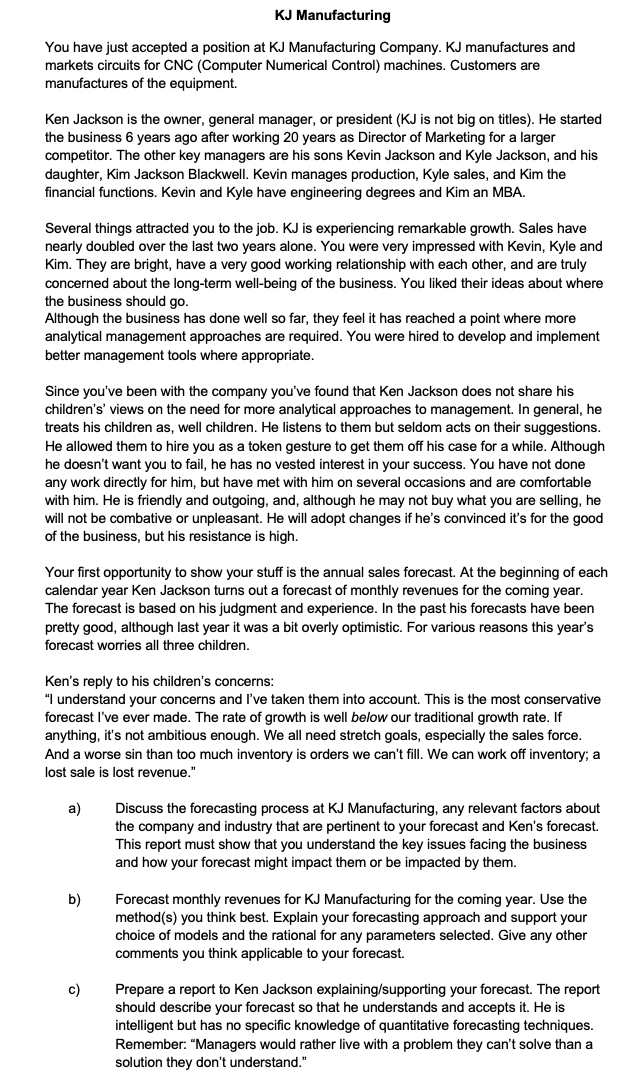

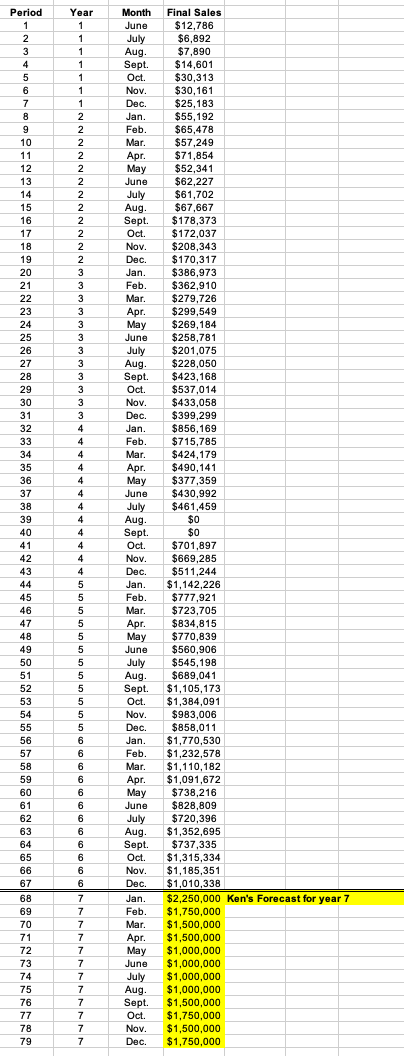

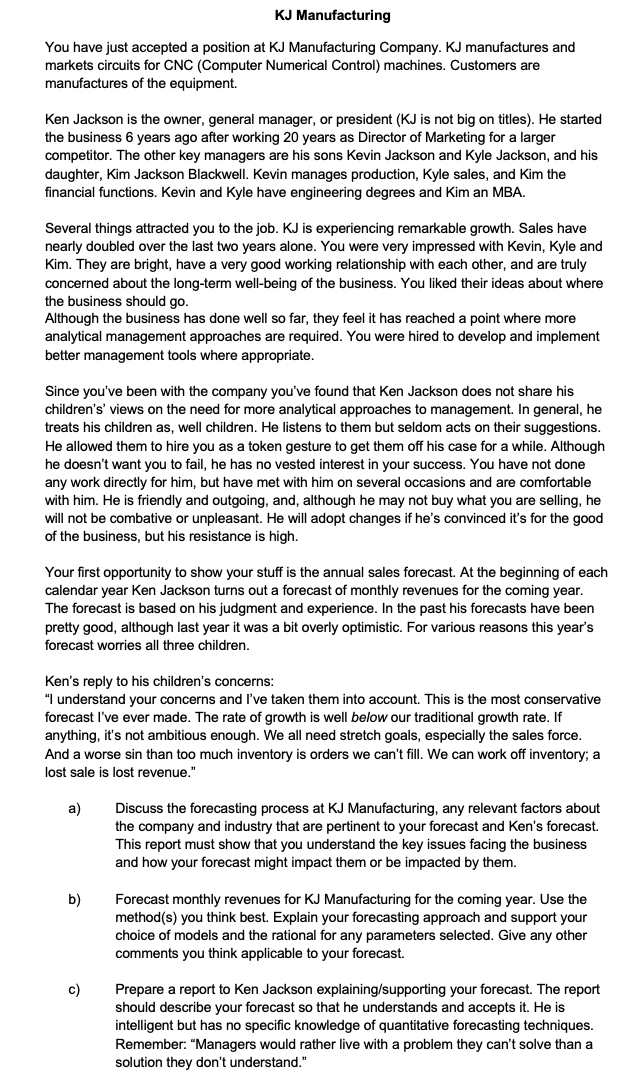

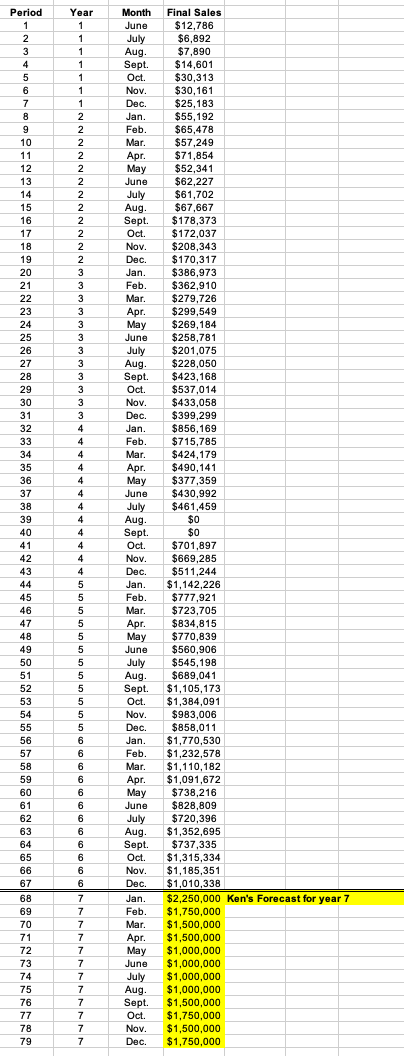

KJ Manufacturing You have just accepted a position at KJ Manufacturing Company. KJ manufactures and markets circuits for CNC (Computer Numerical Control) machines. Customers are manufactures of the equipment. Ken Jackson is the owner, general manager, or president (KJ is not big on titles). He started the business 6 years ago after working 20 years as Director of Marketing for a larger competitor. The other key managers are his sons Kevin Jackson and Kyle Jackson, and his daughter, Kim Jackson Blackwell. Kevin manages production, Kyle sales, and Kim the financial functions. Kevin and Kyle have engineering degrees and Kim an MBA. Several things attracted you to the job. KJ is experiencing remarkable growth. Sales have nearly doubled over the last two years alone. You were very impressed with Kevin, Kyle and Kim. They are bright, have a very good working relationship with each other, and are truly concerned about the long-term well-being of the business. You liked their ideas about where the business should go. Although the business has done well so far, they feel it has reached a point where more analytical management approaches are required. You were hired to develop and implement better management tools where appropriate. Since you've been with the company you've found that Ken Jackson does not share his children's' views on the need for more analytical approaches to management. In general, he treats his children as, well children. He listens to them but seldom acts on their suggestions. He allowed them to hire you as a token gesture to get them off his case for a while. Although he doesn't want you to fail, he has no vested interest in your success. You have not done any work directly for him, but have met with him on several occasions and are comfortable with him. He is friendly and outgoing, and, although he may not buy what you are selling, he will not be combative or unpleasant. He will adopt changes if he's convinced it's for the good of the business, but his resistance is high. Your first opportunity to show your stuff is the annual sales forecast. At the beginning of each calendar year Ken Jackson turns out a forecast of monthly revenues for the coming year. The forecast is based on his judgment and experience. In the past his forecasts have been pretty good, although last year it was a bit overly optimistic. For various reasons this year's forecast worries all three children. Ken's reply to his