Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kitten Company commenced operations early in 2018. During its first 9 months, Kitten acquired real estate for the construction of a building and other

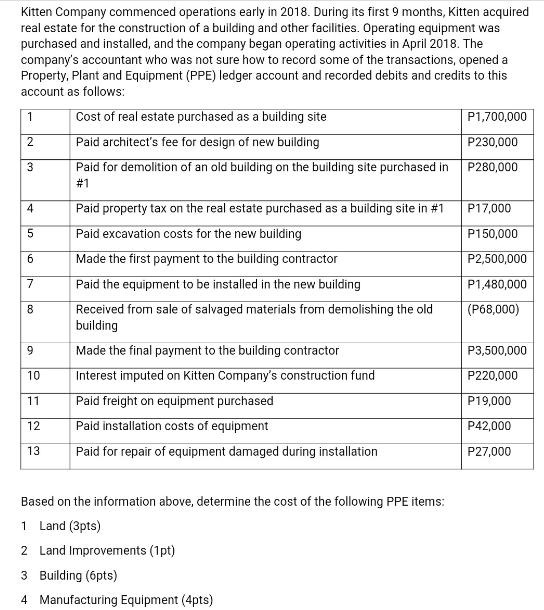

Kitten Company commenced operations early in 2018. During its first 9 months, Kitten acquired real estate for the construction of a building and other facilities. Operating equipment was purchased and installed, and the company began operating activities in April 2018. The company's accountant who was not sure how to record some of the transactions, opened a Property, Plant and Equipment (PPE) ledger account and recorded debits and credits to this account as follows: 1 2 3 4 6 7 8 9 10 11 12 13 Cost of real estate purchased as a building site Paid architect's fee for design of new building Paid for demolition of an old building on the building site purchased in #1 Paid property tax on the real estate purchased as a building site in #1 Paid excavation costs for the new building Made the first payment to the building contractor Paid the equipment to be installed in the new building Received from sale of salvaged materials from demolishing the old building Made the final payment to the building contractor Interest imputed on Kitten Company's construction fund Paid freight on equipment purchased Paid installation costs of equipment Paid for repair of equipment damaged during installation Based on the information above, determine the cost of the following PPE items: 1 Land (3pts) 2 Land Improvements (1 pt) 3 Building (6pts) 4 Manufacturing Equipment (4pts) P1,700,000 P230,000 P280,000 P17,000 P150,000 P2,500,000 P1,480,000 (P68,000) P3,500,000 P220,000 P19,000 P42,000 P27,000

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The cost of the PPE items are as follows Land P1700000 3 points Land Improvemen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started