Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kingston Kiteboards Incorporated ( KKI ) has been experiencing very strong demand for its products as kite - boarding continues to take away market share

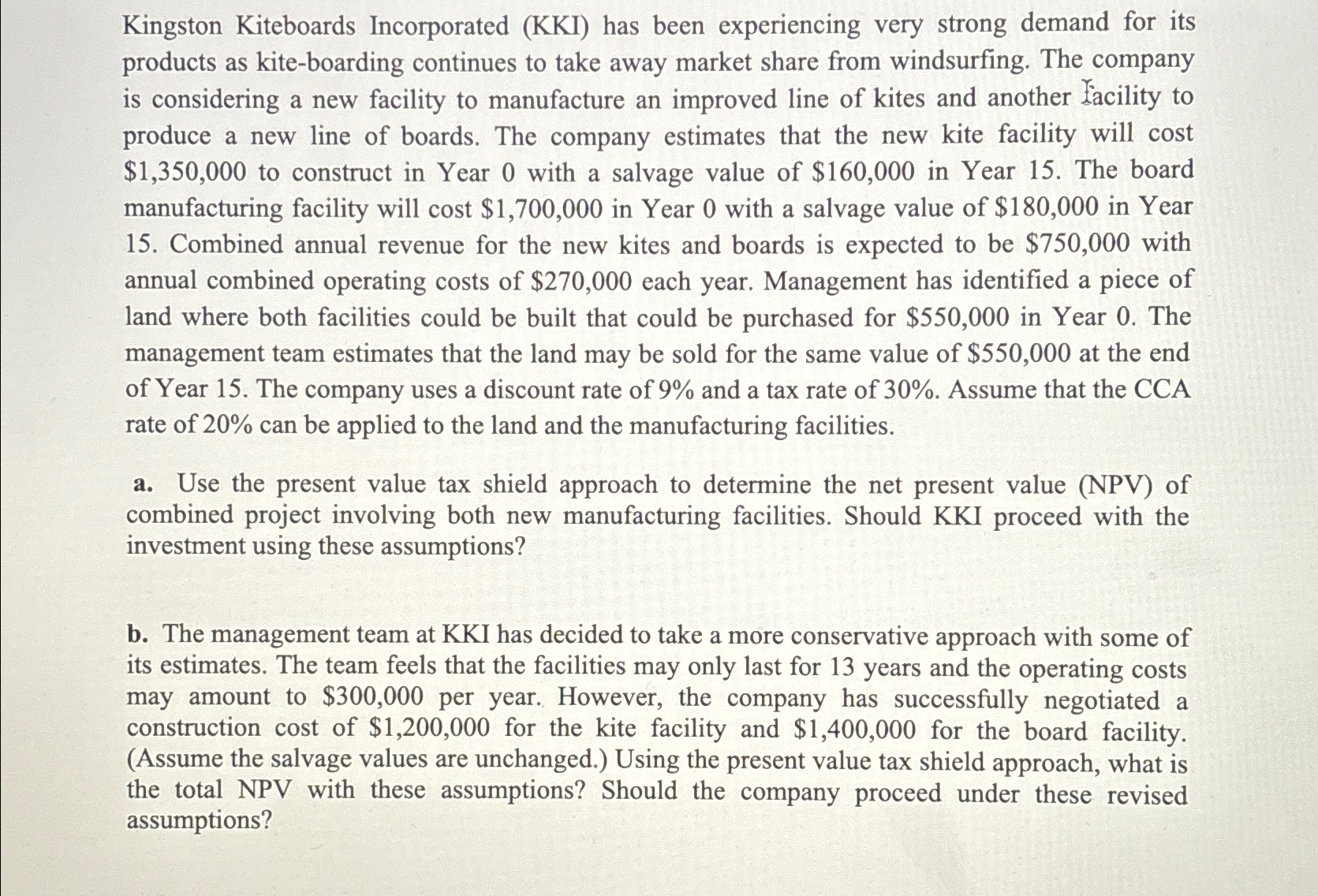

Kingston Kiteboards Incorporated KKI has been experiencing very strong demand for its products as kiteboarding continues to take away market share from windsurfing. The company is considering a new facility to manufacture an improved line of kites and another acility to produce a new line of boards. The company estimates that the new kite facility will cost $ to construct in Year with a salvage value of $ in Year The board manufacturing facility will cost $ in Year with a salvage value of $ in Year Combined annual revenue for the new kites and boards is expected to be $ with annual combined operating costs of $ each year. Management has identified a piece of land where both facilities could be built that could be purchased for $ in Year The management team estimates that the land may be sold for the same value of $ at the end of Year The company uses a discount rate of and a tax rate of Assume that the CCA rate of can be applied to the land and the manufacturing facilities.

a Use the present value tax shield approach to determine the net present value NPV of combined project involving both new manufacturing facilities. Should KKI proceed with the investment using these assumptions?

b The management team at KKI has decided to take a more conservative approach with some of its estimates. The team feels that the facilities may only last for years and the operating costs may amount to $ per year. However, the company has successfully negotiated a construction cost of $ for the kite facility and $ for the board facility. Assume the salvage values are unchanged. Using the present value tax shield approach, what is the total NPV with these assumptions? Should the company proceed under these revised assumptions?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started