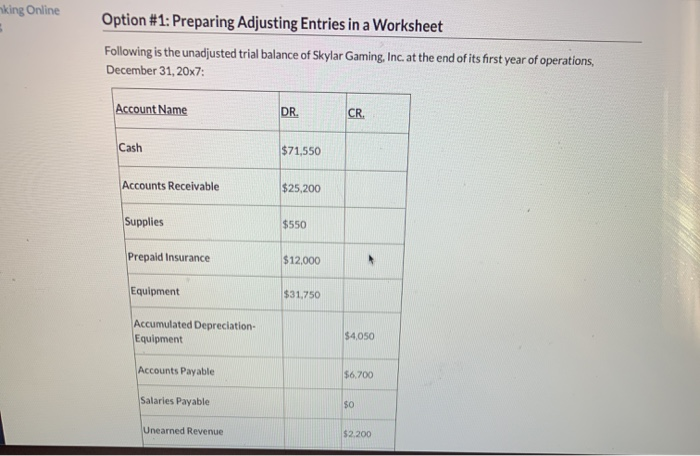

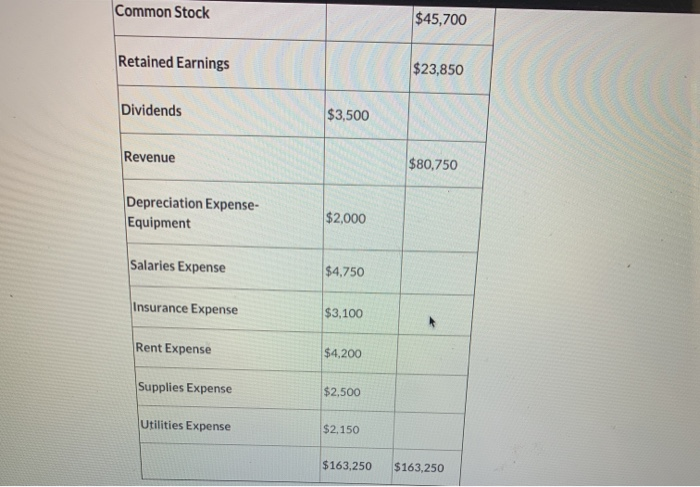

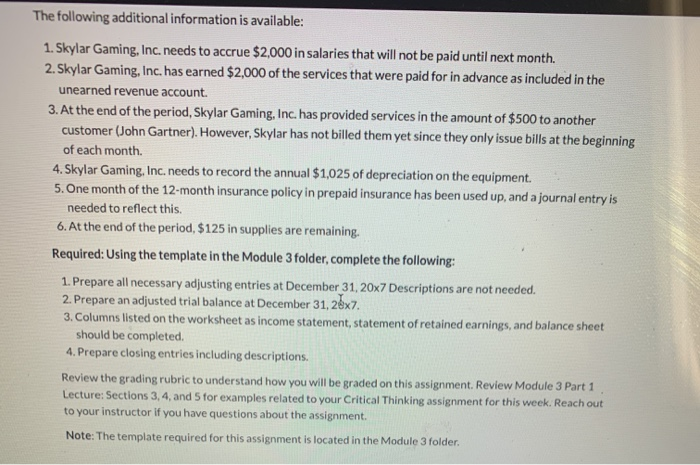

king Online Option #1: Preparing Adjusting Entries in a Worksheet Following is the unadjusted trial balance of Skylar Gaming, Inc. at the end of its first year of operations, December 31, 20x7: Account Name Cash $71,550 Accounts Receivable $25,200 Supplies $550 Prepaid Insurance $12,000 Equipment $31.750 Accumulated Depreciation- Equipment $4.050 Accounts Payable $6.700 Salaries Payable Unearned Revenue $ 2.200 Common Stock $45,700 Retained Earnings $23,850 Dividends $3,500 Revenue $80,750 Depreciation Expense- Equipment $2,000 Salaries Expense $4,750 Insurance Expense $3,100 Rent Expense $4,200 Supplies Expense $2,500 Utilities Expense $2,150 $163,250 $163,250 The following additional information is available: 1. Skylar Gaming, Inc. needs to accrue $2,000 in salaries that will not be paid until next month. 2. Skylar Gaming, Inc. has earned $2,000 of the services that were paid for in advance as included in the unearned revenue account. 3. At the end of the period, Skylar Gaming, Inc. has provided services in the amount of $500 to another customer (John Gartner). However, Skylar has not billed them yet since they only issue bills at the beginning of each month. 4. Skylar Gaming, Inc. needs to record the annual $1,025 of depreciation on the equipment. 5. One month of the 12-month insurance policy in prepaid insurance has been used up, and a journal entry is needed to reflect this. 6. At the end of the period, $125 in supplies are remaining. Required: Using the template in the Module 3 folder, complete the following: 1. Prepare all necessary adjusting entries at December 31, 20x7 Descriptions are not needed. 2. Prepare an adjusted trial balance at December 31, 28x7. 3. Columns listed on the worksheet as income statement, statement of retained earnings, and balance sheet should be completed. 4. Prepare closing entries including descriptions Review the grading rubric to understand how you will be graded on this assignment. Review Module 3 Part 1 Lecture: Sections 3, 4, and 5 for examples related to your Critical Thinking assignment for this week. Reach out to your instructor if you have questions about the assignment. Note: The template required for this assignment is located in the Module 3 folder