Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. Kiwi Corp. has future payables of NZD 3,000,000 (NZD: New Zealand dollar) in one year and wants to BUY NZDUSD currency options to

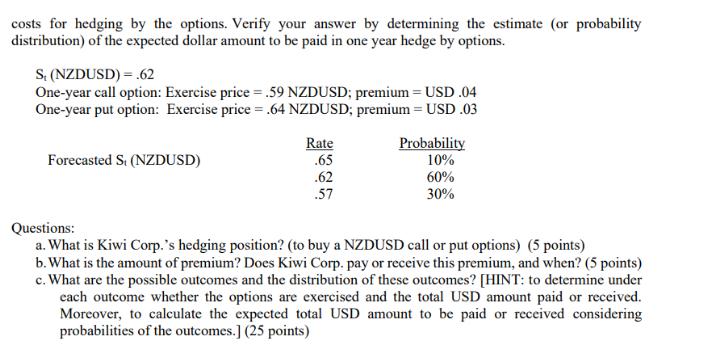

. Kiwi Corp. has future payables of NZD 3,000,000 (NZD: New Zealand dollar) in one year and wants to BUY NZDUSD currency options to hedge this position. Use any of the following information to make the decision. Assume that there are no opportunity costs for hedging by the options. Verify your answer by determining the estimate (or probability distribution) of the expected dollar amount to be paid in one year hedge by options. S. (NZDUSD) = .62 One-year call option: Exercise price= .59 NZDUSD; premium = USD.04 One-year put option: Exercise price= .64 NZDUSD; premium = USD .03 Forecasted S. (NZDUSD) Rate .65 .62 .57 Probability 10% 60% 30% Questions: a. What is Kiwi Corp.'s hedging position? (to buy a NZDUSD call or put options) (5 points) b. What is the amount of premium? Does Kiwi Corp. pay or receive this premium, and when? (5 points) c. What are the possible outcomes and the distribution of these outcomes? [HINT: to determine under each outcome whether the options are exercised and the total USD amount paid or received. Moreover, to calculate the expected total USD amount to be paid or received considering probabilities of the outcomes.] (25 points)

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a What is Kiwi Corps hedging position to buy a NZDUSD call or put options Kiwi Corp should ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started