Answered step by step

Verified Expert Solution

Question

1 Approved Answer

King Corporation began operations in January 2018. The charter authorized the following share capital: Preferred shares: 9 percent, $24 par value, authorized 47,000 shares. Common

| King Corporation began operations in January 2018. The charter authorized the following share capital: |

| Preferred shares: 9 percent, $24 par value, authorized 47,000 shares. |

| Common shares: no par value, authorized 177,000 shares. |

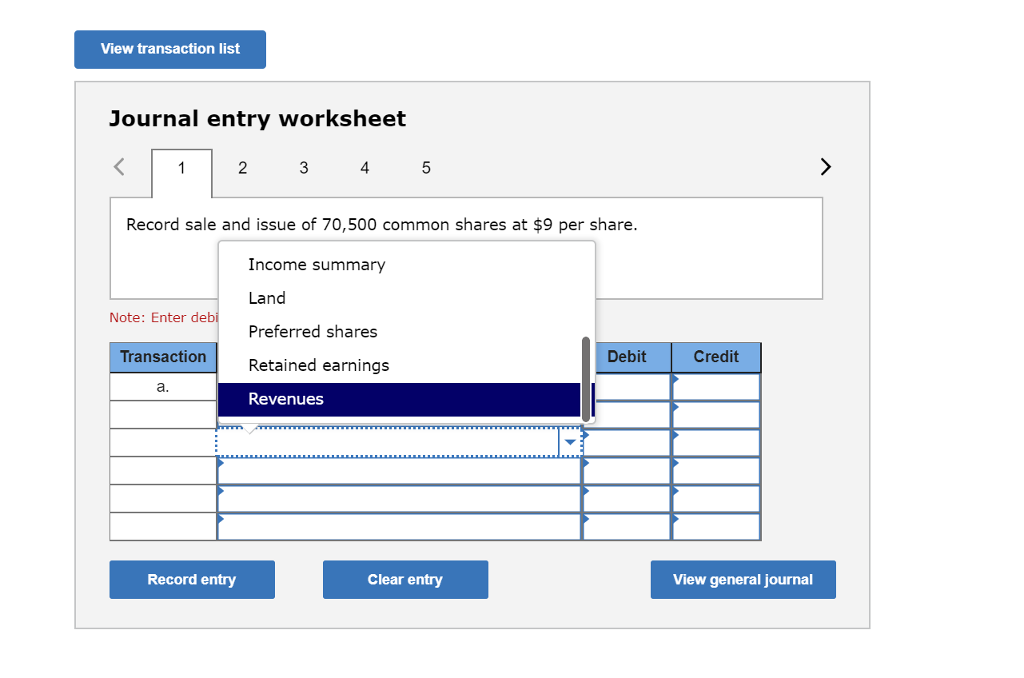

| During 2018, the following transactions occurred in the order given: |

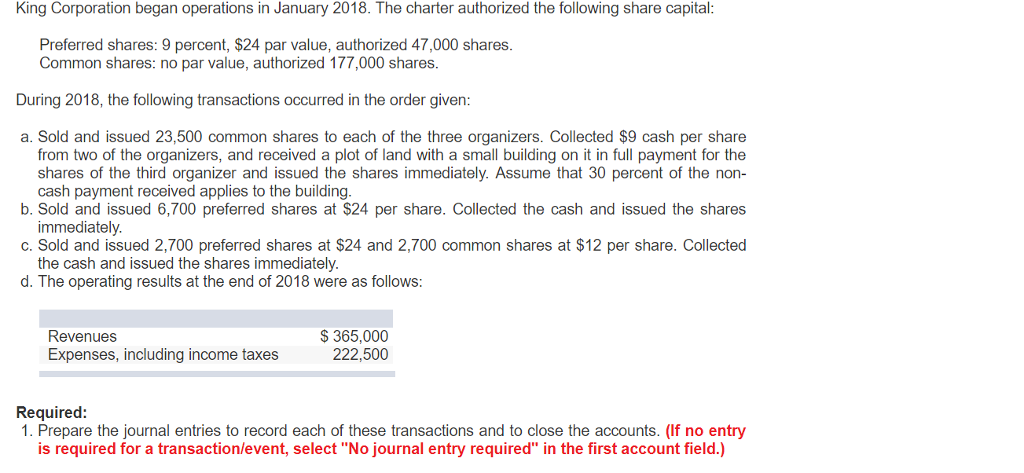

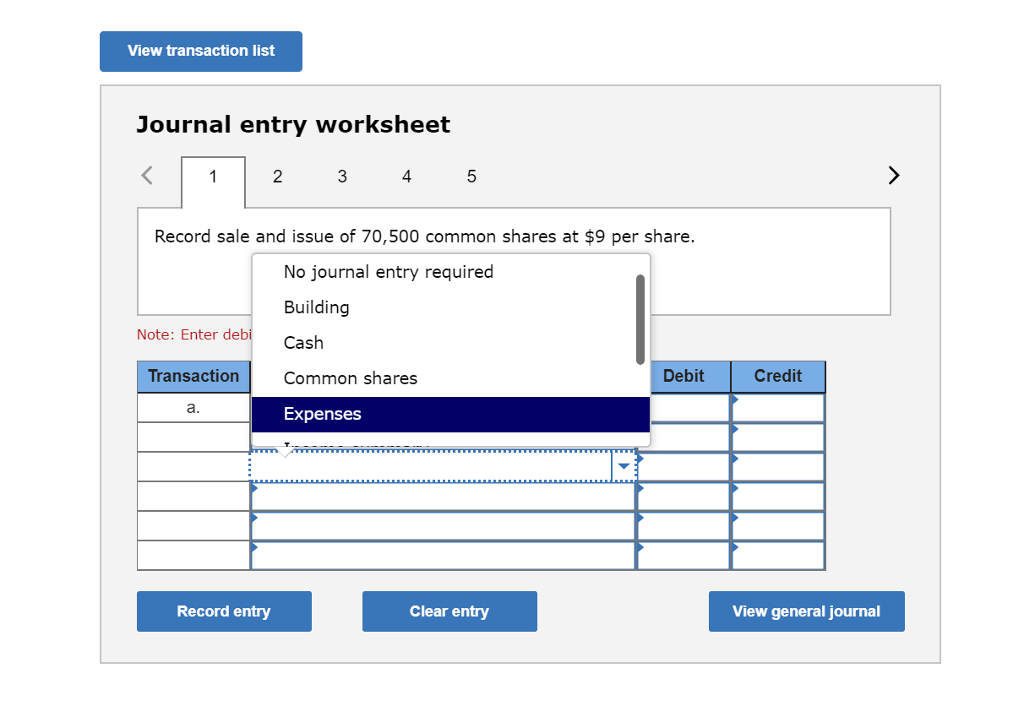

| a. | Sold and issued 23,500 common shares to each of the three organizers. Collected $9 cash per share from two of the organizers, and received a plot of land with a small building on it in full payment for the shares of the third organizer and issued the shares immediately. Assume that 30 percent of the non-cash payment received applies to the building. |

| b. | Sold and issued 6,700 preferred shares at $24 per share. Collected the cash and issued the shares immediately. |

| c. | Sold and issued 2,700 preferred shares at $24 and 2,700 common shares at $12 per share. Collected the cash and issued the shares immediately. |

| d. | The operating results at the end of 2018 were as follows: |

| Revenues | $ | 365,000 | |

| Expenses, including income taxes | 222,500 | ||

| |||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started