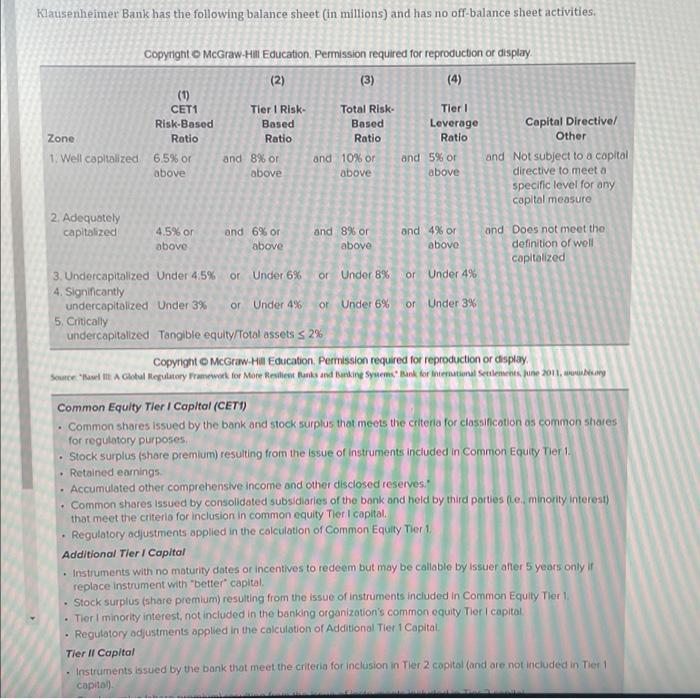

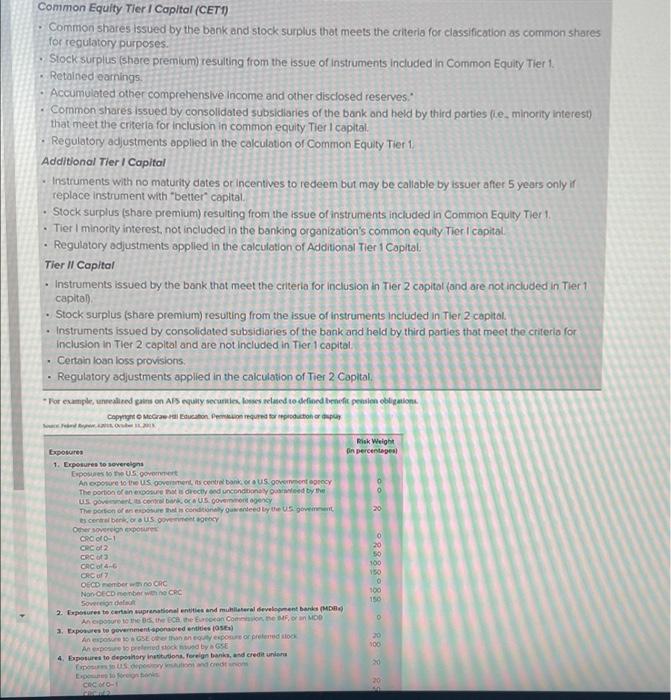

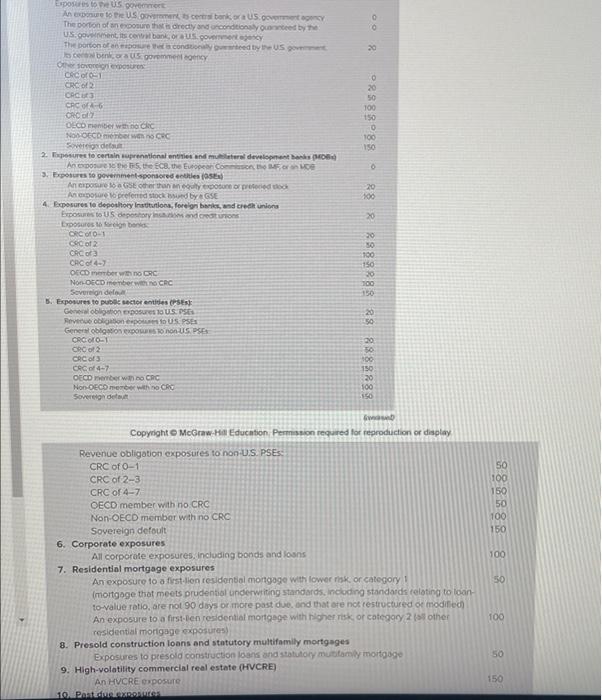

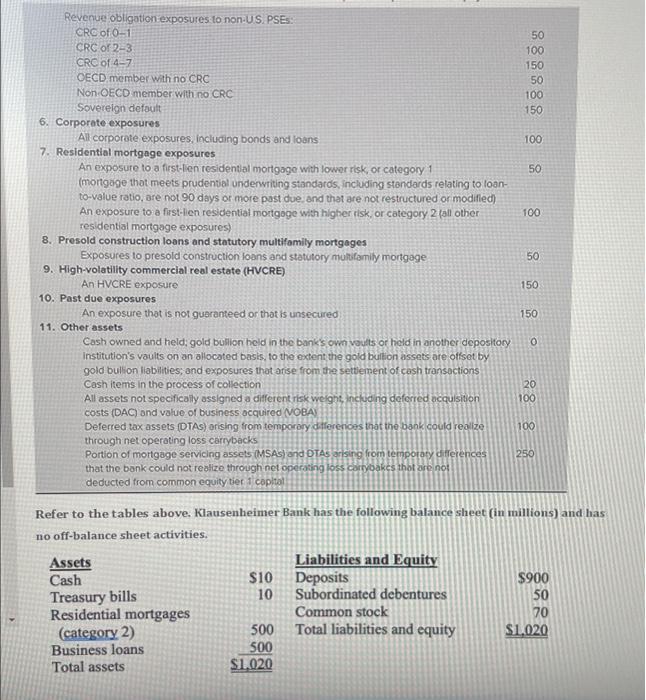

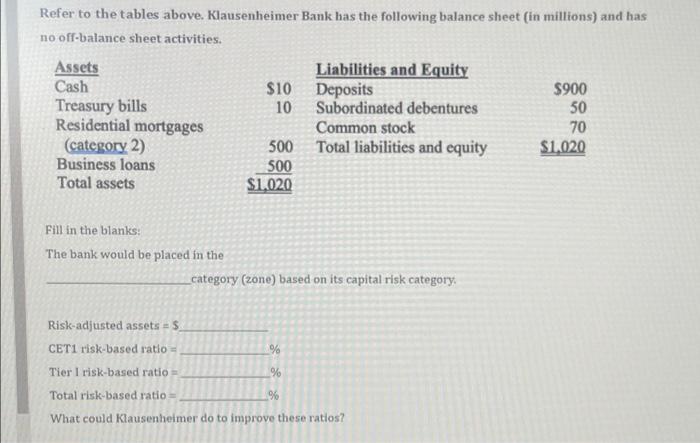

Klausenheimer Bank has the following balance sheet (in millions) and has no off-balance sheet activities. Copyright McGraw-Hill Education. Permission required for reproduction or display (2) (3) (4) (1) CET1 Tier 1 Risk- Total Risk Tier! Risk-Based Based Based Leverage Capital Directive/ Zone Ratio Ratio Ratio Ratio Other 1. Well capltalized 6.5% or and 8% or and 10% or and 5% or and Not subject to a copital above above above above directive to meet a specific level for any capital measure 2. Adequately capitalized 4.5% or and 6% or and 8% or and 4% or and Does not meet the above above above above definition of well capitalized 3. Undercapitalized Under 45% or Under 6% or Under 8% or Under 4% 4. Significantly undercapitalized Under 3% or Under 4% or Under 6% of Under 3% 5. Critically undercapitalized Tangible equity/Total assets s 2% Copyright McGraw-Hill Education. Permission required for reproduction or display Source A Global Regulatory Framework for More Resident funks and linkine synem. Bank for fortional Settlements June 2011, www. Common Equity Tier I Capitol (CET) . Common shares issued by the bank and stock surplus that meets the criteria for classification as common shares for regulatory purposes Stock surplus (shore premium) resulting from the issue of instruments included in Common Equity Tier 1 Retained earings Accumulated other comprehensive income and other disclosed reserves. . Common shares issued by consolidated subsidiaries of the bank and held by third parties (le minority interest) that meet the criteria for inclusion in common equity Tier I capital Regulatory adjustments applied in the calculation of Common Equity Tier 1 Additional Tier I Capital Instruments with no maturity dates or incentives to redeem but may be callable by issuer after 5 years only replace instrument with "better capital Stock surplus (share premium) resulting from the issue of instruments included in Common Equity Tier 1 . Tiori minority interest, not included in the banking organization's common equity Tier I capital Regulatory adjustments applied in the calculation of Additional Tier 1 Capital Tier II Capital Instruments issued by the bank that meet the criteria for inclusion in Tier 2 copitol (and are not included in Tier1 capitol) Common Equity Tier I Capital (CET1) Common shares issued by the bank and stock surplus that meets the criteria for classification as common shares for regulatory purposes. Stock Surplus (share premium) resulting from the issue of Instruments included in Common Equity Tier 1. Retained earnings Accumulated other comprehensive Income and other disclosed reserves." Common shares issued by consolidated subsidiaries of the bank and held by third parties (ie, minority interest) that meet the criteria for inclusion in common equity Tier I capital Regulatory adjustments applied in the calculation of Common Equity Tier 1. Additional Tier I Capital Instruments with no maturity dates or