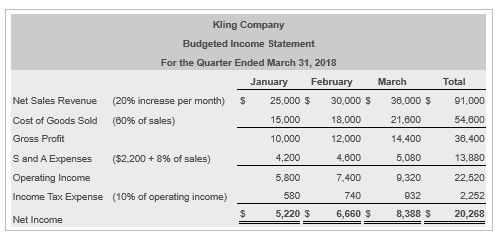

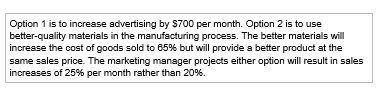

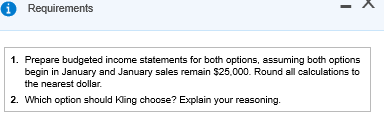

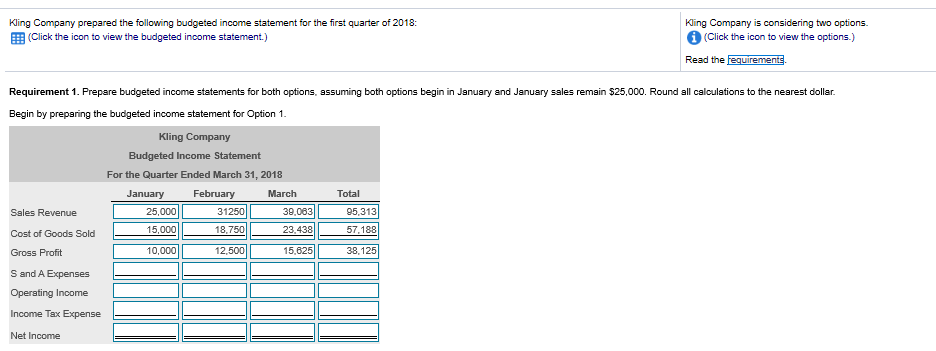

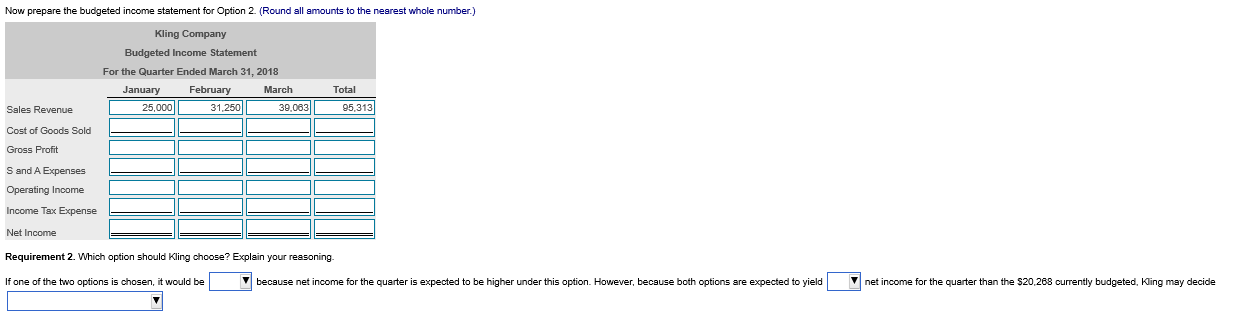

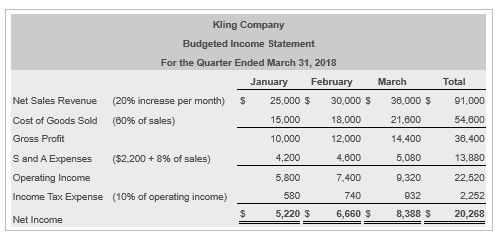

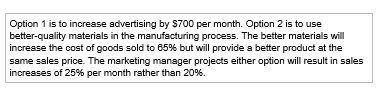

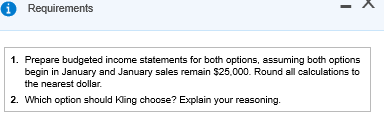

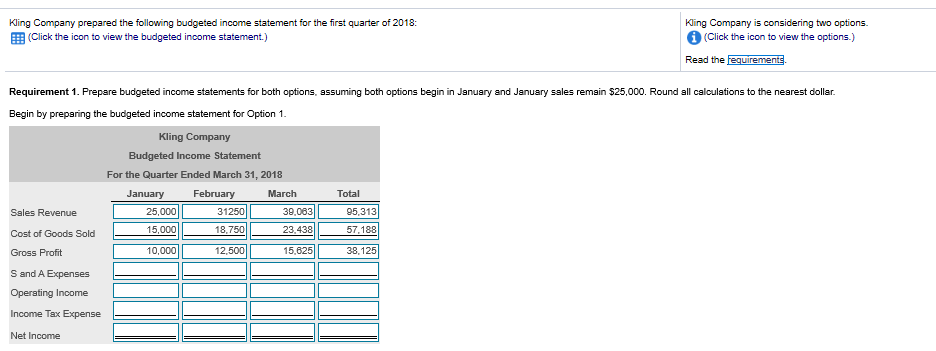

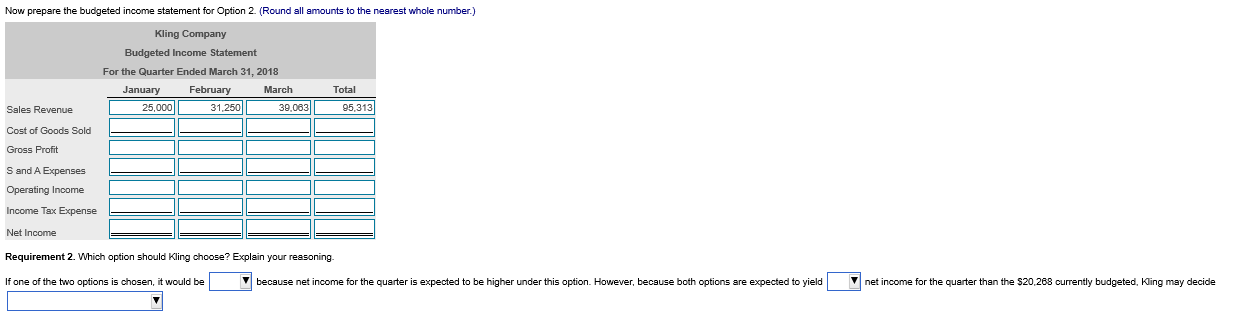

Kling Company Budgeted Income Statement For the Quarter Ended March 31, 2018 January February March Total (20% increase per month) Net Sales Revenue 25,000 $ 30,000 S 38,000 S 91,000 Cost of Goods Sold (60% of sales) 15,000 18,000 21,600 54,800 Gross Profit 10,000 12,000 14,400 38,400 ($2,200 8% of sales) 5,080 S and A Expenses 4,200 4,800 13,880 5,800 Operating Income 7.400 9,320 22,520 Income Tax Expense (10 % of operating income) 580 740 932 2,252 5,220 $ 6,660 S 8,388 20,268 Net Income Option 1 is to increase sdvertising by $700 per month. Option 2 is to use better-quality materials in the manufacturing process. The better materials will increase the cost of goods sold to 65 % but will provide a better product at the same sales price. The marketing manager projects either option will result in sales increases of 25% per month rather than 20 % Requirements 1. Prepare budgeted income statements for both options, assuming both options begin in January and January sales remain $25,000. Round sll calculations to the nearest dollar 2. Which option should Kling