Answered step by step

Verified Expert Solution

Question

1 Approved Answer

kindly someone help me with this question. Thanks in advance Question 3 Cecelia, the currency speculator sells nine Sept futures contracts for 500,000 pesos at

kindly someone help me with this question. Thanks in advance

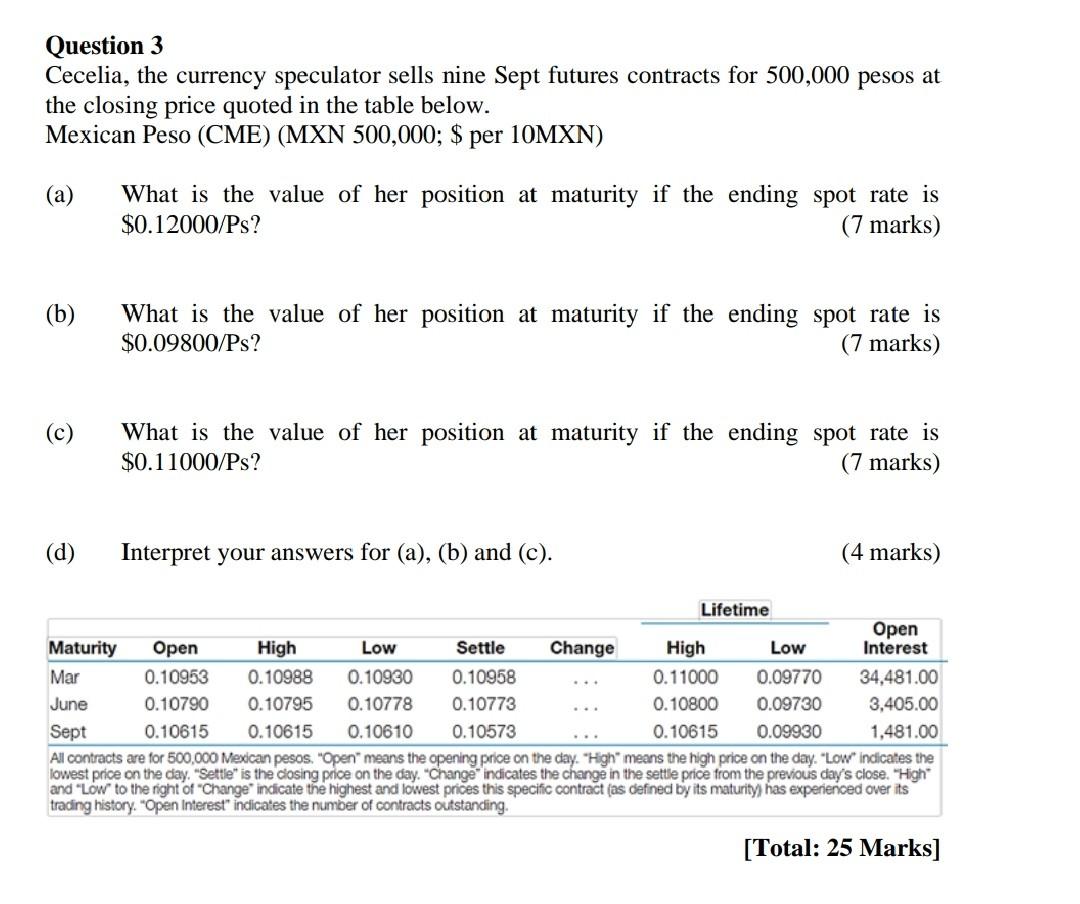

Question 3 Cecelia, the currency speculator sells nine Sept futures contracts for 500,000 pesos at the closing price quoted in the table below. Mexican Peso (CME) (MXN 500,000; $ per 10MXN) (a) What is the value of her position at maturity if the ending spot rate is $0.12000/Ps? (7 marks) (b) What is the value of her position at maturity if the ending spot rate is $0.09800/Ps? (7 marks) What is the value of her position at maturity if the ending spot rate is $0.11000/Ps? (7 marks) (d) Interpret your answers for (a), (b) and (c). (4 marks) Lifetime Open Maturity Open High Low Settle Change High Low Interest Mar 0.10953 0.10988 0.10930 0.10958 0.11000 0.09770 34,481.00 June 0.10790 0.10795 0.10778 0.10773 0.10800 0.09730 3,405.00 Sept 0.10615 0.10615 0.10610 0.10573 0.10615 0.09930 1,481.00 All contracts are for 500,000 Mexican pesos. "Open" means the opening price on the day. "High" means the high price on the day. "LOW" indicates the lowest price on the day. "Settle" is the closing price on the day. "Change indicates the change in the settle price from the previous day's close. "High and "Low" to the right of "Change indicate the highest and lowest prices this specific contract (as defined by its maturity) has experienced over its trading history. "Open Interest" indicates the number of contracts outstanding. [Total: 25 Marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started