Incentives to redeem but may be callable by issuer after 5 years only if replace instrument with better capital Stock surplus (share premium) resulting from the issue of instruments included in Common Equity Tier 1 Tier I minority interest, not included in the banking organization's common equity Tier I capital Regulatory adjustments applied in the calculation of Additional Tier i Capital Tier II Capital Instruments issued by the bank that meet the criteria for inclusion in Tier 2 capitol (ond are not included in Tier 1 capital) Stock surplus (share premium) resulting from the issue of instruments included in Tier 2 capital. Instruments issued by consolidated subsidiaries of the bank and held by third parties that meet the criteria for inclusion in Tier 2 capital and are not included in Tier 1 copital Certain loan loss provisions. Regulatory adjustments applied in the calculation of Tier 2 Capital * For example, uneslied gems on AS equity vecurities dones telated to defined benefit pension obligation capito Mahon. Pened to production www. Risk Weight in percentageal Exposures 1. Exposure to severeigns Exposure to US government AN OD 10 US government is contrabank or a US govorcy The portion of an exposure rectyond uncondition wed by US govt coba US government agency The portion of an exposures condition you need to US gove central bankorausgency Oder sovereign pour CRC O.1 CRC 2 CRC 3 CRC- ORCU OECD member wo CRC Non OECD berwen CRC Sovered 2. Exposure to certain supranational entities and muhlateral development banks (MDG An or to the heatheron Cone F MOD 3. Exposure to government-sporodies ) An expowe Layexposure opened to Aneto pred stock by 4 posures to deposhory inton Foreign banks and credit unio Concrete Explore COCO % 8888888888 20 0 20 20 EDC to De US DOO An exure to the US an tsbokraus.com The portion of an exposure that direct and conditioned by the USentits contbank or US govery The portion of pure in conditioned by US govt e ben ora gorency Osovine Coco-1 CRC of CRG 3 CRC-6 CRO OECD moniter with a chic NODOECD berwen Sverigede 2. posure to certain supranational entities and mural development has An DS5, the ECB, the European Com 3. Exposure to povernment sponsored ettes An OS SE tertany people AND preferred stock by GSE 4 Exposure to depository Institutions for andre unions Epost US deposito Exposure to be ORCO01 CA of 2 CRCoa CRC 4-7 OECD member with no ORC Non-OECD member wo CRC Sovereign del 5. Exposure to put sector antides PSE Genealog posures 10 US.SE Revolution USPSES Generatobom Doon US PSE CRCIO Roof 2 COCO CRC-7 OECD member with CRC Non OECD merce with no CRC Sovereign 08888888888888888888888888 50 100 150 50 100 150 Gwob Copyright McGraw-Hill Education Permission required for reproduction or display Revenue obligation exposures to non-U.S. PSE: CRC of 0-1 CRC of 2-3 CRC of 4-7 OECD member with no CRC Non OECD mombor with no CRC Sovereign defoult 6. Corporate exposures All corporate exposures, including bonds and loans 7. Residential mortgage exposures An exposure to a first lion residential mongoge with lower risk or category (mortgage that meets prudential underwriting standards, including