choose? Explain your reasoning Kling Company prepared the following budgeted income statement for the first quarter of 2018: (Click the icon to view the budgeted income statement.) Kling Company is considering two options (Click the icon to view the options.) Read the fequirements. Requirement 1. Prepare budgeted income statements for both options, ssuming both options begin in January and January sales remsin $25,000. Round all calculations to the nearest dollar Begin by preparing the budgeted income statement for Option 1 Kling Company Budgeted Income Statement For the Quarter Ended March 31, 2018 Total January February March 95,313 25,000 31250 39,063 Sales Revenue 15,000 18,750 23.438 57.188 Cost of Goods Sold 38,125 10,000 12,500 15,625 Gross Profit S and A Expenses Operating Income Income Tax Exnse Net Income Now prepare the budgeted income statement for Option 2. (Round all amounts to the nearest whole number.) Kling Company Budgeted Income Statement For the Quarter Ended March 31, 2018 Total February March January 25,000 31,250 39,063 95,313 Sales Revenue Cost of Goods Sold Gross Profit S and A Expenses Operating Inoome Income Tax Expense Net Income Requirement 2. Which option should Kling choose? Explain your reasoning. because net income for the quarter is expected to be higher under this option. However, because both options are expected to yield net income for the quarter than the $20,268 currently budgeted, Kling may decide If one of the two options is chosen, it would be