Answered step by step

Verified Expert Solution

Question

1 Approved Answer

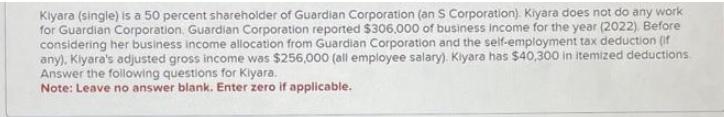

Kiyara (single) is a 50 percent shareholder of Guardian Corporation (an S Corporation). Kiyara does not do any work for Guardian Corporation, Guardian Corporation

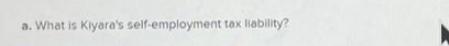

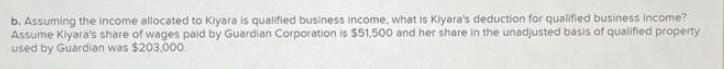

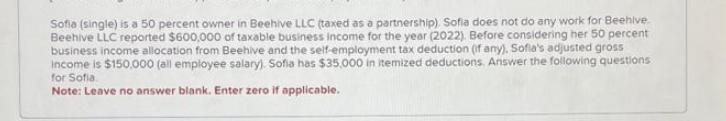

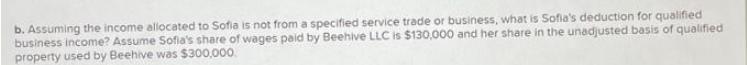

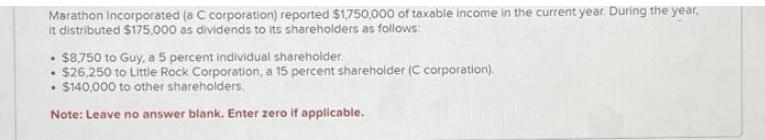

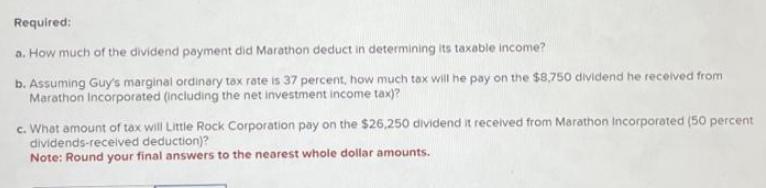

Kiyara (single) is a 50 percent shareholder of Guardian Corporation (an S Corporation). Kiyara does not do any work for Guardian Corporation, Guardian Corporation reported $306,000 of business income for the year (2022) Before considering her business income allocation from Guardian Corporation and the self-employment tax deduction (if any), Kiyara's adjusted gross income was $256,000 (all employee salary). Kiyara has $40,300 in itemized deductions Answer the following questions for Kiyara. Note: Leave no answer blank. Enter zero if applicable. a. What is Kiyara's self-employment tax liability? b. Assuming the income allocated to Kiyara is qualified business income, what is Kiyara's deduction for qualified business income? Assume Kiyara's share of wages paid by Guardian Corporation is $51,500 and her share in the unadjusted basis of qualified property used by Guardian was $203,000 Sofia (single) is a 50 percent owner in Beehive LLC (taxed as a partnership). Sofia does not do any work for Beehive Beehive LLC reported $600,000 of taxable business income for the year (2022). Before considering her 50 percent business income allocation from Beehive and the self-employment tax deduction (if any), Sofia's adjusted gross Income is $150,000 (all employee salary) Sofia has $35,000 in itemized deductions. Answer the following questions for Sofia Note: Leave no answer blank. Enter zero if applicable. a. What is Sofia's self-employment tax liability? b. Assuming the income allocated to Sofia is not from a specified service trade or business, what is Sofia's deduction for qualified business income? Assume Sofia's share of wages paid by Beehive LLC is $130,000 and her share in the unadjusted basis of qualified property used by Beehive was $300,000 Marathon Incorporated (a C corporation) reported $1,750,000 of taxable income in the current year. During the year. it distributed $175,000 as dividends to its shareholders as follows: $8,750 to Guy, a 5 percent individual shareholder. $26,250 to Little Rock Corporation, a 15 percent shareholder (C corporation). $140,000 to other shareholders. Note: Leave no answer blank. Enter zero if applicable. . . . Required: a. How much of the dividend payment did Marathon deduct in determining its taxable income? b. Assuming Guy's marginal ordinary tax rate is 37 percent, how much tax will he pay on the $8,750 dividend he received from Marathon Incorporated (including the net investment income tax)? c. What amount of tax will Little Rock Corporation pay on the $26,250 dividend it received from Marathon Incorporated (50 percent dividends-received deduction)? Note: Round your final answers to the nearest whole dollar amounts.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a The dividend payment of 8750 is considered longterm capital gain for Guy since he held the stock f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started