standards relating to loan to-value ratio, are not 90 days or more past de and that are not restructured or modified An exposure to a first-ten residential mortgage with Higher risk or category 21st other residential mortgage exposures) 8. Presold construction loans and statutory multifamily mortgages Exposures to presold construction loans and statutory muttamil mortgage 9. High-volatility commercial real estate (HVCRE An HVCRE exposure 10. RoMEOS 100 50 100 50 150 Revenue obligation exposures to non-US. PSES: CRC of 0-1 50 CRC or 2-3 100 CRC of 4-7 150 OECD member with no CRC 50 Non OECD member with no CRC 100 Sovereign default 150 6. Corporate exposures All corporate exposures, including bonds and loans 100 7. Residential mortgage exposures An exposure to a first-Ben residential mortgage with lower risk, or category 1 50 (mortgage that meets prudential underwriting standards, including standards relating to loan- to-value ratio, are not 90 days or more past due and that are not restructured or modified) An exposure to a first-lien residential mortgage with higher risk, or category 2 (all other 100 residential mortgage exposures) 8. Presold construction loans and statutory multifamily mortgages Exposures to presold construction loans and statutory multifamily mortgage 50 9. High-volatility commercial real estate (HVCRE) An HVCRE exposure 150 10. Past due exposures An exposure that is not guaranteed or that is unsecured 150 11. Other assets Cash owned and held, gold buillon held in the bank's own vaults or held in another depository Institution's vaults on an allocated basis, to the extent the gold bullion assets are offset by gold bullion liabilities, and exposures that arise from the settement of cash transactions Cash items in the process of collection 20 All assets not specifically assigned a different risk weight, including deferred acquisition 100 costs (DAC) and value of business acquired VOBA Deferred tax assets (DTAS) arising from temporary differences that the bank could realize 100 through net operating loss carrybacks Portion of mortgage servicing assets (MSAS) and DTAS arising from temporary differences 250 that the bank could not realize through net operating loss carrybakes thot are not deducted from common equity tier 1 copitat o 0 Refer to the tables above. Klausenheimer Bank has the following balance sheet (in millions) and has no off-balance sheet activities. Assets Liabilities and Equity Cash S10 Deposits $900 Treasury bills 10 Subordinated debentures SO Residential mortgages Common stock 70 (category 2) 500 Total liabilities and equity $1,020 Business loans 500 Total assets $1.020 Refer to the tables above. Klausenheimer Bank has the following balance sheet (in millions) and has no off-balance sheet activities. Assets Liabilities and Equity Cash $10 Deposits $900 Treasury bills 10 Subordinated debentures 50 Residential mortgages Common stock 70 (category 2) 500 Total liabilities and equity $1.020 Business loans 500 Total assets $1,020 Fill in the blanks: The bank would be placed in the _category (zone) based on its capital risk category, Risk-adjusted assets = $ CET1 risk-based ratio- % Tier