Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly with specific reference to how and why we will treat the merchandise inventory. Will it act to reduce the sales and will we take

Kindly with specific reference to how and why we will treat the merchandise inventory. Will it act to reduce the sales and will we take it to the balance sheet.

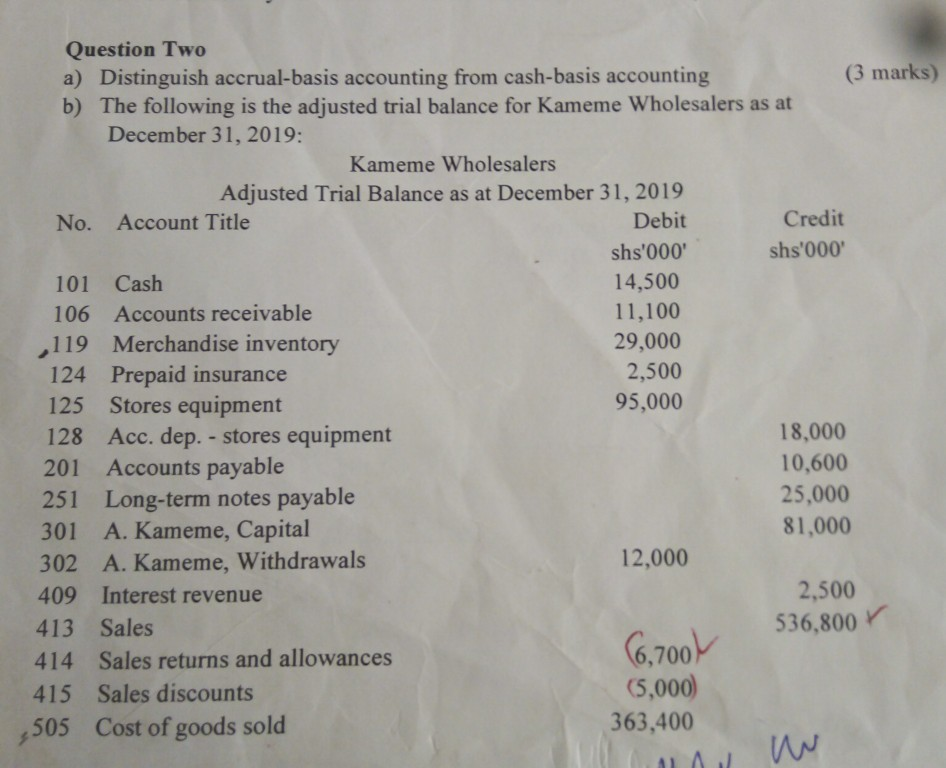

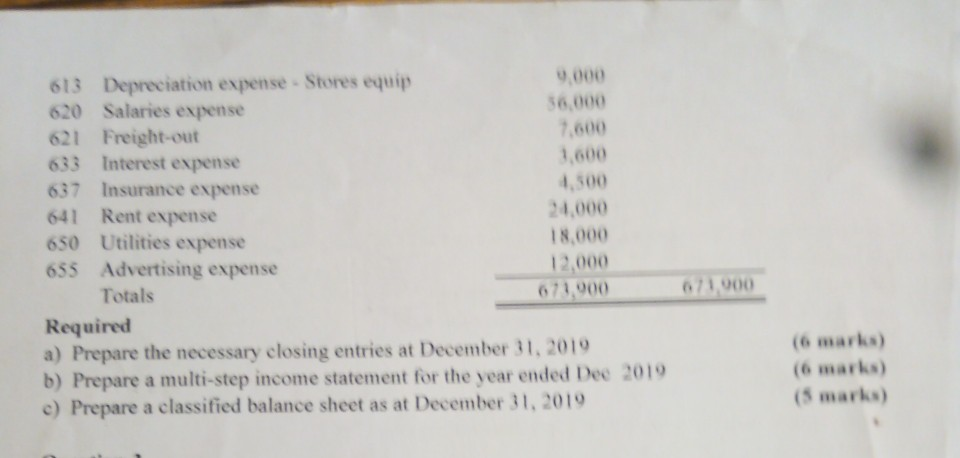

Question Two a) Distinguish accrual-basis accounting from cash-basis accounting (3 marks) b) The following is the adjusted trial balance for Kameme Wholesalers as at December 31, 2019: Kameme Wholesalers Adjusted Trial Balance as at December 31, 2019 No. Account Title Debit Credit shs'000' shs'000 101 Cash 14,500 106 Accounts receivable 11,100 ,119 Merchandise inventory 29,000 124 Prepaid insurance 2,500 125 Stores equipment 95,000 128 Acc. dep. - stores equipment 18,000 201 Accounts payable 10,600 251 Long-term notes payable 25,000 301 A. Kameme, Capital 81,000 302 A. Kameme, Withdrawals 12,000 409 Interest revenue 2,500 413 Sales 536.800 414 Sales returns and allowances 415 Sales discounts (5,000) 505 Cost of goods sold 363,400 LAW 6,700 613 Depreciation expense - Stores equip 620 Salaries expense 621 Freight-out 7.600 633 Interest expense 1.600 637 Insurance expense 4.500 641 Rent expense 24.000 650 Utilities expense 18.000 655 Advertising expense 12.000 Totals 671.000 Required a) Prepare the necessary closing entries at December 31, 2019 b) Prepare a multi-step income statement for the year ended Dee 2019 c) Prepare a classified balance sheet as at December 31, 2019 071.000 (6 marks) (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started