Answered step by step

Verified Expert Solution

Question

1 Approved Answer

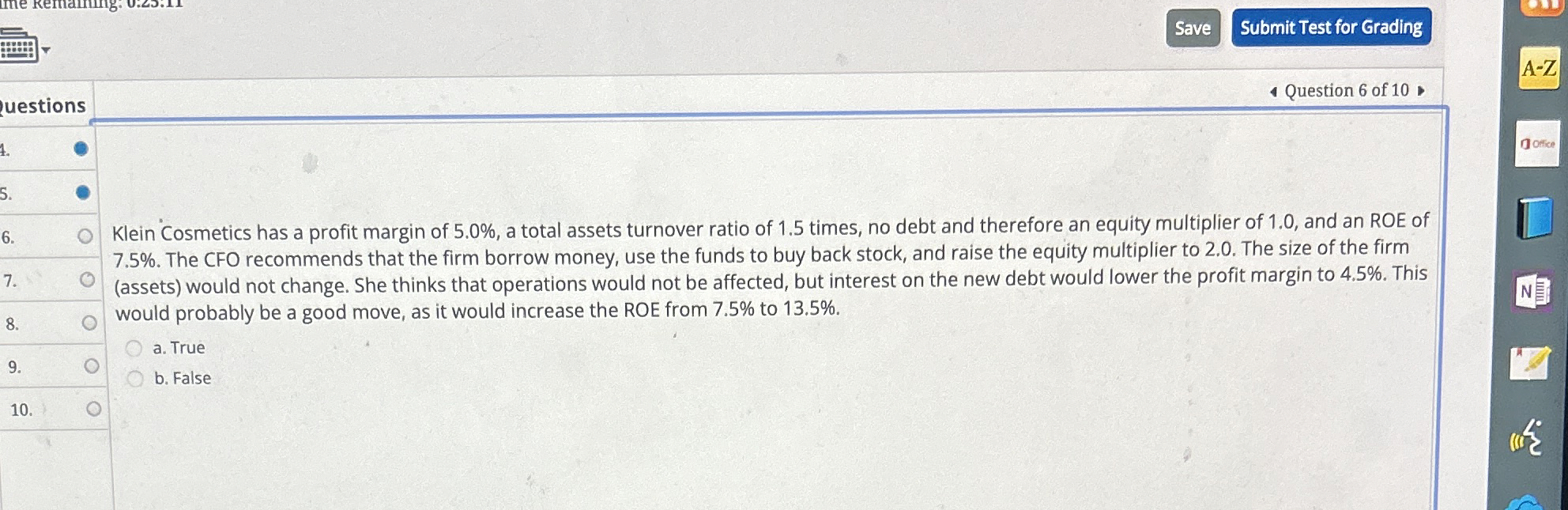

Klein Cosmetics has a profit margin of 5 . 0 % , a total assets turnover ratio of 1 . 5 times, no debt and

Klein Cosmetics has a profit margin of a total assets turnover ratio of times, no debt and therefore an equity multiplier of and an ROE of

The CFO recommends that the firm borrow money, use the funds to buy back stock, and raise the equity multiplier to The size of the firm

assets would not change. She thinks that operations would not be affected, but interest on the new debt would lower the profit margin to This

would probably be a good move, as it would increase the ROE from to

a True

b False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started