I risk-based ratio 9% Total risk-based ratio 9% What could Klausenheimer do to improve these ratios? Klausenheimer Bank has the following balance sheet (in millions) and has no off-balance sheet activities. Copyright McGraw-Hill Education. Permission required for reproduction or display (2) (3) (4) (1) CET1 Tier 1 Risk- Total Risk Tier! Risk-Based Based Based Leverage Capital Directive/ Zone Ratio Ratio Ratio Ratio Other 1. Well capltalized 6.5% or and 8% or and 10% or and 5% or and Not subject to a copital above above above above directive to meet a specific level for any capital measure 2. Adequately capitalized 4.5% or and 6% or and 8% or and 4% or and Does not meet the above above above above definition of well capitalized 3. Undercapitalized Under 45% or Under 6% or Under 8% or Under 4% 4. Significantly undercapitalized Under 3% or Under 4% or Under 6% of Under 3% 5. Critically undercapitalized Tangible equity/Total assets s 2% Copyright McGraw-Hill Education. Permission required for reproduction or display Source A Global Regulatory Framework for More Resident funks and linkine synem. Bank for fortional Settlements June 2011, www. Common Equity Tier I Capitol (CET) . Common shares issued by the bank and stock surplus that meets the criteria for classification as common shares for regulatory purposes Stock surplus (shore premium) resulting from the issue of instruments included in Common Equity Tier 1 Retained earings Accumulated other comprehensive income and other disclosed reserves. . Common shares issued by consolidated subsidiaries of the bank and held by third parties (le minority interest) that meet the criteria for inclusion in common equity Tier I capital Regulatory adjustments applied in the calculation of Common Equity Tier 1 Additional Tier I Capital Instruments with no maturity dates or incentives to redeem but may be callable by issuer after 5 years only replace instrument with "better capital Stock surplus (share premium) resulting from the issue of instruments included in Common Equity Tier 1 . Tiori minority interest, not included in the banking organization's common equity Tier I capital Regulatory adjustments applied in the calculation of Additional Tier 1 Capital Tier II Capital Instruments issued by the bank that meet the criteria for inclusion in Tier 2 copitol (and are not included in Tier1 capitol) Common Equity Tier I Capital (CET1) Common shares issued by the bank and stock surplus that meets the criteria for classification as common shares for regulatory purposes. Stock Surplus (share premium) resulting from the issue of Instruments included in Common Equity Tier 1. Retained earnings Accumulated other comprehensive Income and other disclosed reserves." Common shares issued by consolidated subsidiaries of the bank and held by third parties (ie, minority interest) that meet the criteria for inclusion in common equity Tier I capital Regulatory adjustments applied in the calculation of Common Equity Tier 1. Additional Tier I Capital Instruments with no maturity dates or Incentives to redeem but may be callable by issuer after 5 years only if replace instrument with better capital