Answered step by step

Verified Expert Solution

Question

1 Approved Answer

King Company is a business located in Queens, NY, that manufacturers equipment. On October 14, Year 2, King sold manufacturing equipment to Prince Company

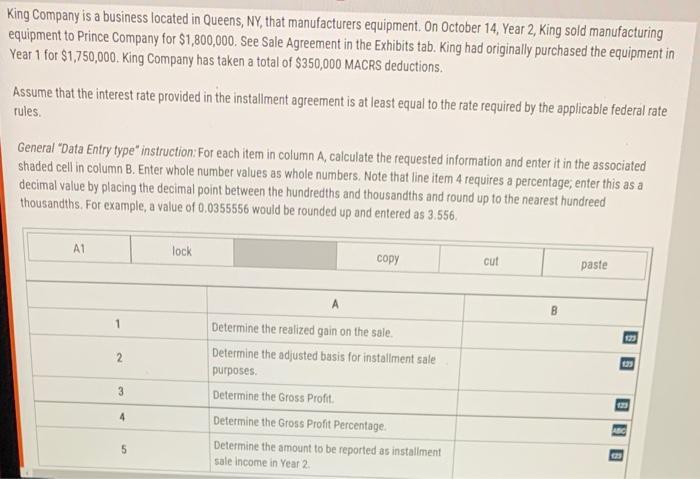

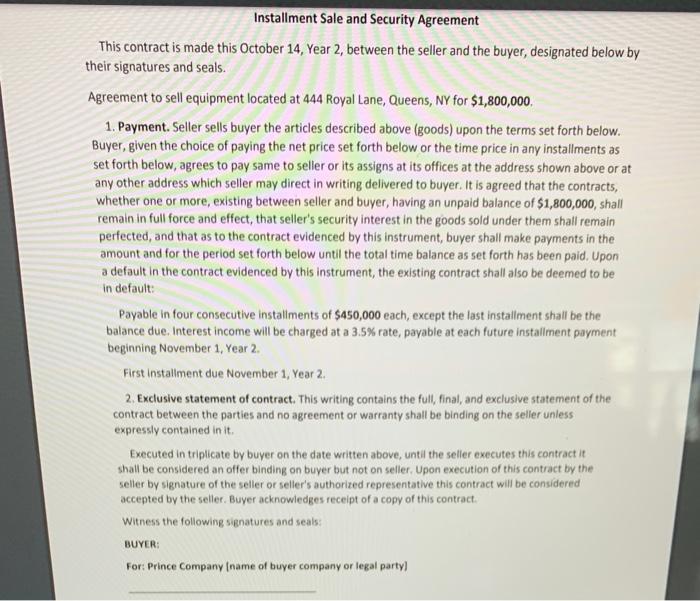

King Company is a business located in Queens, NY, that manufacturers equipment. On October 14, Year 2, King sold manufacturing equipment to Prince Company for $1,800,000. See Sale Agreement in the Exhibits tab. King had originally purchased the equipment in Year 1 for $1,750,000. King Company has taken a total of $350,000 MACRS deductions. Assume that the interest rate provided in the installment agreement is at least equal to the rate required by the applicable federal rate rules. General "Data Entry type" instruction: For each item in column A, calculate the requested information and enter it in the associated shaded cell in column B. Enter whole number values as whole numbers. Note that line item 4 requires a percentage, enter this as a decimal value by placing the decimal point between the hundredths and thousandths and round up to the nearest hundreed thousandths. For example, a value of 0.0355556 would be rounded up and entered as 3.556. A1 1 2 3 4 lock copy Determine the realized gain on the sale. Determine the adjusted basis for installment sale purposes. Determine the Gross Profit. Determine the Gross Profit Percentage. Determine the amount to be reported as installment sale income in Year 2. cut B paste 23 123 123 Installment Sale and Security Agreement This contract is made this October 14, Year 2, between the seller and the buyer, designated below by their signatures and seals. Agreement to sell equipment located at 444 Royal Lane, Queens, NY for $1,800,000. 1. Payment. Seller sells buyer the articles described above (goods) upon the terms set forth below. Buyer, given the choice of paying the net price set forth below or the time price in any installments as set forth below, agrees to pay same to seller or its assigns at its offices at the address shown above or at any other address which seller may direct in writing delivered to buyer. It is agreed that the contracts, whether one or more, existing between seller and buyer, having an unpaid balance of $1,800,000, shall remain in full force and effect, that seller's security interest in the goods sold under them shall remain perfected, and that as to the contract evidenced by this instrument, buyer shall make payments in the amount and for the period set forth below until the total time balance as set forth has been paid. Upon a default in the contract evidenced by this instrument, the existing contract shall also be deemed to be in default: Payable in four consecutive installments of $450,000 each, except the last installment shall be the balance due. Interest income will be charged at a 3.5% rate, payable at each future installment payment beginning November 1, Year 2. First installment due November 1, Year 2. 2. Exclusive statement of contract. This writing contains the full, final, and exclusive statement of the contract between the parties and no agreement or warranty shall be binding on the seller unless expressly contained in it. Executed in triplicate by buyer on the date written above, until the seller executes this contract it shall be considered an offer binding on buyer but not on seller. Upon execution of this contract by the seller by signature of the seller or seller's authorized representative this contract will be considered accepted by the seller. Buyer acknowledges receipt of a copy of this contract. Witness the following signatures and seals: BUYER: For: Prince Company [name of buyer company or legal party)

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

A1 Determine the realized gain on the sale B 50000 A1 Determine the adjusted basis for installment s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started