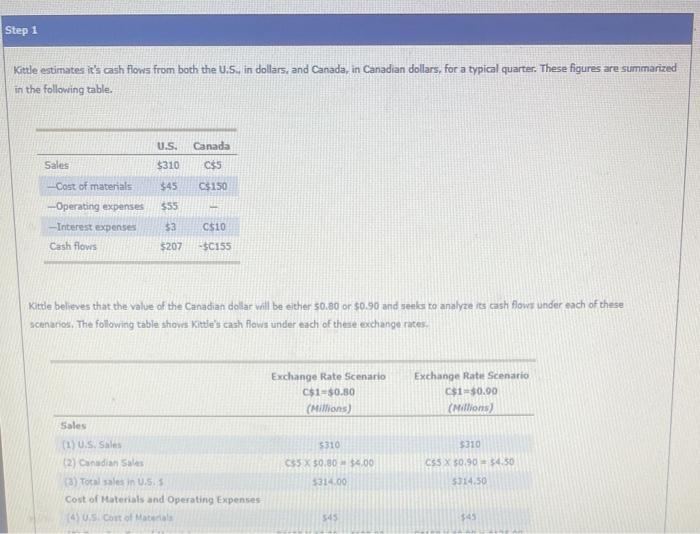

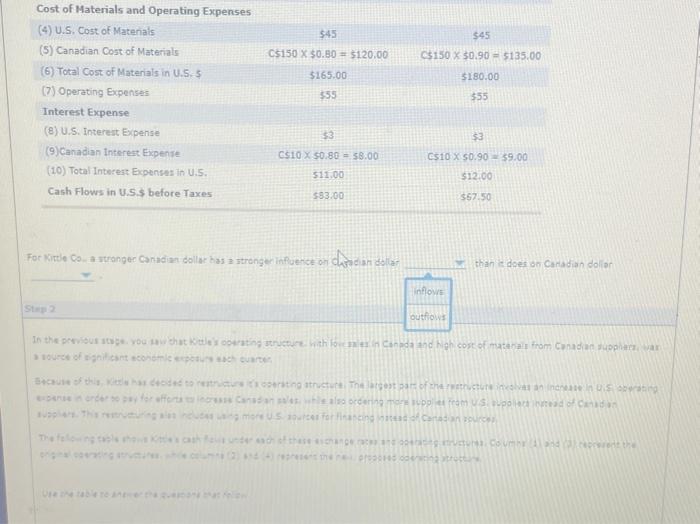

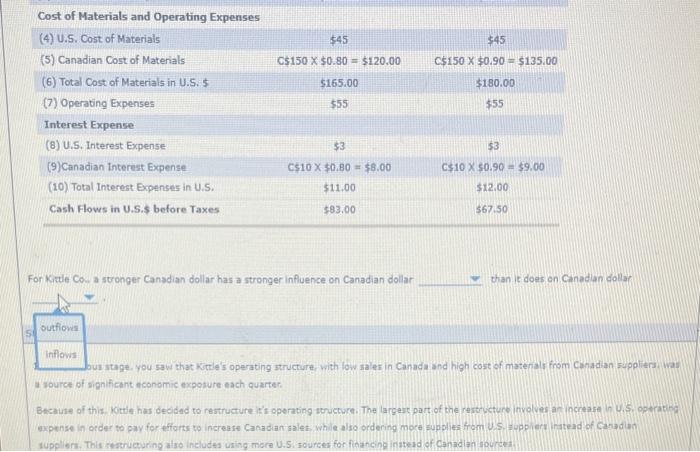

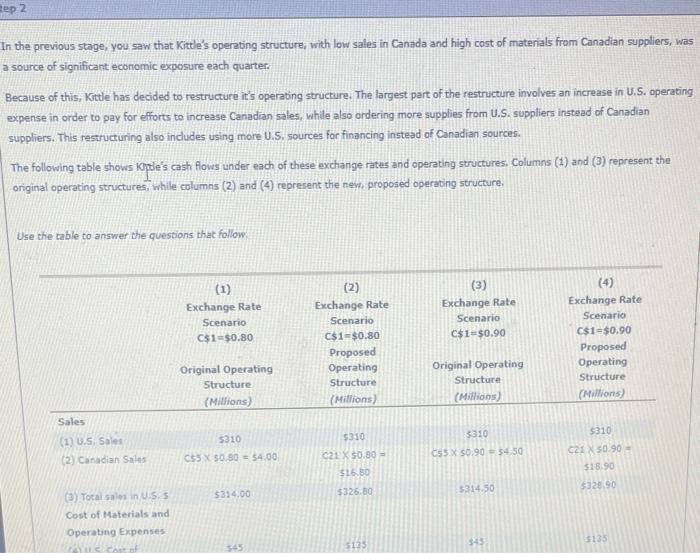

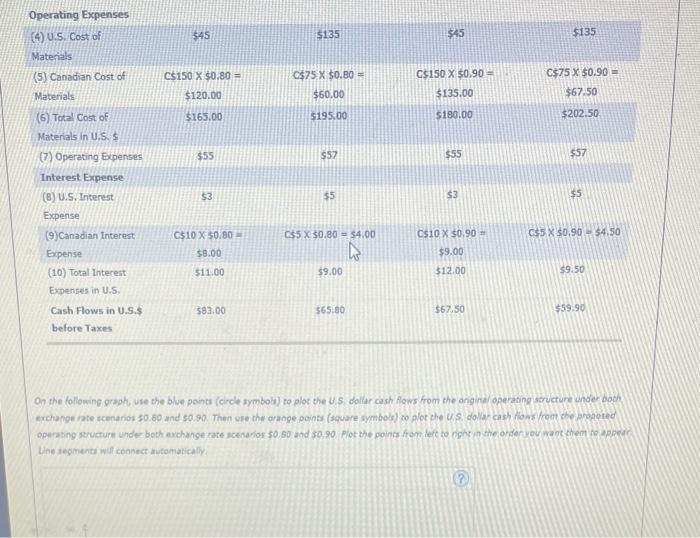

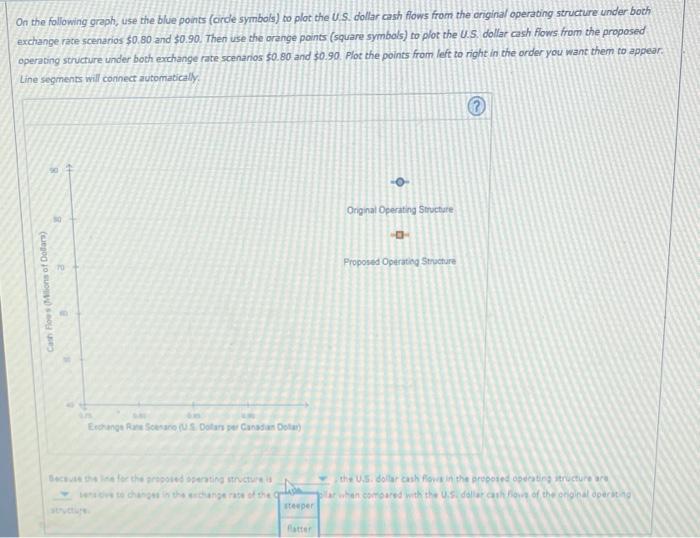

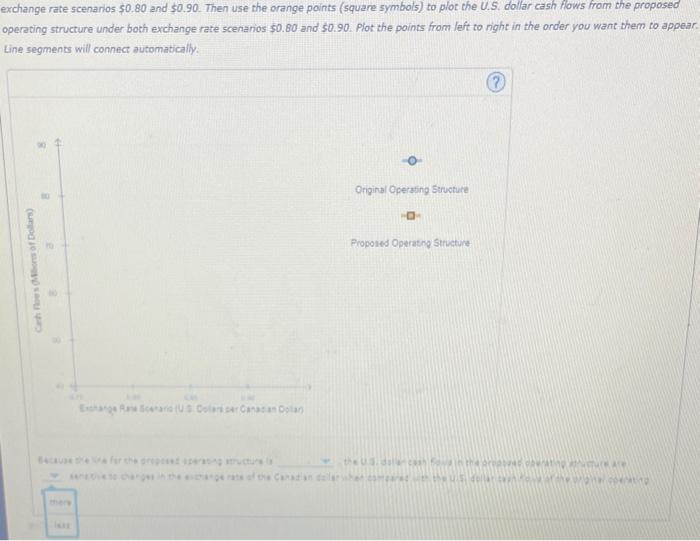

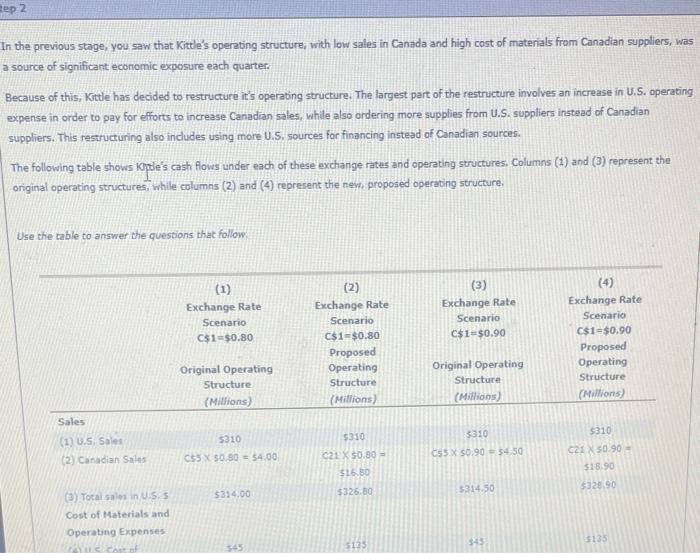

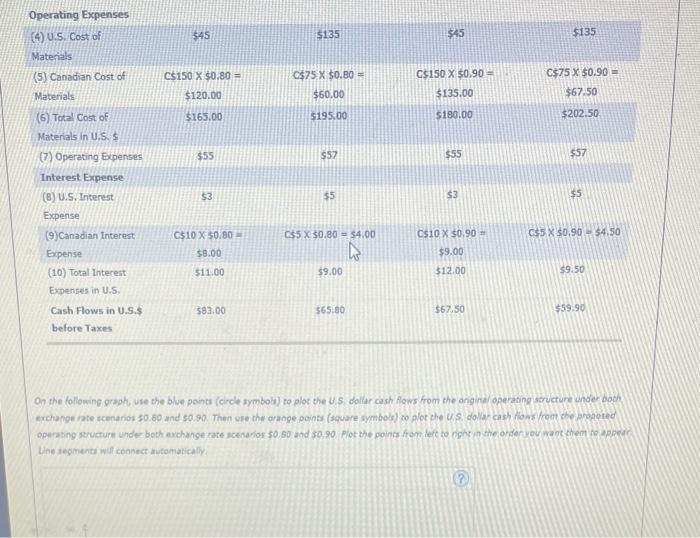

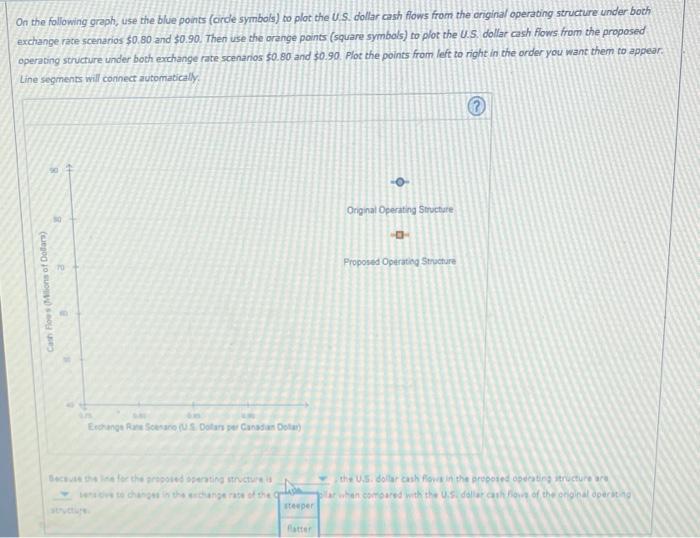

Kitle estimates it's cash flows from both the U.5;, in dollars, and Canada, in Canadian dollars, for a typical quarter. These figures are summarized in the following table. Kittie believes that the value of the Canadian dolar vail be echer 50.90 or 50.90 and seels to analyze its cash flowz under each of these scanarios. The following table shows Kitte's cash flows under each of these exchange rates. than is does on cantadian dolion sts2 For Kixte Cow a suronger Canadian dollar has a stronger influence on Canadian dollar than it does en Cinadian dollar Wa stage, you saw that katte's operating structure, with low saler in Canada and high cost of matenals from Canadian supplierni was a source of significant sconomic expoture each quarter: expense in order to pay for efforts to increase Canadian aalet, whie also ordering more fupples frem us. fopplera inatead of cabadan In the previous stage, you saw that Kittle's operating structure, with low sales in Canada and high cost of materials from Canadian suppliers, was source of significant economic exposure each quarter. Because of this, Kttle has decided to restructure it's operating structure. The largest part of the restructure involves an increase in