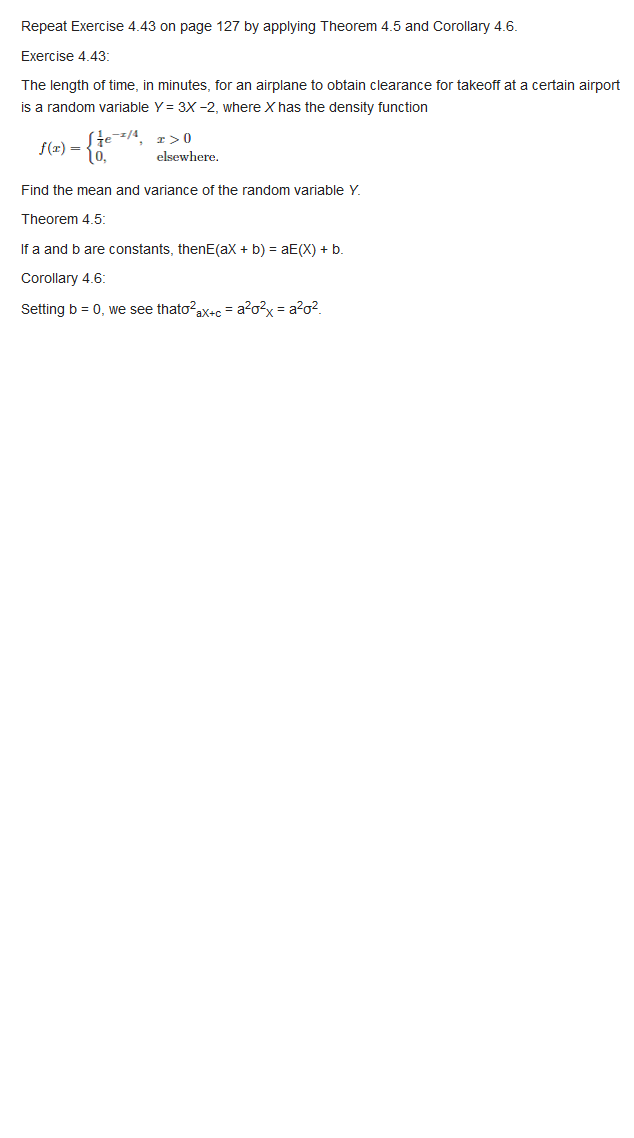

kindly solve these problems

BinHealth, a biodevice systems leasing company, is considering a new equipment purchase to re- place a currently owned asset that was purchased 2 years ago for $250,000, It is appraised at a cur- rent market value of only $50,000. An upgrade is possible for $200,000 now that would be adequate for another 3 years of lease rights, after which the entire system could be sold on the international circuit for an estimated $40,000. The challenger, which can be purchased for $300,000, has an ex- pected life of 10 years and a $50,000 salvage value. Determine whether the company should up- grade or replace at a MARR of 12%% per year. As- summe the AOC estimates are the same for both alternatives. For the estimates in Problem 11.30, use a spreadsheet-based analysis to determine the first cost for the augmentation of the current system that will make the defender and challenger break even. Is this a maximum of minimum for the up- grade, if the current system is to be retained? Herald Richter and Associates, 3 years ago, pur- chased for $45,000 a microwave signal graphical plotter for corrosion detection in concrete struce bores. It is expected to have the market values and annual operating costs shown below for its rc- maining usefial life of up to 3 years. It could be traded now at an appraised market value of $8000. Market Value AOC at End of Year, $ $ per Year 6000 -50,000 4000 DOO'ES A replacement plotter with new Internet-based, digital technology costing $125,000 has an esti- mated $10,000 salvage value after its 3-year life and an AOC of $31,000 per year. At an interest rate of 15%% per year, determine how many more years11.47 In conducting a replacement study, all of the follow- ing are correct viewpoints for the analyst except: (a) Consultant's (b) Owner's c Qursider's () Nonowner's 11.48 A sunk cost is the difference between: (4) The first cost and the salvage value (b) The market value and the salvage value c The first cost and the market value The book value and the market value 11:49 A truck was purchased 3 years ago for $45,000 and can be sold today for $24,000. The operating costs are $9000 per year, and it is expected to last 4 more years with a $3000 salvage value. A new truck, which will perform that same service, can be pur- chased for $50,000, and it will have a life of 10 years with operating costs of $28,000 per year and a $10,000 salvage value. The value that should be used as P for the presently owned vehicle in a replacement study is: (4) $45,000 (6) $5000 (3) $501000 () $24.000Two equivalent pieces of quality inspection equipment are being considered for purchase by Square D Electric. Machine 2 is expected to be versatile and technologically advanced enough to provide net income longer than machine 1. Machine 1 Machine 2 First cool, $ 12000 8.000 Annual NCF, 5 3,000 1,000 (years 1-5). 3,000 (years 6-14) Maximum life, years The quality manager used a return of 13% per year and software that incorporates Equa- tions (13.8] and [13.9] to recommend machine I because it has a shorter payback period of 657 years at 1 = 15%. The computations are summarized here $30306 per year Cash flow neglected by peryback analysis Machine I - 6.57 $12.DO0 Cash flows neglected $5000 per year by payback aralysis $1006 per year Machine 2 1, - 952 Figure 13-7 Illustration of payback periods and neglected net cash flows, Example 13.5. Machine 1: 0. = 657 years, which is less than the 7-year life Equation used: 0 = -12,000 + 3000(P/4,13%,a) Machine 2: 0, = 9.52 years, which is less than the 14-year life. Equation used 0 = -8000 + 1000(P/4,15%,5) + 3000( P/A,15%on, -5KP/F.15%%,5) Recommendation: Select machine 1 w, use a 13%% PW analysis to compare the machines and comment on any difference in the ommendation.\f\f