children's concerns: "I understand your concerns and I've taken them into account. This is the most conservative forecast I've ever made. The rate of growth is well below our traditional growth rate. If anything, it's not ambitious enough. We all need stretch goals, especially the sales force. And a worse sin than too much inventory is orders we can't fill. We can work off inventory; a lost sale is lost revenue." a) Discuss the forecasting process at KJ Manufacturing, any relevant factors about the company and industry that are pertinent to your forecast and Ken's forecast. This report must show that you understand the key issues facing the business and how your forecast might impact them or be impacted by them. b) Forecast monthly revenues for KJ Manufacturing for the coming year. Use the method(s) you think best. Explain your forecasting approach and support your choice of models and the rational for any parameters selected. Give any other comments you think applicable to your forecast. c) Prepare a report to Ken Jackson explaining/supporting your forecast. The report should describe your forecast so that he understands and accepts it. He is intelligent but has no specific knowledge of quantitative forecasting techniques. Remember: "Managers would rather live with a problem they can't solve than a solution they don't understand." Period 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 Year 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 Month June July Aug. Sept. Oct Nov. Dec. Jan. Feb Mar Apr. May June July Aug. Sept. Oct. , Dec. Jan. Feb Mar Apr. May June July Aug. Sept. Oct. Nov. Dec. Jan. Feb. Mar. Apr. May June July Aug. Sept. Oct Nov. Dec. Jan. Feb. Mar. Apr. May June July Aug. Sept. Oct. Nov. Dec. Jan. Feb. Mar. Apr. May June July Aug. Sept. Oct. Nov. Dec. Jan. Feb Mar. Apr. May June July Aug. Sept. Oct. Nov. Dec. Final Sales $12,786 $6,892 $7,890 $14,601 $30,313 $30, 161 $25,183 $55,192 $ $65,478 $57,249 $71.854 $52,341 $62,227 $61,702 $67,667 $178,373 $172,037 $208,343 $170,317 $386,973 $362,910 $279,726 $299,549 $269,184 $258,781 $ 201,075 $228,050 $423,168 $537,014 $433,058 $399,299 $856,169 $715,785 $424,179 $490,141 $377,359 $430,992 $461,459 $ $0 $0 $701,897 $669,285 $511,244 $1,142,226 $777,921 $ $723,705 $834,815 $770,839 $560,906 $545,198 $689,041 $1,105,173 $1,384,091 $983,006 $858,011 $1,770,530 $1,232,578 $1,110,182 $1,091,672 $738,216 $828,809 $720,396 $1,352,695 $737,335 $1,315,334 $1,185,351 $1,010,338 $2,250,000 Ken's Forecast for year 7 $1,750,000 $1,500,000 $1,500,000 $1,000,000 $1,000,000 $1,000,000 $1,000,000 $1,500,000 $1,750,000 $1,500,000 $1,750,000 6 6 6 6 68 69 70 71 72 73 74 75 76 77 78 79 7 7 7 7 7 7 7 7 7 7 7 7 KJ Manufacturing You have just accepted a position at KJ Manufacturing Company. KJ manufactures and markets circuits for CNC (Computer Numerical Control) machines. Customers are manufactures of the equipment. Ken Jackson is the owner, general manager, or president (KJ is not big on titles). He started the business 6 years ago after working 20 years as Director of Marketing for a larger competitor. The other key managers are his sons Kevin Jackson and Kyle Jackson, and his daughter, Kim Jackson Blackwell. Kevin manages production, Kyle sales, and Kim the financial functions. Kevin and Kyle have engineering degrees and Kim an MBA. Several things attracted you to the job. KJ is experiencing remarkable growth. Sales have nearly doubled over the last two years alone. You were very impressed with Kevin, Kyle and Kim. They are bright, have a very good working relationship with each other, and are truly concerned about the long-term well-being of the business. You liked their ideas about where the business should go. Although the business has done well so far, they feel it has reached a point where more analytical management approaches are required. You were hired to develop and implement better management tools where appropriate. Since you've been with the company you've found that Ken Jackson does not share his children's' views on the need for more analytical approaches to management. In general, he treats his children as, well children. He listens to them but seldom acts on their suggestions. He allowed them to hire you as a token gesture to get them off his case for a while. Although he doesn't want you to fail, he has no vested interest in your success. You have not done any work directly for him, but have met with him on several occasions and are comfortable with him. He is friendly and outgoing, and, although he may not buy what you are selling, he will not be combative or unpleasant. He will adopt changes if he's convinced it's for the good of the business, but his resistance is high. Your first opportunity to show your stuff is the annual sales forecast. At the beginning of each calendar year Ken Jackson turns out a forecast of monthly revenues for the coming year. The forecast is based on his judgment and experience. In the past his forecasts have been pretty good, although last year it was a bit overly optimistic. For various reasons this year's forecast worries all three children. Ken's reply to his children's concerns: "I understand your concerns and I've taken them into account. This