Stock surplus (share premium) resulting from the issue of instruments included in Common Equity Tier 1 Tier I minority interest, not included in the banking organization's common equity Tier I capital Regulatory adjustments applied in the calculation of Additional Tier i Capital Tier II Capital Instruments issued by the bank that meet the criteria for inclusion in Tier 2 capitol (ond are not included in Tier 1 capital) Stock surplus (share premium) resulting from the issue of instruments included in Tier 2 capital. Instruments issued by consolidated subsidiaries of the bank and held by third parties that meet the criteria for inclusion in Tier 2 capital and are not included in Tier 1 copital Certain loan loss provisions. Regulatory adjustments applied in the calculation of Tier 2 Capital * For example, uneslied gems on AS equity vecurities dones telated to defined benefit pension obligation capito Mahon. Pened to production www. Risk Weight in percentageal Exposures 1. Exposure to severeigns Exposure to US government AN OD 10 US government is contrabank or a US govorcy The portion of an exposure rectyond uncondition wed by US govt coba US government agency The portion of an exposures condition you need to US gove central bankorausgency Oder sovereign pour CRC O.1 CRC 2 CRC 3 CRC- ORCU OECD member wo CRC Non OECD berwen CRC Sovered 2. Exposure to certain supranational entities and muhlateral development banks (MDG An or to the heatheron Cone F MOD 3. Exposure to government-sporodies ) An expowe Layexposure opened to Aneto pred stock by 4 posures to deposhory inton Foreign banks and credit unio Concrete Explore COCO % 8888888888 20 0 20 20 EDC to De US DOO An exure to the US an tsbokraus.com The portion of an exposure that direct and conditioned by the USentits contbank or US govery The portion of pure in conditioned by US govt e ben ora gorency Osovine Coco-1 CRC of CRG 3 CRC-6 CRO OECD moniter with a chic NODOECD berwen Sverigede 2. posure to certain supranational entities and mural development has An DS5, the ECB, the European Com 3. Exposure to povernment sponsored ettes An OS SE tertany people AND preferred stock by GSE 4 Exposure to depository Institutions for andre unions Epost US deposito Exposure to be ORCO01 CA of 2 CRCoa CRC 4-7 OECD member with no ORC Non-OECD member wo CRC Sovereign del 5. Exposure to put sector antides PSE Genealog posures 10 US.SE Revolution USPSES Generatobom Doon US PSE CRCIO Roof 2 COCO CRC-7 OECD member with CRC Non OECD merce with no CRC Sovereign 08888888888888888888888888 50 100 150 50 100 150 Gwob Copyright McGraw-Hill Education Permission required for reproduction or display Revenue obligation exposures to non-U.S. PSE: CRC of 0-1 CRC of 2-3 CRC of 4-7 OECD member with no CRC Non OECD mombor with no CRC Sovereign defoult 6. Corporate exposures All corporate exposures, including bonds and loans 7. Residential mortgage exposures An exposure to a first lion residential mongoge with lower risk or category (mortgage that meets prudential underwriting standards, including standards relating to loan to-value ratio, are not 90 days or more past de and that are not restructured