Answered step by step

Verified Expert Solution

Question

1 Approved Answer

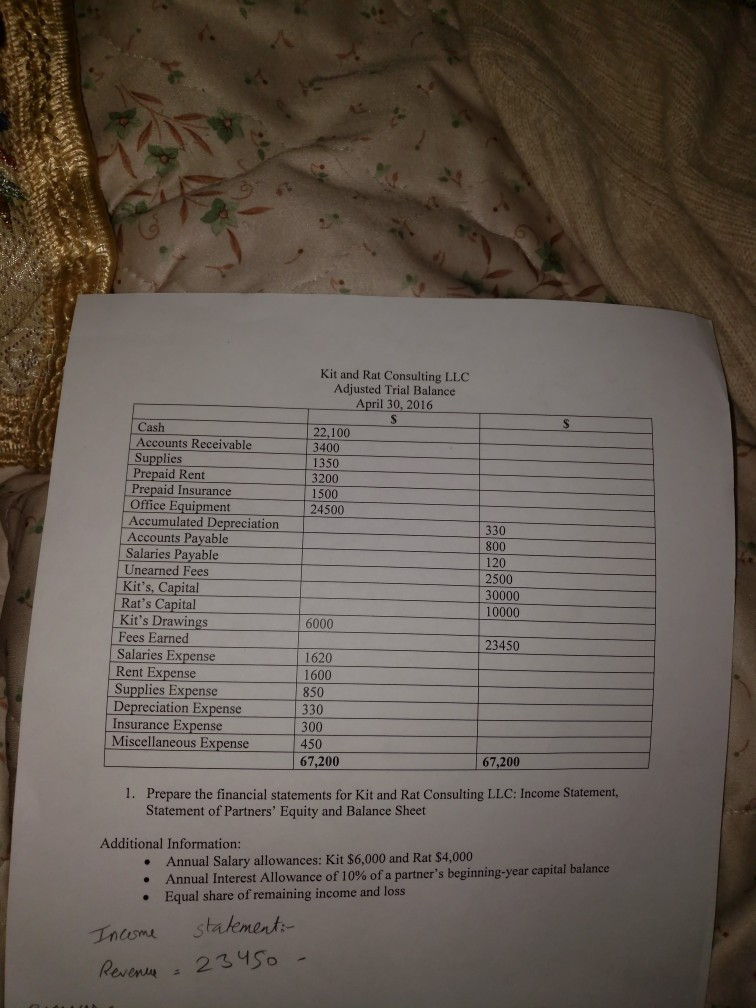

Kit and Rat Consulting LLC Adjusted Trial Balance April 30, 2016 Cash 22,100 3400 1350 3200 1500 24500 Accounts Receivable Supplies Prepaid Rent Prepaid Insurance

Kit and Rat Consulting LLC Adjusted Trial Balance April 30, 2016 Cash 22,100 3400 1350 3200 1500 24500 Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Office Equipment Accumulated Depreciation 330 800 120 2500 30000 10000 Accounts Payable Salaries Payable Unearned Fees Kit's, Capital Rat's Capital Kit's Drawings Fees Earned Salaries Expense Rent Expense Supplies Expense 6000 23450 1620 1600 850 330 300 450 67,200 Depreciation Expense Insurance Expense Miscellaneous Expense 67,200 1. Prepare the financial statements for Kit and Rat Consulting LLC: Income Statement, Statement of Partners' Equity and Balance Sheet Additional Information: Annual Salary allowances: Kit $6,000 and Rat $4,000 Annual Interest Allowance of 10% of a partne Equal share of remaining income and loss r's beginning-year capital balance . e Income statement Reventa 2345o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started