kj

kj

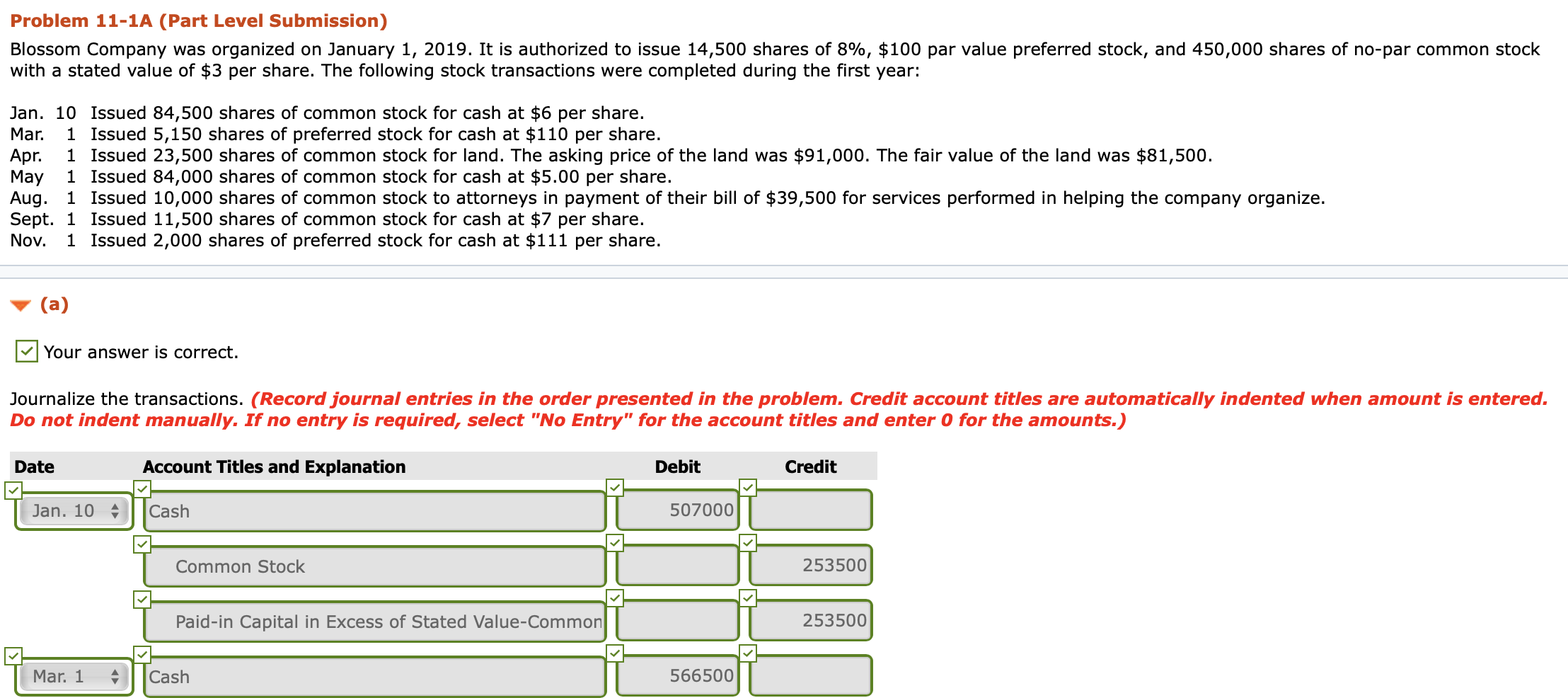

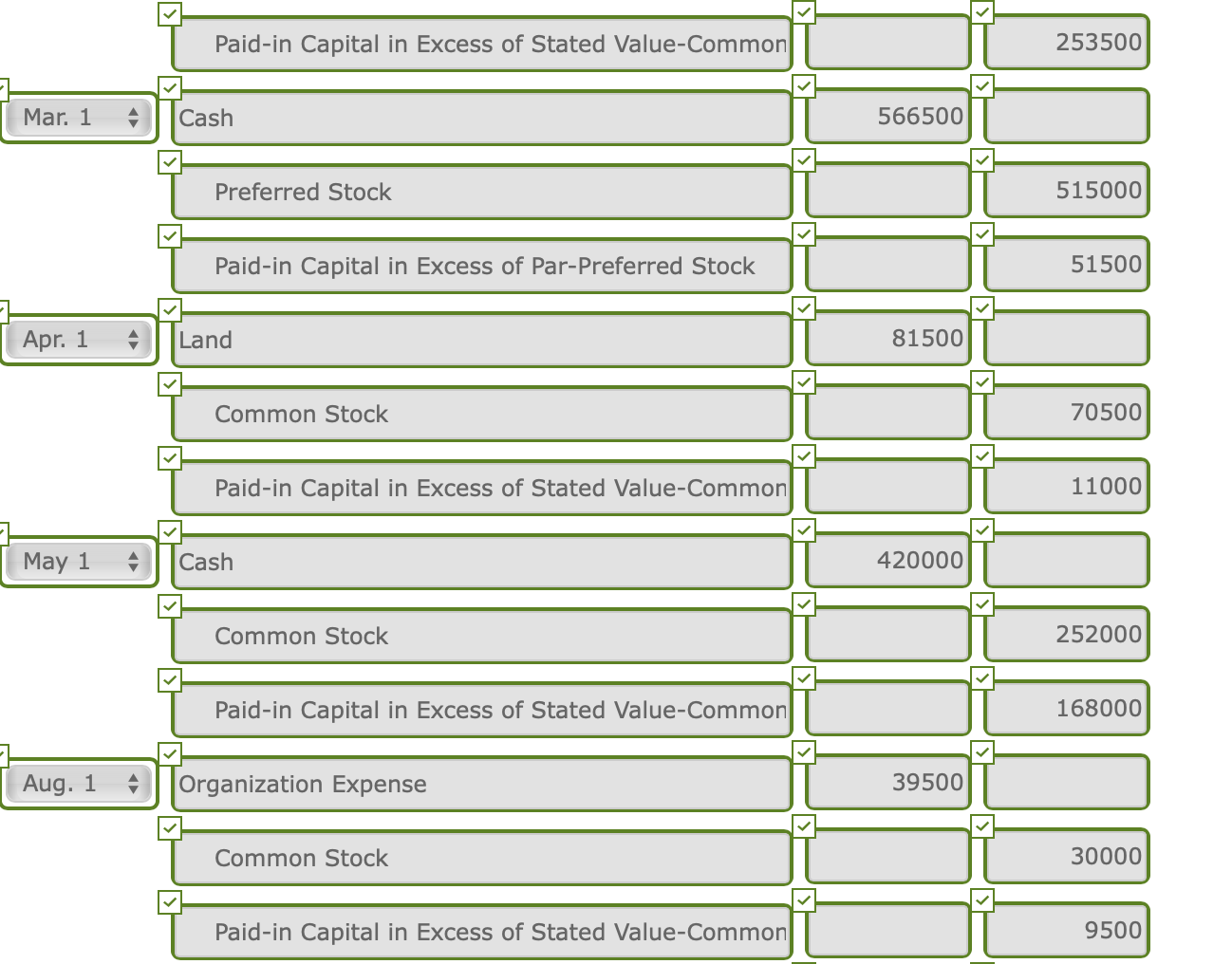

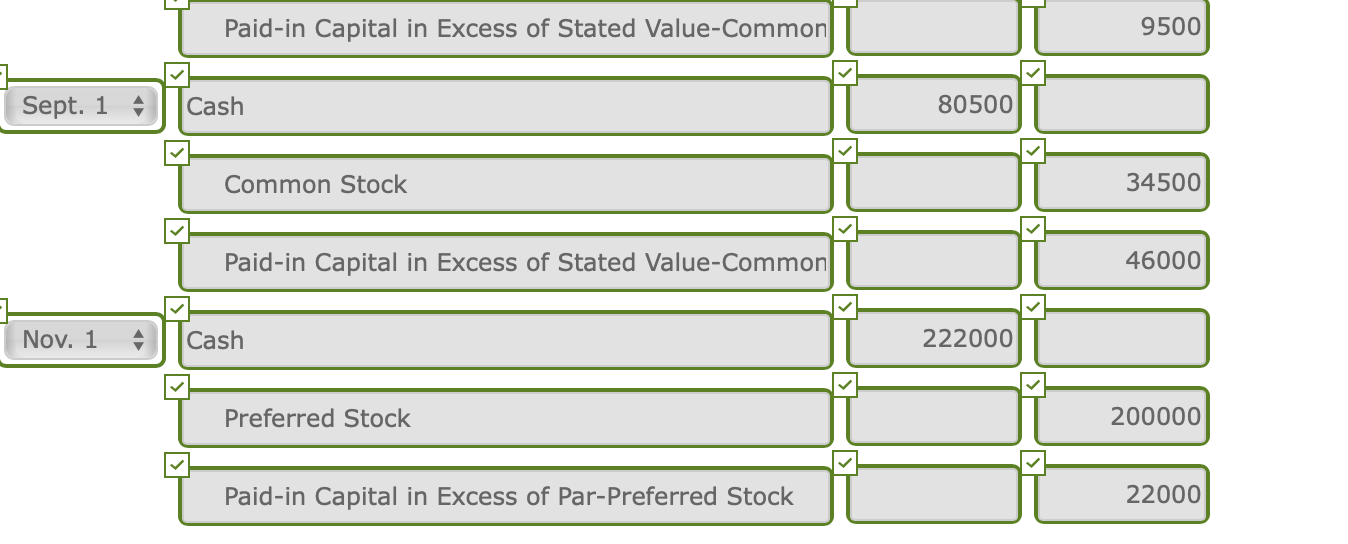

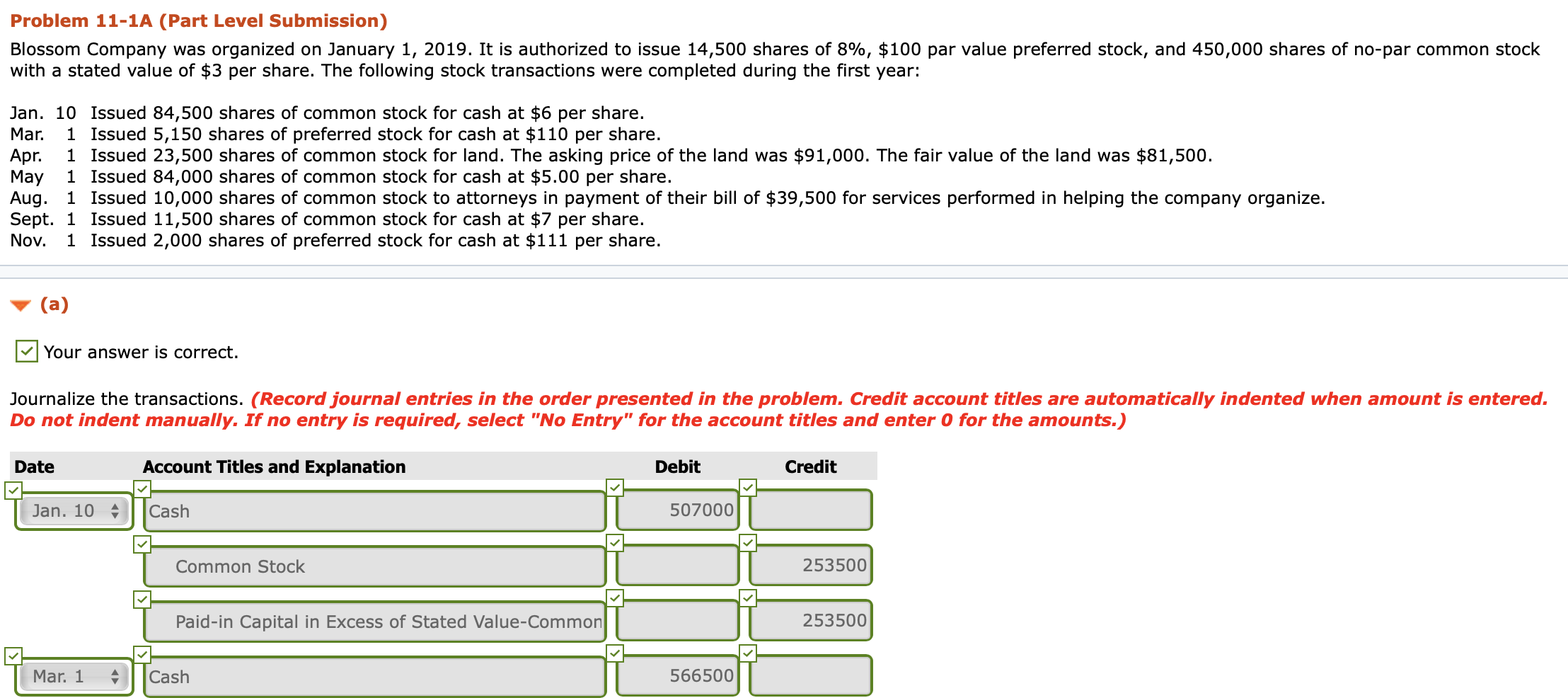

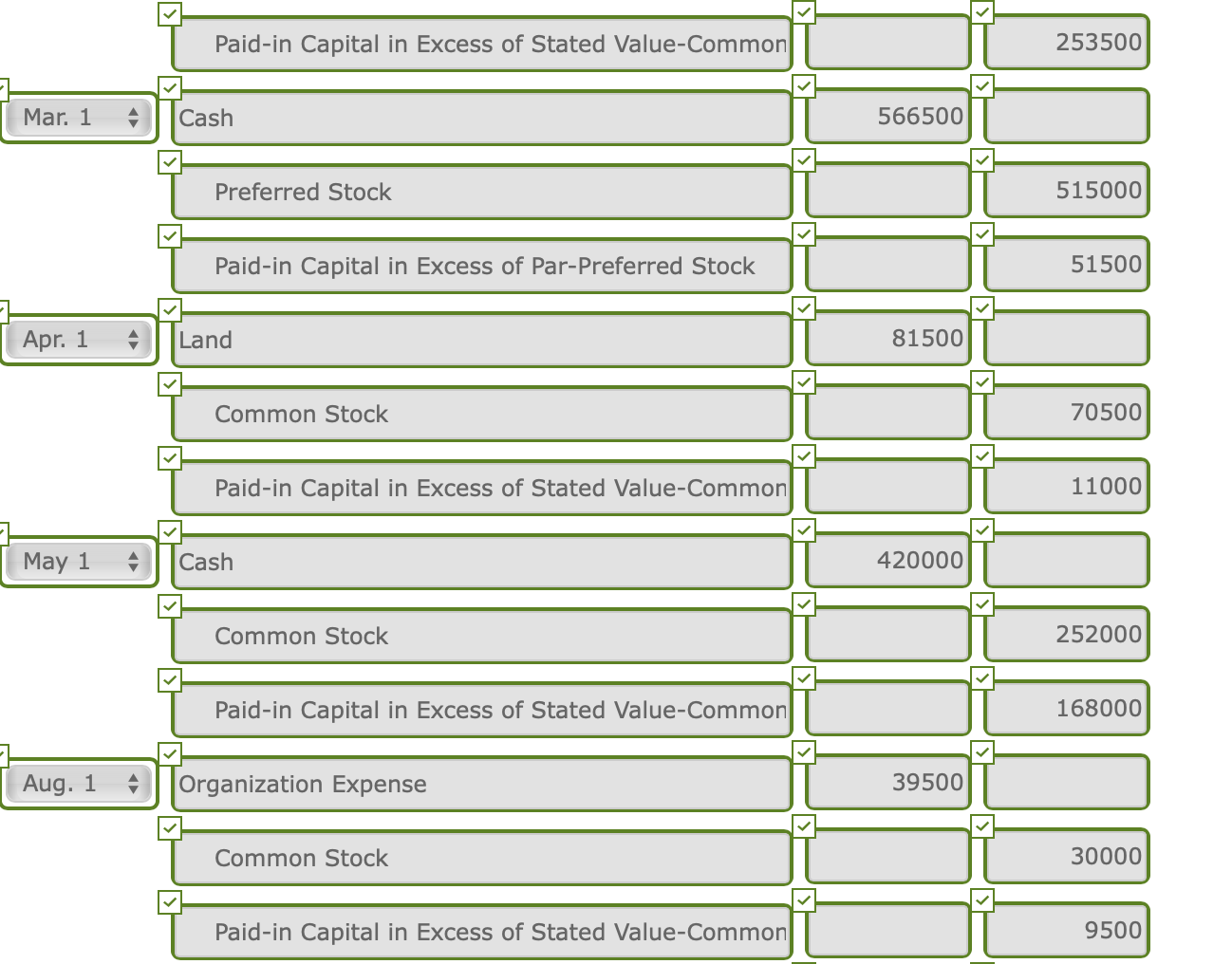

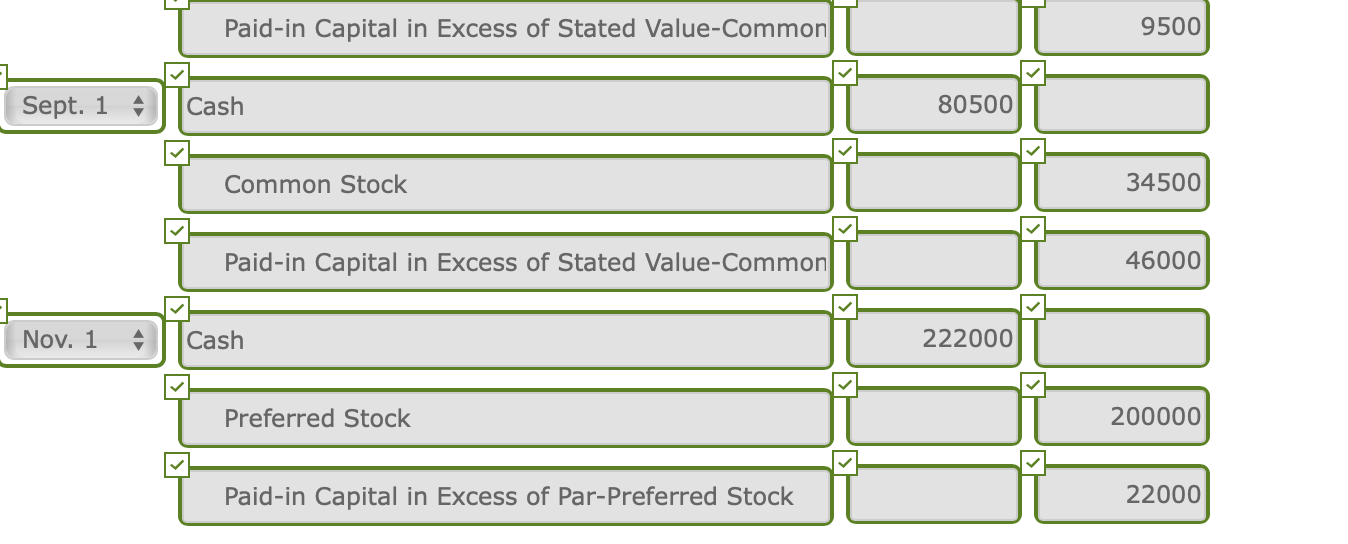

Problem 11-1A (Part Level Submission) Blossom Company was organized on January 1, 2019. It is authorized to issue 14,500 shares of 8%, $100 par value preferred stock, and 450,000 shares of no-par common stock with a stated value of $3 per share. The following stock transactions were completed during the first year: Jan. 10 Issued 