or modified An exposure to a first-ten residential mortgage with Higher risk or category 21st other residential mortgage exposures) 8. Presold construction loans and statutory multifamily mortgages Exposures to presold construction loans and statutory muttamil mortgage 9. High-volatility commercial real estate (HVCRE An HVCRE exposure 10. RoMEOS 100 50 100 50 150 Revenue obligation exposures to non-US. PSES: CRC of 0-1 50 CRC or 2-3 100 CRC of 4-7 150 OECD member with no CRC 50 Non OECD member with no CRC 100 Sovereign default 150 6. Corporate exposures All corporate exposures, including bonds and loans 100 7. Residential mortgage exposures An exposure to a first-Ben residential mortgage with lower risk, or category 1 50 (mortgage that meets prudential underwriting standards, including standards relating to loan- to-value ratio, are not 90 days or more past due and that are not restructured or modified) An exposure to a first-lien residential mortgage with higher risk, or category 2 (all other 100 residential mortgage exposures) 8. Presold construction loans and statutory multifamily mortgages Exposures to presold construction loans and statutory multifamily mortgage 50 9. High-volatility commercial real estate (HVCRE) An HVCRE exposure 150 10. Past due exposures An exposure that is not guaranteed or that is unsecured 150 11. Other assets Cash owned and held, gold buillon held in the bank's own vaults or held in another depository Institution's vaults on an allocated basis, to the extent the gold bullion assets are offset by gold bullion liabilities, and exposures that arise from the settement of cash transactions Cash items in the process of collection 20 All assets not specifically assigned a different risk weight, including deferred acquisition 100 costs (DAC) and value of business acquired VOBA Deferred tax assets (DTAS) arising from temporary differences that the bank could realize 100 through net operating loss carrybacks Portion of mortgage servicing assets (MSAS) and DTAS arising from temporary differences 250 that the bank could not realize through net operating loss carrybakes thot are not deducted from common equity tier 1 copitat o 0 Refer to the tables above. Klausenheimer Bank has the following balance sheet (in millions) and has no off-balance sheet activities. Assets Liabilities and Equity Cash S10 Deposits $900 Treasury bills 10 Subordinated debentures SO Residential mortgages Common stock 70 (category 2) 500 Total liabilities and equity $1,020 Business loans 500 Total assets $1.020 Refer to the tables above. Klausenheimer Bank has the following balance sheet (in millions) and has no off-balance sheet activities. Assets Liabilities and Equity Cash $10 Deposits $900 Treasury bills 10 Subordinated debentures 50 Residential mortgages Common stock 70 (category 2) 500 Total liabilities and equity $1.020 Business loans 500 Total assets $1,020 Fill in the blanks: The bank would be placed in the _category (zone) based on its capital risk category, Risk-adjusted assets = $ CET1 risk-based ratio- % Tier I risk-based ratio 9% Total risk-based ratio 9% What could Klausenheimer do to improve these ratios