Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly solve these questions correctly. Thanks If you need any information ask me for that. Apex Footwear Ltd. Brac Bank Ltd. Year 2020 2019 2018

Kindly solve these questions correctly. Thanks

If you need any information ask me for that.

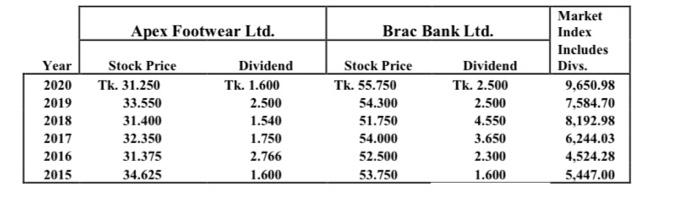

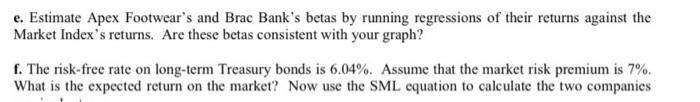

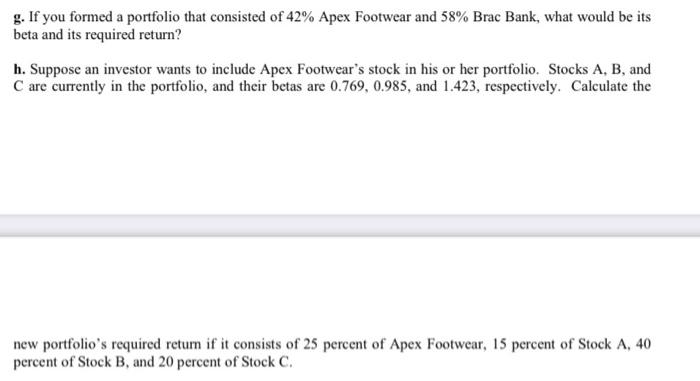

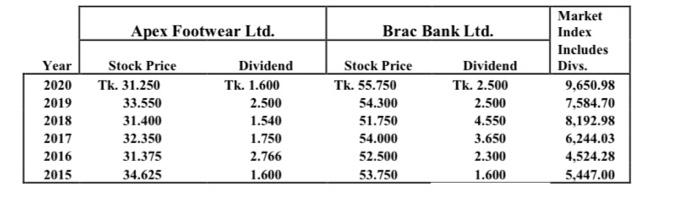

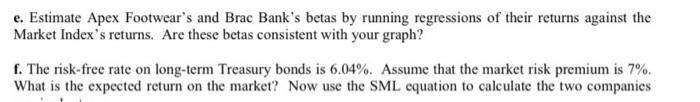

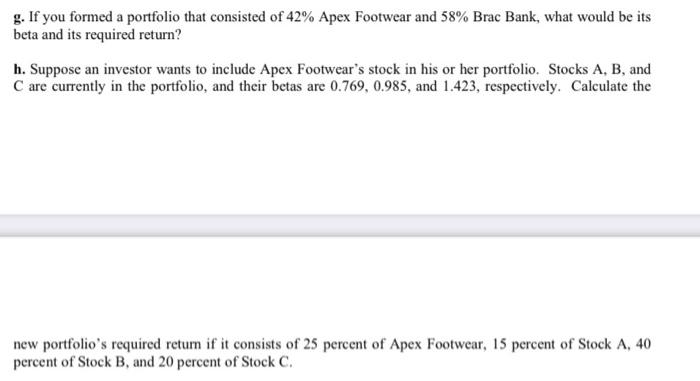

Apex Footwear Ltd. Brac Bank Ltd. Year 2020 2019 2018 2017 2016 2015 Stock Price Tk. 31.250 33.550 31.400 32.350 31.375 34.625 Dividend Tk. 1.600 2.500 1.540 1.750 2.766 1.600 Stock Price Tk. 55.750 54.300 51.750 54.000 52.500 53.750 Dividend Tk. 2.500 2.500 4.550 3.650 2.300 1.600 Market Index Includes Divs. 9,650.98 7,584.70 8,192.98 6,244.03 4,524.28 5,447.00 e. Estimate Apex Footwear's and Brac Bank's betas by running regressions of their returns against the Market Index's returns. Are these betas consistent with your graph? f. The risk-free rate on long-term Treasury bonds is 6.04%. Assume that the market risk premium is 7%. What is the expected return on the market? Now use the SML equation to calculate the two companies g. If you formed a portfolio that consisted of 42% Apex Footwear and 58% Brac Bank, what would be its beta and its required return? h. Suppose an investor wants to include Apex Footwear's stock in his or her portfolio. Stocks A, B, and C are currently in the portfolio, and their betas are 0.769, 0.985, and 1.423, respectively. Calculate the new portfolio's required return if it consists of 25 percent of Apex Footwear, 15 percent of Stock A, 40 percent of Stock B, and 20 percent of Stock C. Apex Footwear Ltd. Brac Bank Ltd. Year 2020 2019 2018 2017 2016 2015 Stock Price Tk. 31.250 33.550 31.400 32.350 31.375 34.625 Dividend Tk. 1.600 2.500 1.540 1.750 2.766 1.600 Stock Price Tk. 55.750 54.300 51.750 54.000 52.500 53.750 Dividend Tk. 2.500 2.500 4.550 3.650 2.300 1.600 Market Index Includes Divs. 9,650.98 7,584.70 8,192.98 6,244.03 4,524.28 5,447.00 e. Estimate Apex Footwear's and Brac Bank's betas by running regressions of their returns against the Market Index's returns. Are these betas consistent with your graph? f. The risk-free rate on long-term Treasury bonds is 6.04%. Assume that the market risk premium is 7%. What is the expected return on the market? Now use the SML equation to calculate the two companies g. If you formed a portfolio that consisted of 42% Apex Footwear and 58% Brac Bank, what would be its beta and its required return? h. Suppose an investor wants to include Apex Footwear's stock in his or her portfolio. Stocks A, B, and C are currently in the portfolio, and their betas are 0.769, 0.985, and 1.423, respectively. Calculate the new portfolio's required return if it consists of 25 percent of Apex Footwear, 15 percent of Stock A, 40 percent of Stock B, and 20 percent of Stock C Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started