84,500 shares of common stock for cash at $6 per share. Mar. 1 Issued 5,150 shares of preferred stock for cash at $110 per share. Apr. 1 Issued 23,500 shares of common stock for land. The asking price of the land was $91,000. The fair value of the land was $81,500. May 1 Issued 84,000 shares of common stock for cash at $5.00 per share. Aug. 1 Issued 10,000 shares of common stock to attorneys in payment of their bill of $39,500 for services performed in helping the company organize. Sept. 1 Issued 11,500 shares of common stock for cash at $7 per share. Nov. 1 Issued 2,000 shares of preferred stock for cash at $111 per share. (a) Your answer is correct. Journalize the transactions. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 10 cash 507000 | Common Stock 253500 Paid-in Capital in Excess of Stated Value-Common 253500 Mar. 1 cash T 566500 Paid-in Capital in Excess of Stated Value-Common 253500 Mar. 1 Mar. 1 A (cash 566500 Preferred Stock IN 515000 Paid-in Capital in Excess of Par-Preferred Stock 51500 Apr. 1 A. Land 81500|| | Common Stock 70500 Paid-in Capital in Excess of Stated Value-Common I 11000 May 1 Cash 420000 Common Stock 252000 | Paid-in Capital in Excess of Stated Value-Common | 168000 Aug. 1 Organization Expense 500 Common Stock 30000 Paid-in Capital in Excess of Stated Value-Common 9500 Paid-in Capital in Excess of Stated Value-Common 9500 Sept. 1 ATCash 80500|| | Common Stock ID 34500 Paid-in Capital in Excess of Stated Value-Com 46000 Nov. 1 Tcash Preferred Stock 200000 Paid-in Capital in Excess of Par-Preferred Stock 22000 Your answer is correct. Post to the stockholders' equity accounts. (Post entries in the order of journal entries presented in the previous part.) Preferred Stock Mar. 1 515000 Nov.1 AL 200000 