is the most conservative forecast I've ever made. The rate of growth is well below our traditional growth rate. If anything, it's not ambitious enough. We all need stretch goals, especially the sales force. And a worse sin than too much inventory is orders we can't fill. We can work off inventory; a lost sale is lost revenue." a) Discuss the forecasting process at KJ Manufacturing, any relevant factors about the company and industry that are pertinent to your forecast and Ken's forecast. This report must show that you understand the key issues facing the business and how your forecast might impact them or be impacted by them. b) Forecast monthly revenues for KJ Manufacturing for the coming year. Use the method(s) you think best. Explain your forecasting approach and support your choice of models and the rational for any parameters selected. Give any other comments you think applicable to your forecast. c) Prepare a report to Ken Jackson explaining/supporting your forecast. The report should describe your forecast so that he understands and accepts it. He is intelligent but has no specific knowledge of quantitative forecasting techniques. Remember: "Managers would rather live with a problem they can't solve than a solution they don't understand." Period 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 Year 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 Month June July Aug. Sept. Oct Nov. Dec. Jan. Feb Mar Apr. May June July Aug. Sept. Oct. , Dec. Jan. Feb Mar Apr. May June July Aug. Sept. Oct. Nov. Dec. Jan. Feb. Mar. Apr. May June July Aug. Sept. Oct Nov. Dec. Jan. Feb. Mar. Apr. May June July Aug. Sept. Oct. Nov. Dec. Jan. Feb. Mar. Apr. May June July Aug. Sept. Oct. Nov. Dec. Jan. Feb Mar. Apr. May June July Aug. Sept. Oct. Nov. Dec. Final Sales $12,786 $6,892 $7,890 $14,601 $30,313 $30, 161 $25,183 $55,192 $ $65,478 $57,249 $71.854 $52,341 $62,227 $61,702 $67,667 $178,373 $172,037 $208,343 $170,317 $386,973 $362,910 $279,726 $299,549 $269,184 $258,781 $ 201,075 $228,050 $423,168 $537,014 $433,058 $399,299 $856,169 $715,785 $424,179 $490,141 $377,359 $430,992 $461,459 $ $0 $0 $701,897 $669,285 $511,244 $1,142,226 $777,921 $ $723,705 $834,815 $770,839 $560,906 $545,198 $689,041 $1,105,173 $1,384,091 $983,006 $858,011 $1,770,530 $1,232,578 $1,110,182 $1,091,672 $738,216 $828,809 $720,396 $1,352,695 $737,335 $1,315,334 $1,185,351 $1,010,338 $2,250,000 Ken's Forecast for year 7 $1,750,000 $1,500,000 $1,500,000 $1,000,000 $1,000,000 $1,000,000 $1,000,000 $1,500,000 $1,750,000 $1,500,000 $1,750,000 6 6 6 6 68 69 70 71 72 73 74 75 76 77 78 79 7 7 7 7 7 7 7 7 7 7 7 7