Answered step by step

Verified Expert Solution

Question

1 Approved Answer

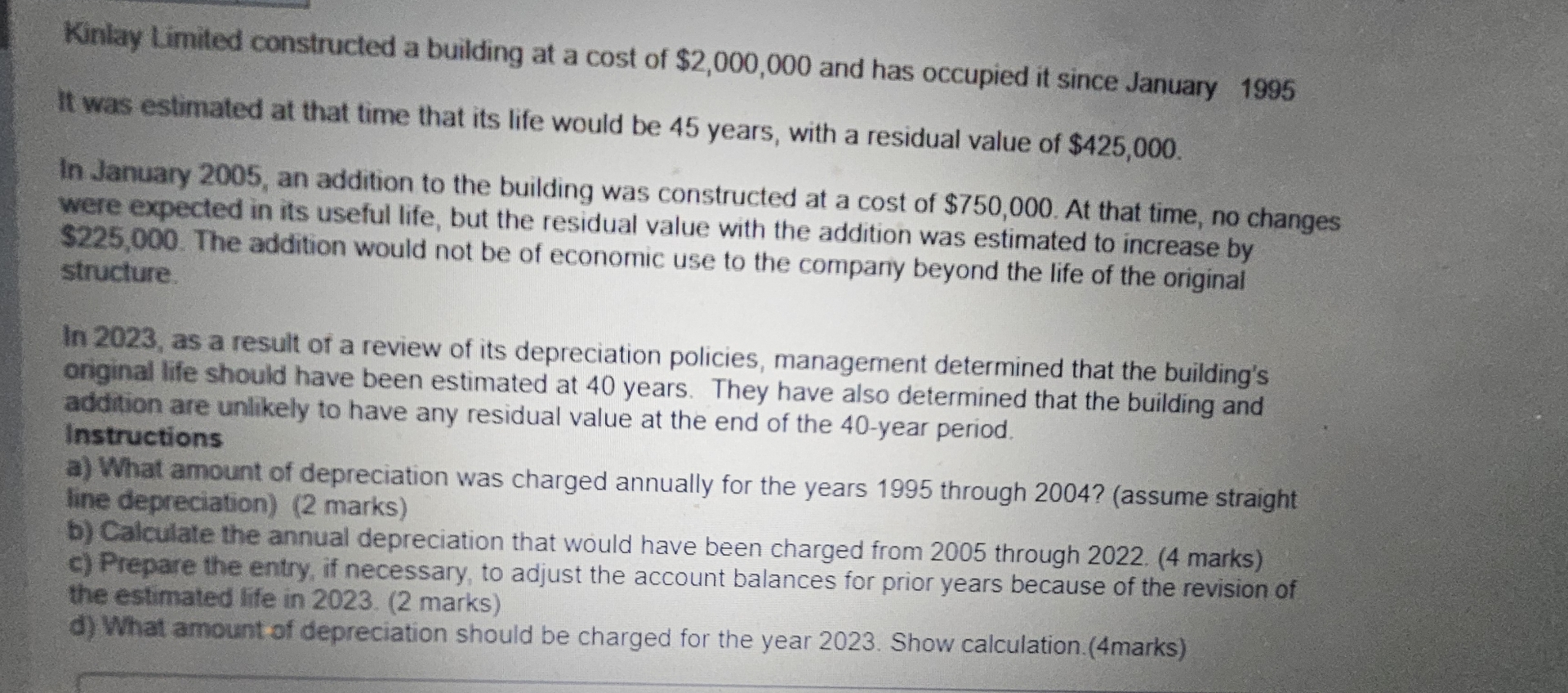

Kinlay Limited constructed a building at a cost of $ 2 , 0 0 0 , 0 0 0 and has occupied it since January

Kinlay Limited constructed a building at a cost of $ and has occupied it since January

It was estimated at that time that its life would be years, with a residual value of $

In January an addition to the building was constructed at a cost of $ At that time, no changes were expected in its useful life, but the residual value with the addition was estimated to increase by $ The addition would not be of economic use to the company beyond the life of the original structure.

In as a result of a review of its depreciation policies, management determined that the building's oniginal life should have been estimated at years. They have also determined that the building and addition are unlikely to have any residual value at the end of the year period.

Instructions

a What amount of depreciation was charged annually for the years through assume straight line depreciation marks

b Calculate the annual depreciation that would have been charged from through marks

c Prepare the entry, if necessary, to adjust the account balances for prior years because of the revision of the estimated life in marks

d What amount of depreciation should be charged for the year Show calculation.marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started