Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kingbird Stores has been in business for several years, uses a perpetual inventory system, and has its own credit card, called Kingbird Credit. The business

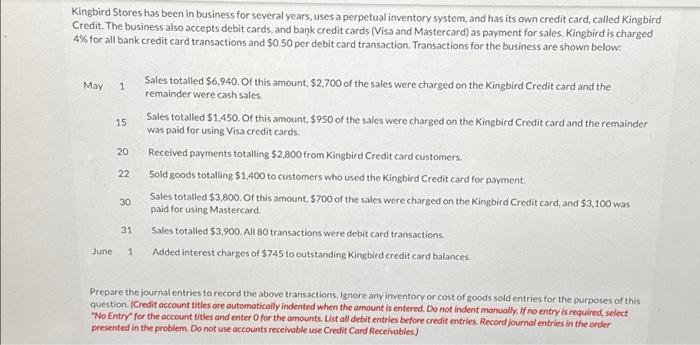

Kingbird Stores has been in business for several years, uses a perpetual inventory system, and has its own credit card, called Kingbird Credit. The business also accepts debit cards, and bank credit cards (Visa and Mastercard) as payment for sales. Kingbird is charged 4% for all bank credit card transactions and $0.50 per debit card transaction. Transactions for the business are shown below: May 1 June 15 20 22 30 31 1 Sales totalled $6,940. Of this amount, $2,700 of the sales were charged on the Kingbird Credit card and the remainder were cash sales. Sales totalled $1,450. Of this amount, $950 of the sales were charged on the Kingbird Credit card and the remainder was paid for using Visa credit cards. Received payments totalling $2,800 from Kingbird Credit card customers. Sold goods totalling $1,400 to customers who used the Kingbird Credit card for payment. Sales totalled $3,800. Of this amount, $700 of the sales were charged on the Kingbird Credit card, and $3,100 was paid for using Mastercard. Sales totalled $3,900. All 80 transactions were debit card transactions. Added interest charges of $745 to outstanding Kingbird credit card balances. Prepare the journal entries to record the above transactions. Ignore any inventory or cost of goods sold entries for the purposes of this question. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem. Do not use accounts receivable use Credit Card Receivables.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started