kindly solve these problems

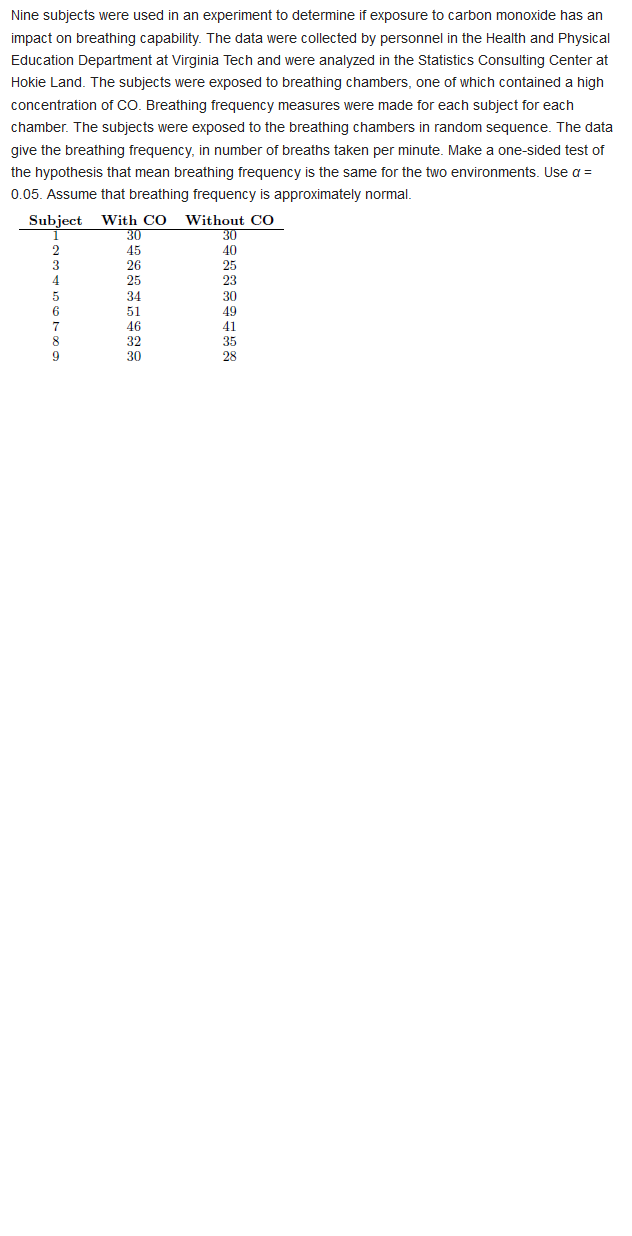

Nano Technologies intends to use the newest and finest equipment in its labs. Accordingly, a senior engineer has recommended that a 2-year-old piece of precision measurement equipment be replaced immediately. This engineer believes it can be shown that the proposed equipment is economi- cally advantageous at a 10% per year return and a planning horizon of 3 years. (a) Perform the replacement analysis using the annual worth method for a specified 3-year study period. (bj Determine the challenger's capital recovery amount for the 3-year study period and the expected full life. Comment on the effect made by the 3-year study period. Current Proposed Original purchase price, 5 OD'DE- Current market value, $ 17,DO0 Remaining life, years S 15 wimated value in 3 years, $ 9000 20 00 salvage value atber 15 years, $ 5.000 Annual operating cost, $ per year -8.000 -3,000Use the PW method at 8%% per year to select up to three projects from the four available omes if no more than $20,000 can be invested. Estimated lives and annual net cash flows vary. Initial Net Cash Flow. 5 per Year Project Investment S -5,060 1,600 1,300 1,860 2,500 2000 900 950 1,000 1,050 10,500 4000 3,000 1,000 500 500 2000 -10 050 0 17,600 Charlie's Garage has $70,000 to spend on new equipment that may increase revenue for his car repair shop. Use the PW method to determine which of these independent investments are finan- cially acceptable at 6%% per year, compounded monthly. All are expected to last 3 years Installed Estimated Added Feature Cost. $ Revenue, 5 per Month Diagnostics system -45,000 2200 Exhaust analyzer -30,00 2000 Hyleid engine tester -22,000 1500As the price of gasoline goes up, people are will- ing to drive farther to fill their tank in order to save money. Assume you had been buying gasoline for $2.90 per gallon and that it went up to $2.98 per gallon at the station where you usually go. If you drive an F-150 pickup that gets 18 miles per gal- lon, what is the round-trip distance you can drive to break even if it will take 20 gallons to fill your tank? Use an interest rate of 8%6 per year. An automobile company is investigating the ad- visability of converting a plant that manufactures economy cars into one that will make retro sports cars. The initial cost for equipment conversion will be $200 million with a 20% salvage value anytime within a 5-year period. The cost of pro- ducing a car will be $21,000, but it is expected to have a selling price of $33,000 to dealers. The production capacity for the first year will be 4000 units. At an interest rate of 12% per year, by what uniform amount will production have to in- crease each year in order for the company to re- cover its investment in 3 years?\f\f