate P()X - p| 2 ko) for the values of k given in part (a). What does this suggest about the upper bound relative to the corresponding probability? c. Let X have possible values -1, 0, and 1, with probabilities 1/18, 8/9 and 1/8 , respectively. What is P(1X - p/2 30), and how does it compare to the corresponding bound? d. Give a distribution for which P(IX - p|2 50) = .04.In comparing two alternatives by the B/C method, if the overall B/C ratio for both alternatives is cal- culated to be exactly 1.0, which alternative should you select? In comparing alternatives X and Y by the B/C method, if B/Cy = 1.6 and B/Cy = 1.8, what is known about the B/C ratio on the increment of in- vestment between X and Y? Logan Well Services Group is considering two sites for storage and recovery of reclaimed water. The mountain site (MS) will use injection wells that cost $4.2 million to develop and $280.000 per year for M&O costs. This site will be able to accommodate 150 million gallons per year. The valley site (VS) will involve recharge basins that cost $11 million to con- struct and $400,000 to operate and maintain. At this site, 890 million gallons can be injected each year. If the value of the injected water is $3.00 per 1000 gal- Ions, which alternative, if either, should be selected according to the B/C ratio method? Use an interest rate of 8% per year and a 20-year study period. The estimates shown are for a bridge under consid cration for a river crossing in Wheeling, West Virginia. Use the B/C ratio method at an interest rate of 6% per year to determine which bridge, if either, should be built. East Location West Location Initial cost, $ 11 x 10 27 x 10 Annual M&O, $/year 100,000 90,000 Benefits, $/year 990.000 2,400,000 Disbenefits, $/year 120,000 100,000 Life, years DOThe joint probability distribution of the number X of cars and the number Y of buses per signal cycle at a proposed left-turn lane is displayed in the accompanying joint probability table. p(x, y) 0 2 .025 015 010 050 030 020 .125 .075 .050 UAWNEO .150 .090 060 .100 .060 040 .050 030 .020 a. What is the probability that there is exactly one car and exactly one bus during a cycle? b. What is the probability that there is at most one car and at most one bus during a cycle? c. What is the probability that there is exactly one car during a cycle? Exactly one bus? d. Suppose the left-turn lane is to have a capacity of five cars, and that one bus is equivalent to three cars. What is the probability of an overflow during a cycle? e. Are X and Y independent rv's? Explain