Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kinetic Corporation is considering acquiring High Tech Systems. Jim Smith, the vice president of finance at Kinetic, has been assigned the task of estimating

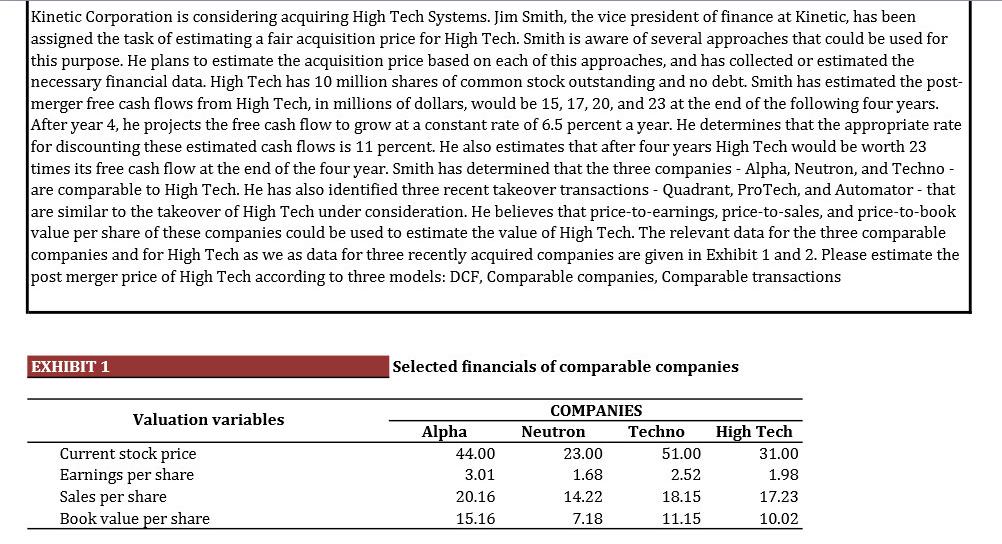

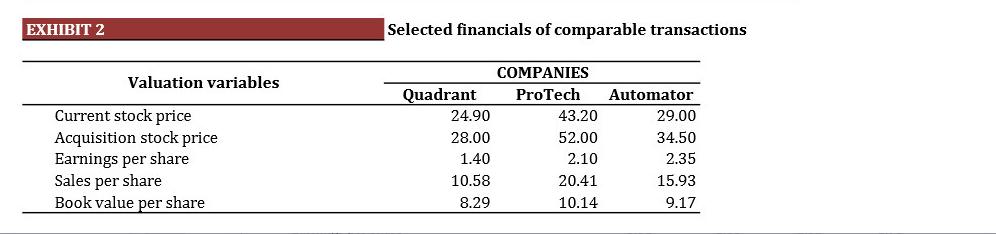

Kinetic Corporation is considering acquiring High Tech Systems. Jim Smith, the vice president of finance at Kinetic, has been assigned the task of estimating a fair acquisition price for High Tech. Smith is aware of several approaches that could be used for this purpose. He plans to estimate the acquisition price based on each of this approaches, and has collected or estimated the necessary financial data. High Tech has 10 million shares of common stock outstanding and no debt. Smith has estimated the post- merger free cash flows from High Tech, in millions of dollars, would be 15, 17, 20, and 23 at the end of the following four years. After year 4, he projects the free cash flow to grow at a constant rate of 6.5 percent a year. He determines that the appropriate rate for discounting these estimated cash flows is 11 percent. He also estimates that after four years High Tech would be worth 23 times its free cash flow at the end of the four year. Smith has determined that the three companies - Alpha, Neutron, and Techno - are comparable to High Tech. He has also identified three recent takeover transactions - Quadrant, ProTech, and Automator - that are similar to the takeover of High Tech under consideration. He believes that price-to-earnings, price-to-sales, and price-to-book value per share of these companies could be used to estimate the value of High Tech. The relevant data for the three comparable companies and for High Tech as we as data for three recently acquired companies are given in Exhibit 1 and 2. Please estimate the post merger price of High Tech according to three models: DCF, Comparable companies, Comparable transactions EXHIBIT 1 Valuation variables Current stock price Earnings per share Sales per share Book value per share Selected financials of comparable companies COMPANIES Alpha Neutron Techno 44.00 23.00 51.00 High Tech 31.00 3.01 1.68 2.52 1.98 20.16 14.22 18.15 17.23 15.16 7.18 11.15 10.02 EXHIBIT 2 Valuation variables Current stock price Acquisition stock price Earnings per share Sales per share Book value per share Selected financials of comparable transactions COMPANIES Quadrant ProTech Automator 24.90 43.20 29.00 28.00 52.00 34.50 1.40 2.10 2.35 10.58 20.41 15.93 8.29 10.14 9.17

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started