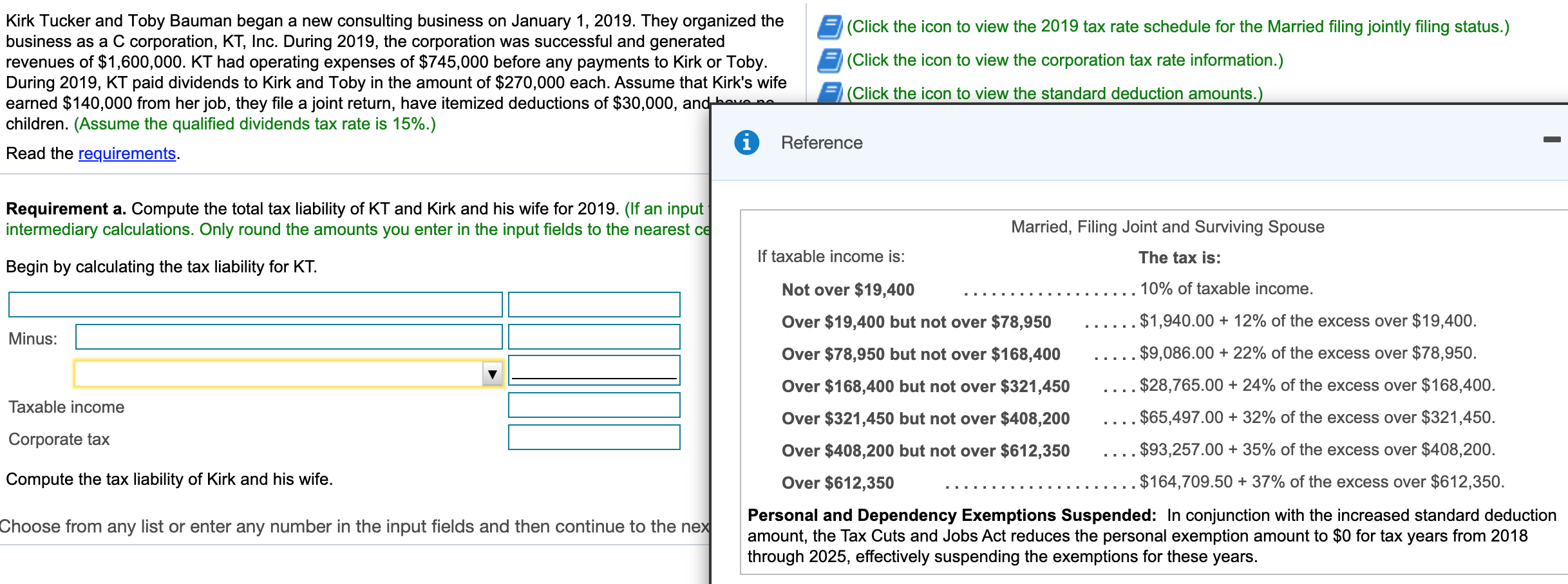

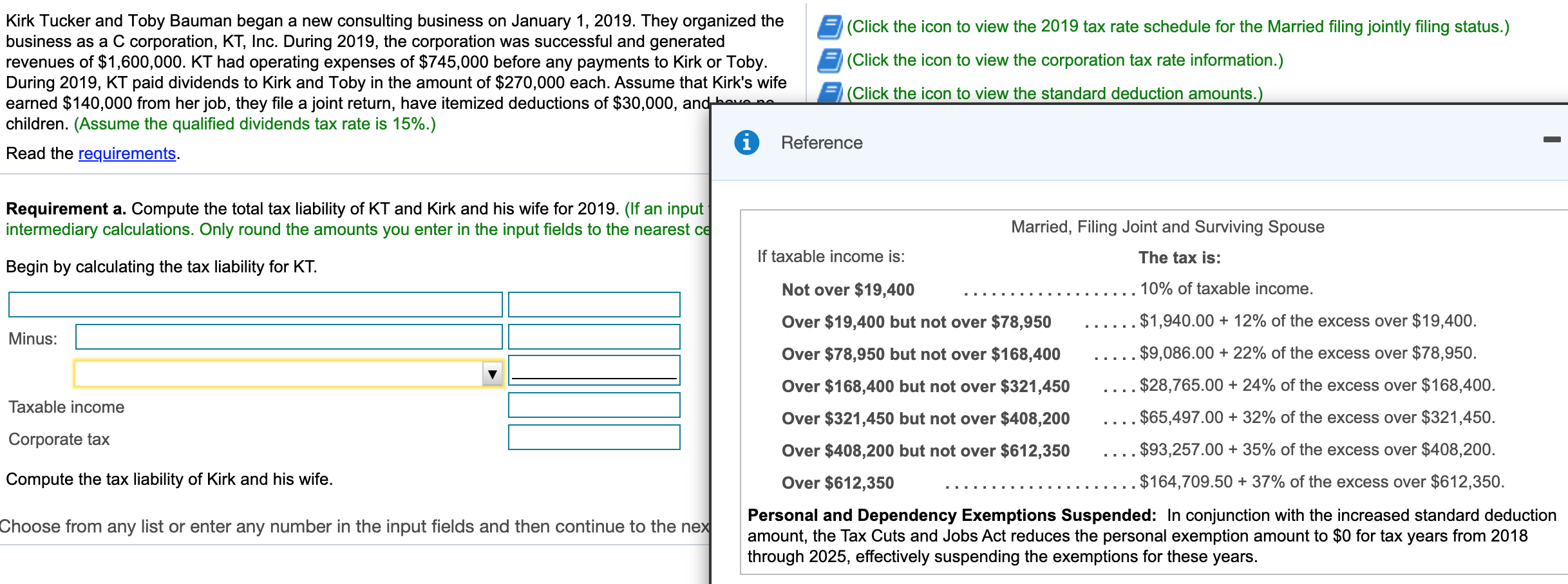

Kirk Tucker and Toby Bauman began a new consulting business on January 1, 2019. They organized the (Click the icon to view the 2019 tax rate schedule for the Married filing jointly filing status.) business as a C corporation, KT, Inc. During 2019, the corporation was successful and generated revenues of $1,600,000. KT had operating expenses of $745,000 before any payments to Kirk or Toby. (Click the icon to view the corporation tax rate information.) During 2019, KT paid dividends to Kirk and Toby in the amount of $270,000 each. Assume that Kirk's wife (Click the icon to view the standard deduction amounts.) earned $140,000 from her job, they file a joint return, have itemized deductions of $30,000, and children. (Assume the qualified dividends tax rate is 15%.) i Reference Read the requirements. Requirement a. Compute the total tax liability of KT and Kirk and his wife for 2019. (If an input intermediary calculations. Only round the amounts you enter in the input fields to the nearest ce Married, Filing Joint and Surviving Spouse If taxable income is: The tax is: Begin by calculating the tax liability for KT. Not over $19,400 10% of taxable income. Minus: $1,940.00 + 12% of the excess over $19,400. $9,086.00 + 22% of the excess over $78,950. Over $19,400 but not over $78,950 Over $78,950 but not over $168,400 Over $168,400 but not over $321,450 Over $321,450 but not over $408,200 Over $408,200 but not over $612,350 Taxable income $28,765.00 + 24% of the excess over $168,400. .$65,497.00 + 32% of the excess over $321,450. Corporate tax . $93,257.00 + 35% of the excess over $408,200. $164,709.50 + 37% of the excess over $612,350. Compute the tax liability of Kirk and his wife. Over $612,350 Choose from any list or enter any number in the input fields and then continue to the nex Personal and Dependency Exemptions Suspended: In conjunction with the increased standard deduction amount, the Tax Cuts and Jobs Act reduces the personal exemption amount to $0 for tax years from 2018 through 2025, effectively suspending the exemptions for these years