U.S. operating expense in order to pay for efforts to increase Canadian sales, while also ordering more supplies from U.S. suppliers instead of Canadian suppliers. This restructuring also indudes using more U.S. sourtes for financing instead of Canadian sources. The following table shows Kople's cash flows under each of these exchange rates and operating structures. Columns (1) and (3) represent the original operating structures, while columns (2) and (4) represent the nevi, proposed operating structure. On the following graph, vie the blue ponts (circle symbola) to ploc the U.S. dollar cash flews from the angind operaing suructure under doch operating seructurn unde both exchange rate scenarios $0.50 and 50.90 plot the poing from left to rghten the ovder yevinant chem to asecde Une segments wuff connect automatically. On the following graph, use the blue points (cicle symbols) to plot the US. dollar cash fows from the original operating structure under both exchange rate scenarios $0.80 and $0.90. Then use the orange paints (square symbols) to plot the U.S. dollar cash flows from the proposed operating scructure under both exchange rate scenanios 50.80 and 50.90 . Flor the points from left to right in the order you want them to appear: Line segments will connect automatically: (3) Orginal Operating Structure. a Proposed Operating Stweture Erotunge Rers Soevaco fuS Dotan se Canssan Dolen) ithe U.5. dolar cash fosidin the prepoied opeoting iencture are Wes eve to changu in the encinge rase of the ? exchange rate scenarios $0.80 and $0.90. Then use the orange points (square symbols) to plot the U.S. dollar cash