Dec.31 Bal. A 715000 Paid-in Capital in Excess of Par Value-Preferred Stock IT Mar. 1 Nov.1 AT AT 51500 22000) Nov. 1 Dec.31 Bal. A 73500 Common Stock Jan. 10 253500 > Apr. 1 AL 70500 > May 1 May 1 252000 || May 1 | 252000 Aug. 1 30000 Sept. 1 34500 Dec.31 Bal. A 640500 Paid-in Capital in Excess of Stated Value-Common Stock Jan. 10 253500 Apr. 1 11000 May 1 168000 Aug. 1 9500 IT Sept. 1 46000 Dec.31 Bal. A 488000 Your answer is partially correct. Try again. Prepare the paid-in capital section of stockholders' equity at December 31, 2019. (Enter the account name only and do not provide the descriptive information provided in the question.) Blossom Company Balance Sheet (Partial), December 31, 2019 T Paid-in Capital Preferred Stock 715000 T Common Stock T 640500 1355500 Paid-in Capital in Excess of Par-Preferred Stock J 73500 Paid-in Capital in Excess of Stated Value-Common 488000 Blossom Company Balance Sheet (Partial) December 31, 2019 Paid-in Capital T Preferred Stock 715000) 715000 Common Stock T 640500 | 1355500 Paid-in Capital in Excess of Par-Preferred Stock J 73500 | Paid-in Capital in Excess of Stated Value-Common 488000 + Paid-in Capital 1917000

kj

kj