Answered step by step

Verified Expert Solution

Question

1 Approved Answer

King Warrior(KW), the Official Waterloo Athletics Mascot, is considering three investment proposals. Each of them is characterized by an initial cost, annual savings over four

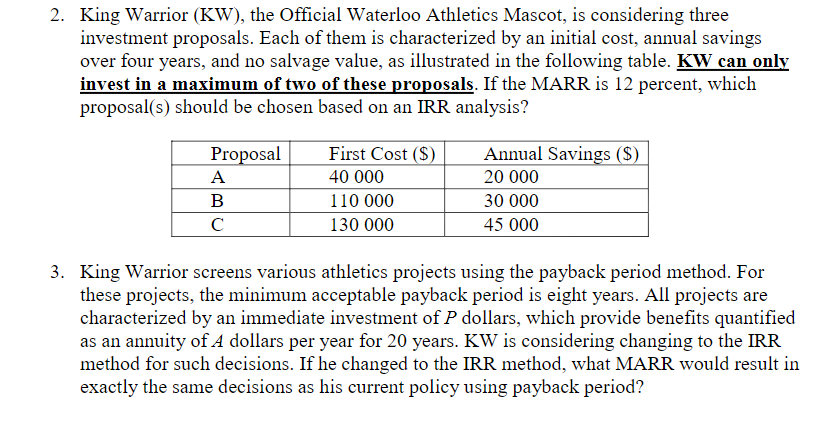

King Warrior(KW), the Official Waterloo Athletics Mascot, is considering three investment proposals. Each of them is characterized by an initial cost, annual savings over four years, and no salvage value, as illustrated in the following table. KW can only invest in amaximum of two of these proposals. If theMARR is 12 percent, which proposal(s)should bechosenbased on an IRR analysis?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started