flows from the proposed operating structure under both exchange rate scenarios $0.80 and 50.90 . Plot the points from left to right in the order you want them to appear. Line segments will connect automatically. Kitle estimates it's cash flows from both the U.5;, in dollars, and Canada, in Canadian dollars, for a typical quarter. These figures are summarized in the following table. Kittie believes that the value of the Canadian dolar vail be echer 50.90 or 50.90 and seels to analyze its cash flowz under each of these scanarios. The following table shows Kitte's cash flows under each of these exchange rates. than is does on cantadian dolion sts2 For Kixte Cow a suronger Canadian dollar has a stronger influence on Canadian dollar than it does en Cinadian dollar Wa stage, you saw that katte's operating structure, with low saler in Canada and high cost of matenals from Canadian supplierni was a source of significant sconomic expoture each quarter: expense in order to pay for efforts to increase Canadian aalet, whie also ordering more fupples frem us. fopplera inatead of cabadan In the previous stage, you saw that Kittle's operating structure, with low sales in Canada and high cost of materials from Canadian suppliers, was source of significant economic exposure each quarter. Because of this, Kttle has decided to restructure it's operating structure. The largest part of the restructure involves an increase in U.S. operating expense in order to pay for efforts to increase Canadian sales, while also ordering more supplies from U.S. suppliers instead of Canadian suppliers. This restructuring also indudes using more