Question

King disposed of the following assets during the tax year 2017/18: 1. On 30 June 2017 King sold a house for 308,000. The house had

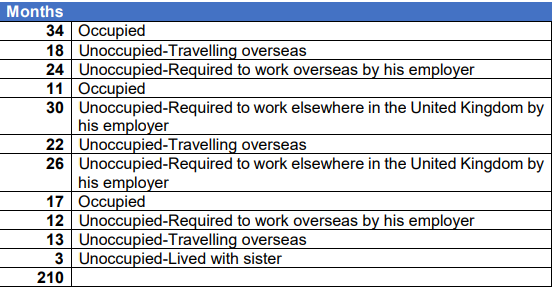

King disposed of the following assets during the tax year 2017/18: 1. On 30 June 2017 King sold a house for 308,000. The house had been purchased on 01 January 2000 for 93,000. On 10 June 2006, King had incurred legal fees of 5,000 in relation to a boundary dispute with his neighbour. Throughout the 210 months of ownership the house had been occupied by King as follows:

King let the house out during all of the periods when he did not occupy it personally. Throughout the period 01 January 2000 to 30 June 2017 King did not have any other main residence.

2. On 30 September 2017 King sold a copyright for 80,300. The copyright had been purchased on 01 October 2015 for 70,000 when it had an unexpired life of 10 years.

3. 0n 6 October 2017 King sold a painting for 5,400. The painting had been purchased on 18 May 2012 for 2,200.

4. On 29 October 2017, King sold a motor car for 10,700. The motor car had been purchased on 21 December 2014 for 14,600.

REQUIRED Calculate Kings taxable gains for the tax year 2017/18

Months 34 Occupied 18 Unoccupied-Travelling 24 Unoccupied-Required 11 Occupied 30 overseas to work overseas by his employer to work elsewhere in the United Kingdom by 22 Unoccupied-Travelling overseas 26 Unoccupied-Required to work elsewhere in the United Kingdom by his employer Unoccupied-Required his employer 17 Occupied 12 Unoccupied-Required to work overseas by his employer 13 Unoccupied-Travelling overseas 3 Unoccupied-Lived with sister 210

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started