U.S. sourtes for financing instead of Canadian sources. The following table shows Kople's cash flows under each of these exchange rates and operating structures. Columns (1) and (3) represent the original operating structures, while columns (2) and (4) represent the nevi, proposed operating structure. On the following graph, vie the blue ponts (circle symbola) to ploc the U.S. dollar cash flews from the angind operaing suructure under doch operating seructurn unde both exchange rate scenarios $0.50 and 50.90 plot the poing from left to rghten the ovder yevinant chem to asecde Une segments wuff connect automatically. On the following graph, use the blue points (cicle symbols) to plot the US. dollar cash fows from the original operating structure under both exchange rate scenarios $0.80 and $0.90. Then use the orange paints (square symbols) to plot the U.S. dollar cash flows from the proposed operating scructure under both exchange rate scenanios 50.80 and 50.90 . Flor the points from left to right in the order you want them to appear: Line segments will connect automatically: (3) Orginal Operating Structure. a Proposed Operating Stweture Erotunge Rers Soevaco fuS Dotan se Canssan Dolen) ithe U.5. dolar cash fosidin the prepoied opeoting iencture are Wes eve to changu in the encinge rase of the ? exchange rate scenarios $0.80 and $0.90. Then use the orange points (square symbols) to plot the U.S. dollar cash flows from the proposed operating structure under both exchange rate scenarios $0.80 and 50.90 . Plot the points from left to right in the order you want them to appear. Line segments will connect automatically